Mortgage Rates: What to Know

Original Content written by Carl Johnson

You hear it all of the time… Interest rates are high then interest rates are low… It is a great time to sell but it's a bad time to buy. No, it’s a good time to buy and a bad time to sell! Though there may never be a perfect time in the market to buy or sell a home, there is a right time in your life when you are ready to buy a home. Being knowledgeable about what is going on in the market at that time can help save you money in the long term. In this article we explore interest rates and some key factors to keep in mind while looking for the best mortgage company for you!

With the start of the Covid-19 Pandemic, all industries entered unknown territory. The housing and banking market were no different, and actions were taken to keep the market strong. In March 2020, the Federal Reserve cut its “target range for the federal funds rate to 0 to 1/4 percent.” This move lowered the cost it takes to borrow money from banks for business and households, and introduced new lower mortgage interest rates driving a high demand for houses. In fact, according to a recent Wall Street Journal article, the U.S. Existing-Home Sales Reached a 15 year high of 6.1 million last year.

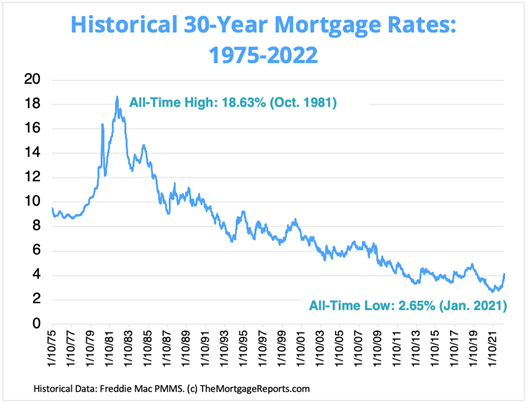

Since the all time low interest rates in 2021 (2.65%), it is only normal for rates to increase. In our conversation with Susan Trimmer, a Senior Mortgage Originator for Pinnacle Funding, Inc, she stated that “2022 kicked off with similar 2021 low mortgage rates, but rates began increasing significantly in March for the first time since 2018. While you can expect rates to go up and down due to record-high inflation, global instability, and the war in Ukraine, if you are looking to buy a house in 2022, be prepared for interest rates to keep moving up.” Though rates have already increased slightly, and are predicted increase even more before they plateau, it is important to keep the bigger picture in mind. Looking at past history shows us that rates of 4, 5, or even 6% are great rates for the mortgage industry and still offer good financing options.

You hear it all of the time… Interest rates are high then interest rates are low… It is a great time to sell but it's a bad time to buy. No, it’s a good time to buy and a bad time to sell! Though there may never be a perfect time in the market to buy or sell a home, there is a right time in your life when you are ready to buy a home. Being knowledgeable about what is going on in the market at that time can help save you money in the long term. In this article we explore interest rates and some key factors to keep in mind while looking for the best mortgage company for you!

With the start of the Covid-19 Pandemic, all industries entered unknown territory. The housing and banking market were no different, and actions were taken to keep the market strong. In March 2020, the Federal Reserve cut its “target range for the federal funds rate to 0 to 1/4 percent.” This move lowered the cost it takes to borrow money from banks for business and households, and introduced new lower mortgage interest rates driving a high demand for houses. In fact, according to a recent Wall Street Journal article, the U.S. Existing-Home Sales Reached a 15 year high of 6.1 million last year.

Since the all time low interest rates in 2021 (2.65%), it is only normal for rates to increase. In our conversation with Susan Trimmer, a Senior Mortgage Originator for Pinnacle Funding, Inc, she stated that “2022 kicked off with similar 2021 low mortgage rates, but rates began increasing significantly in March for the first time since 2018. While you can expect rates to go up and down due to record-high inflation, global instability, and the war in Ukraine, if you are looking to buy a house in 2022, be prepared for interest rates to keep moving up.” Though rates have already increased slightly, and are predicted increase even more before they plateau, it is important to keep the bigger picture in mind. Looking at past history shows us that rates of 4, 5, or even 6% are great rates for the mortgage industry and still offer good financing options.

While shopping around for mortgages, there are other factors you want to be aware of that can offer relief if you are uncomfortable with rates at that time. Did you know you are able to “buy down” your interest rate? We asked Susan about what it means to “buy down” your rate, and how it helps you as a borrower in the long term. Susan stated that “borrowers are always able to buy the rate down by paying 'mortgage points' or 'discount points'. Points offer a trade-off. They let you pay more money in exchange for a lower mortgage interest rate, thus increasing your closing costs for a smaller monthly payment. If you keep your mortgage long enough, those points could equal huge savings over time. Points can also be tax-deductible depending on which deductions you claim on your federal income taxes. Always consult with your professional tax preparer.” In general, if you are looking for a lower monthly payment and you are able to put a little bit more down at closing, you will save money in the long run and keep your monthly payments in a range you are comfortable with.

Additionally, the type of mortgage you are applying for can play a factor into the interest rate you are given. Susan said that “Government backed loans such as FHA, VA, and USDA tend to have slightly lower rates than Conventional loans.” What are these loans, read below to learn more:

Susan also stated that an Adjusted-Rate Mortgage is sometimes an option to get a lower interest rate. An Adjusted-Rate Mortgage is a loan that starts with a lower interest rate for a set period of years - 5, 7, or 10. Then the rate fluctuates with the market every so often depending on your loan terms (though not over 5% of your original rate). With an ARM loan you get a lower rate at first but take the risk of an increased rate in years to come. However, if a lower monthly payment is what is needed at that time in your life it may be a great option!

In general, it is important to do your research and see what options are best for you when it is time for you to apply for a mortgage. Susan suggests “when shopping around for a mortgage, don’t allow your credit to be pulled multiple times. Also keep in mind that a Mortgage Broker will do the shopping for you as they have relationships with multiple lenders. Ask the same questions from one to the other so that you have an “apples-to-apples” comparison, and inquire what lender and/or broker fees are charged. Most importantly, work with a broker who comes highly recommended by your real estate agent and whom you feel is providing details, has your best interest at heart, and offers financing options.”

Though interest rates may rise in the future, they are projected to plateau at a reasonable rate. If the idea of a high rate makes it difficult for your goal of monthly payments, there are options available to you to find a loan that works. From paying down your rate to different loan types, your agent and broker are here to help you!

Buying your home is a very big decision in your life and should be taken with knowledge, care, and thoughtfulness. At Carl Johnson Real Estate, we take pride in the care we give to each client, who often becomes a friend! We work one-on-one to help you reach your goals and are with you each step of the way.

Click here to read more from our testimonials on the work we do!

Additionally, the type of mortgage you are applying for can play a factor into the interest rate you are given. Susan said that “Government backed loans such as FHA, VA, and USDA tend to have slightly lower rates than Conventional loans.” What are these loans, read below to learn more:

- FHA - A loan insured by the Federal Housing Administration. Popular for first-time home buyers and offers lower down payments from 3.5% and those with lower credit scores. Mortgage Insurance payments will be required for down payment below 20%. Other requirements on the home and borrow are needed, click here to read more.

- VA - A loan backed by the Veteran Administration. You must be a service member and pass the Certificate of Eligibility to get such a loan. Though credit and income are still a requirement, “nearly 90% of VA-backed loans are made with no down payment” (VA.gov).

- USDA - United States Department of Agriculture backed loan for rural home buyers. “The USDA's definition of 'rural' is largely liberal, meaning many in small towns, suburbs and exurbs of major U.S. cities meet the 'rural' requirement” (USDA.gov). If you are in a market that is considered rural by their checklist, you can get a loan often with 0% down payment and they often offer rates lower than conventional loans.

- Conventional - Insured by Freddie Mac and Fannie Mae, conventional loans tend to have stricter requirements since they are not fully government backed. However there are no specific requirements, as a variety of options are available based on the borrower's personal needs and situation.

Susan also stated that an Adjusted-Rate Mortgage is sometimes an option to get a lower interest rate. An Adjusted-Rate Mortgage is a loan that starts with a lower interest rate for a set period of years - 5, 7, or 10. Then the rate fluctuates with the market every so often depending on your loan terms (though not over 5% of your original rate). With an ARM loan you get a lower rate at first but take the risk of an increased rate in years to come. However, if a lower monthly payment is what is needed at that time in your life it may be a great option!

In general, it is important to do your research and see what options are best for you when it is time for you to apply for a mortgage. Susan suggests “when shopping around for a mortgage, don’t allow your credit to be pulled multiple times. Also keep in mind that a Mortgage Broker will do the shopping for you as they have relationships with multiple lenders. Ask the same questions from one to the other so that you have an “apples-to-apples” comparison, and inquire what lender and/or broker fees are charged. Most importantly, work with a broker who comes highly recommended by your real estate agent and whom you feel is providing details, has your best interest at heart, and offers financing options.”

Though interest rates may rise in the future, they are projected to plateau at a reasonable rate. If the idea of a high rate makes it difficult for your goal of monthly payments, there are options available to you to find a loan that works. From paying down your rate to different loan types, your agent and broker are here to help you!

Buying your home is a very big decision in your life and should be taken with knowledge, care, and thoughtfulness. At Carl Johnson Real Estate, we take pride in the care we give to each client, who often becomes a friend! We work one-on-one to help you reach your goals and are with you each step of the way.

Click here to read more from our testimonials on the work we do!

Getting Ready For a Mortgage

Content written by Carl Johnson

Purchasing a home for the first time is an exciting step in one’s life, however it’s far more logistical than your average transaction and can be rather intimidating. But, not to fret, with the proper research and knowledge your home buying experience can be a lot simpler than it might appear!

One of the most important processes when preparing to buy a home is getting ready for a mortgage, which will be used to help you finance your purchase. In order to be approved for a traditional mortgage, you will need a minimum credit score between 580 and 620. If you are applying for a different program, such as a government-backed loan, the requirements may differ. In order to check your credit and assure you are in the right spot to buy a home, you will need to get a credit report from each of these three bureaus: Experian, TransUnion, and Equifax.

Most lenders will require you to have a DTI, debt-to-income ratio, no more than 43%. A DTI ratio is the percentage of your gross monthly income that goes to paying your monthly debt payments and is used by lenders to determine your borrowing risk. If you are looking to improve your DTI ratio, you want to pay off as much debt as possible before applying for a mortgage. Examples of such debt include auto loans, student loans, and credit cards. Although you will not have to be debt-free to buy a home, less debt will help increase your purchasing power.

Another crucial step when it comes to getting ready for a mortgage is saving money. Most mortgage programs require a down payment that ranges from a minimum of 3% to 5% for conventional loans and a minimum of 3.5% for a FHA home loan. You will most likely need mortgage insurance if you are purchasing with less than a 20% down payment. Mortgage insurance is an insurance policy that protects a mortgage lender or titleholder if the borrower defaults on payments, passes away, or is otherwise unable to meet the contractual obligations of the mortgage.

Although this process may seem intimidating, we recommend working with a local mortgage broker who will shop lenders on behalf of the borrower. Working with a broker who can be trusted, has years of experience, and provides full disclosure of the process can help alleviate the financial stress of getting ready for a mortgage.

One of the most important processes when preparing to buy a home is getting ready for a mortgage, which will be used to help you finance your purchase. In order to be approved for a traditional mortgage, you will need a minimum credit score between 580 and 620. If you are applying for a different program, such as a government-backed loan, the requirements may differ. In order to check your credit and assure you are in the right spot to buy a home, you will need to get a credit report from each of these three bureaus: Experian, TransUnion, and Equifax.

Most lenders will require you to have a DTI, debt-to-income ratio, no more than 43%. A DTI ratio is the percentage of your gross monthly income that goes to paying your monthly debt payments and is used by lenders to determine your borrowing risk. If you are looking to improve your DTI ratio, you want to pay off as much debt as possible before applying for a mortgage. Examples of such debt include auto loans, student loans, and credit cards. Although you will not have to be debt-free to buy a home, less debt will help increase your purchasing power.

Another crucial step when it comes to getting ready for a mortgage is saving money. Most mortgage programs require a down payment that ranges from a minimum of 3% to 5% for conventional loans and a minimum of 3.5% for a FHA home loan. You will most likely need mortgage insurance if you are purchasing with less than a 20% down payment. Mortgage insurance is an insurance policy that protects a mortgage lender or titleholder if the borrower defaults on payments, passes away, or is otherwise unable to meet the contractual obligations of the mortgage.

Although this process may seem intimidating, we recommend working with a local mortgage broker who will shop lenders on behalf of the borrower. Working with a broker who can be trusted, has years of experience, and provides full disclosure of the process can help alleviate the financial stress of getting ready for a mortgage.