Tax season is upon us, and if you sold your house in 2020 (or are planning to sell it in the future), you're in luck! Thanks to the 2018 Tax Cuts and Jobs Act, there are some tax deductions you can take that may result in serious savings! Here are a few of the most important. 1. Capital Improvements If you've made certain upgrades to your home before selling, the IRS allows you to add the costs of these "capital improvements" to your home's cost basis. This can reduce the amount of capital gains tax you may owe after you sell your home. It's important to note that not all repairs and upgrades meet the government's definition of a capital improvement. Some of the things that meet the guidelines include upgrading your HVAC system, adding a lawn sprinkler system, adding an additional bedroom, bathroom, deck, garage, porch, or patio, updating your water heater, adding built-in appliances, and more. If you make any improvements or upgrades to your home, be sure to hold onto all your receipts. When it's time for you and your tax preparer to complete your return, they can review your expenses and determine what may qualify. 2. Selling Costs Costs tied directly to the sale of your home are deductible as long as the home is your primary residence and you lived there at least two of the five years prior to the sale. As long as you meet these requirements, you can write off expenses, including real estate commissions, legal fees, escrow fees, advertising costs, and even home staging fees. Note that this isn't a direct deduction. Instead, it's subtracted from the sales price of your home, which positively impacts the amount of capital gains tax you might owe. 3. Mortgage Interest Current tax rules allow you to deduct the interest you pay on your home mortgage debt of up to $750,000. Just remember that mortgage interest and property taxes are itemized deductions, and it only makes sense to itemize if the total is higher than your standard deduction. 4. Property Taxes The new 2018 rules capped the amount of property taxes you can write off, but they still allow you to take a deduction of up to $10,000. Make sure you include the amount of any property taxes you paid on your tax return. 5. Discount Points When you pay points in cash to buy down the interest rate on your mortgage or refinance, the IRS allows you to deduct a portion of the points each year until your mortgage is paid in full. When you sell your house and pay off your mortgage loan, you're able to deduct the remaining amount all at once. This is one of the most forgotten-about home selling tax deductions, but it can be significant in some cases. 6. Moving Expenses Unfortunately, not everyone can deduct their moving expenses. However, if you're active-duty military personnel, you'll want to take advantage of this deduction. 7. BONUS: Capital Gains Taxes The capital gains tax rule isn't really a deduction, it's an exclusion. However, it's so important that we decided to add it to this list. Capital gains are the profit you make from selling your home. It's the cash left over after you've paid off your mortgage and other expenses. As long as you have lived in the home at least two of the last five years, single filers can exclude up to $250,000 of capital gains, and married filers can exclude up to $500,000. While the information above is an excellent starting point, remember that each person's finances are different. It's always a good idea to speak to a tax professional before filing your taxes, particularly in years when you have a major life change, like a home sale.

1 Comment

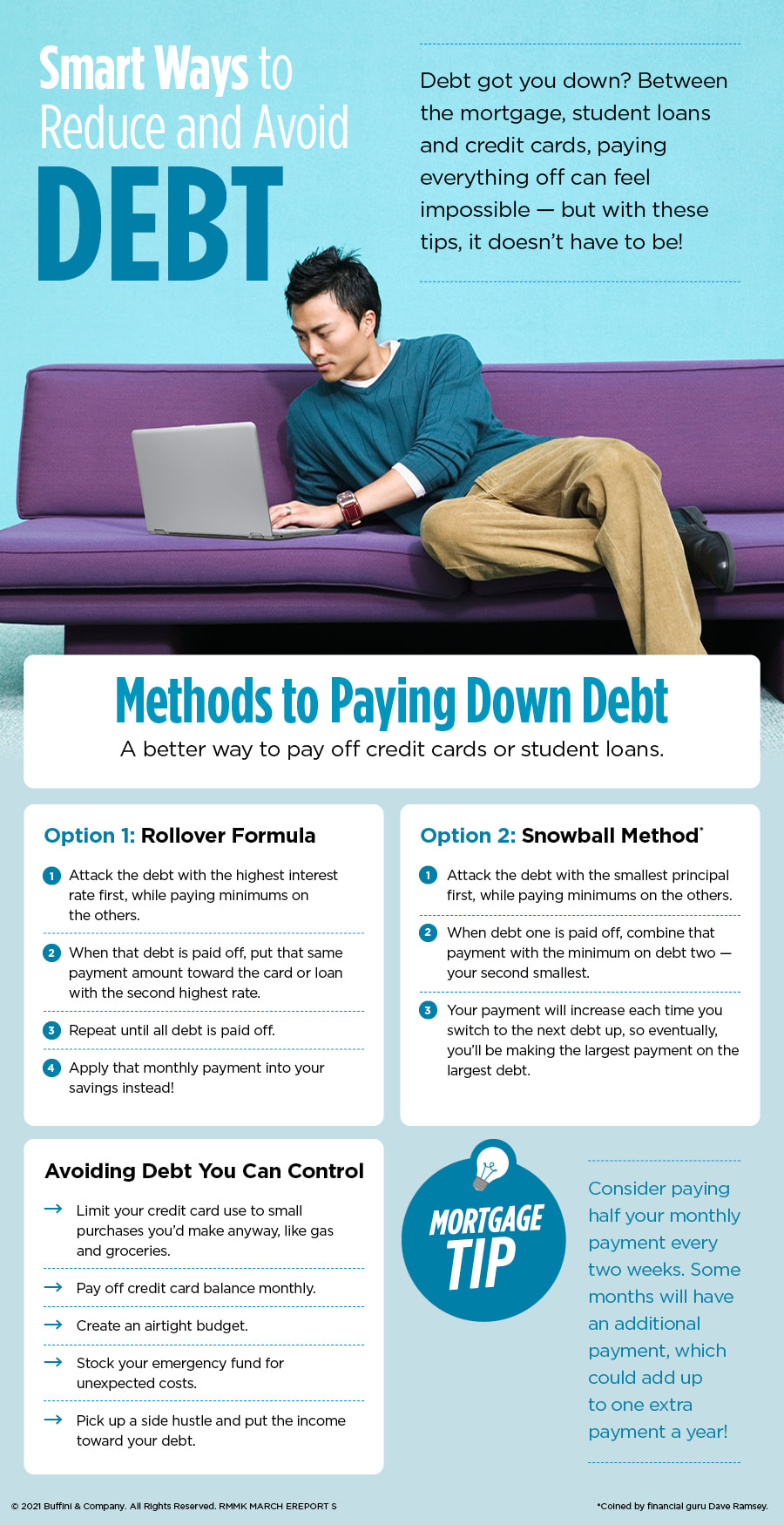

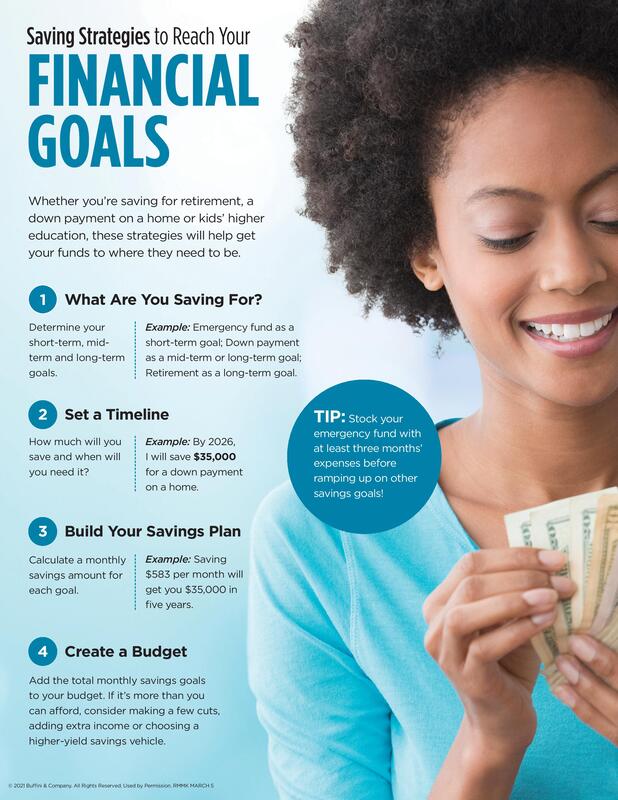

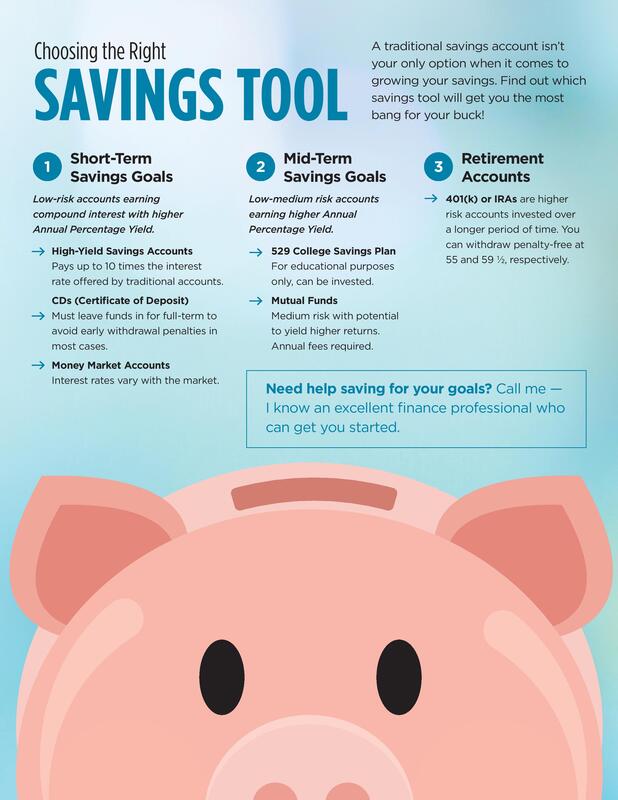

Spring has sprung and outdoor dining can help you make the most of the weather. Durham has a wide variety of cuisines to offer. Read below for a few of Carl's favorite local eats. Bleu Olive Bistro | 1821 Hillandale Rd, Duham NC 27705 Family owned and operated, this aptly named Mediterranean Bistro focuses on creating authentic meals with high quality ingredients. Their extensive menu has options for everyone and includes a variety of tapas dishes, soups, salads, and entrees. bleuolivebistro.com Blue Corn Cafe | 716 9th St, Durham NC 27705 Your stop for Latin American dishes, crafted with intention from local and organic ingredients. The menu contains everything from Cuban style beans to authentic hand rolled empanadas, and an expansive dessert selection. GRUB Durham | 1200 W Chapel Hill St, Durham NC 27701 Offering Breakfast until 3PM, this woman owned restaurant creates a space for people to enjoy their food together. With an emphasis on Southern style comfort food, the menu is packed with everything from breakfast sandwiches to smoked BBQ ribs and milkshakes. grubdurham.com Parizade | 2200 W Main St, Durham NC 27705 Parizade describes itself as "a tenured illustration of our commitment to unwavering gracious hospitality". Focusing Mediterranean style dishes, their ingredients are locally sourced from both land and sea and served in an upscale atmosphere. There are plenty of fan favorites to choose from for both dinner and dessert. parizadedurham.com Saladelia | 4201University Drive, Durham NC 27707 An independently owned business specializing in homemade Mediterranean cuisine made with fresh and local ingredients. Find something for everyone with their offering of sandwiches, salads, soups, specialty entrees, and platters. Don't forget dessert with their house-made cakes, cookies, and pastries. saladelia.com Tobacco Rd Sports Cafe | 280 S Mangum St #100, Durham NC 27701 A restaurant built with a love of sports and food in mind. Carrying every single sports package available, the menu includes regional faves with a twist, gourmet entrees, and healthy alternatives. For those that have specific dietary needs, check out their interactive menu on their website. tobaccordsportscafe.com Vin Rouge | 2010 Hillsborough Rd, Durham NC 27705 A French Bistro atmosphere complete with a garden space and front patio will transport you to Europe while you eat. Featuring traditional French dishes on their dinner menu like escargots and steak frites, they also offer brunch. vinrougerestaurant.com Everyone tends to pay off their debt in a different way, implementing various tools and strategies until it's finally gone. Though it may feel overwhelming at the start, you can tackle your debt one step at a time. If you are struggling to start and needs some pointers on your debt-reduction strategy read below: Learn more about saving strategies to help you reach your financial goals by CLICKING HERE.

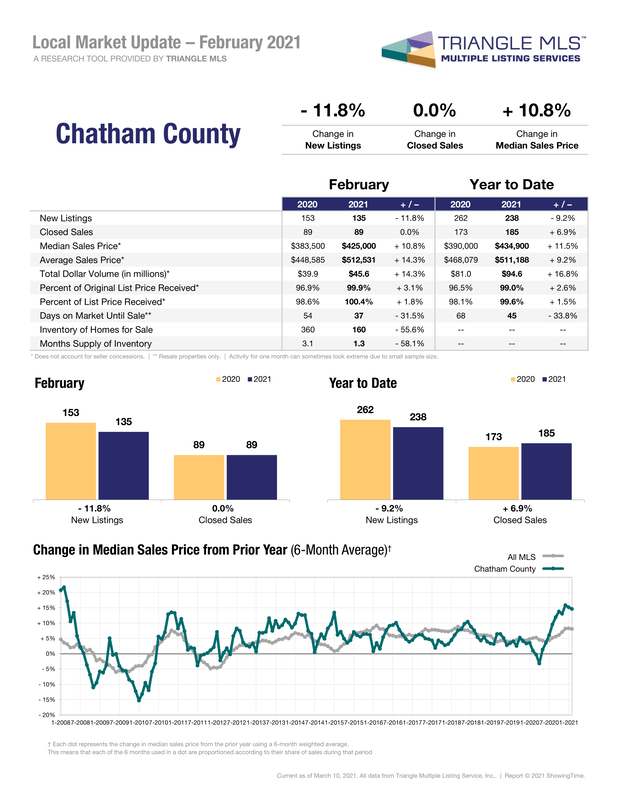

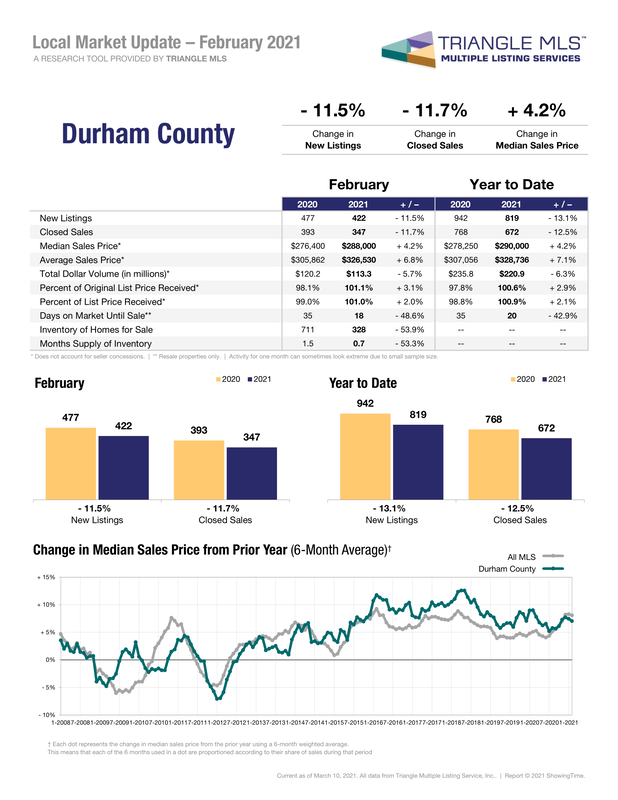

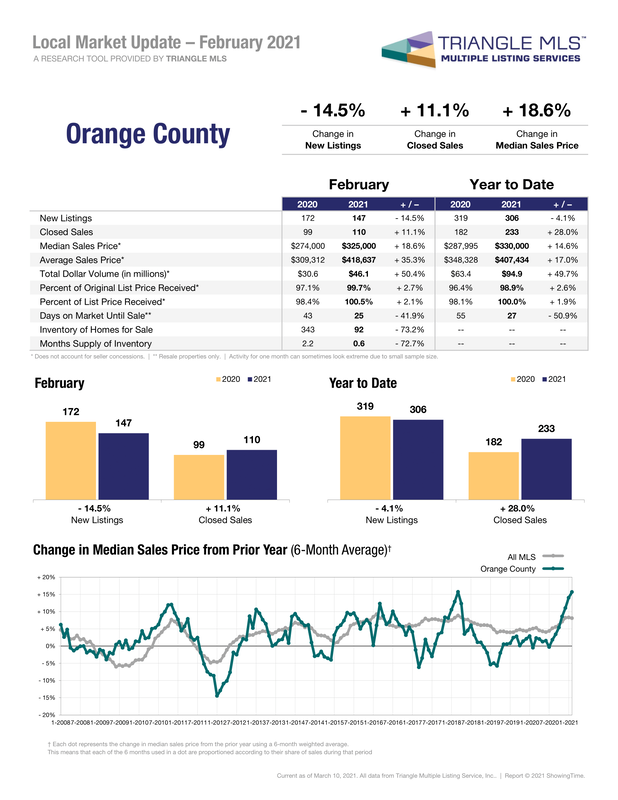

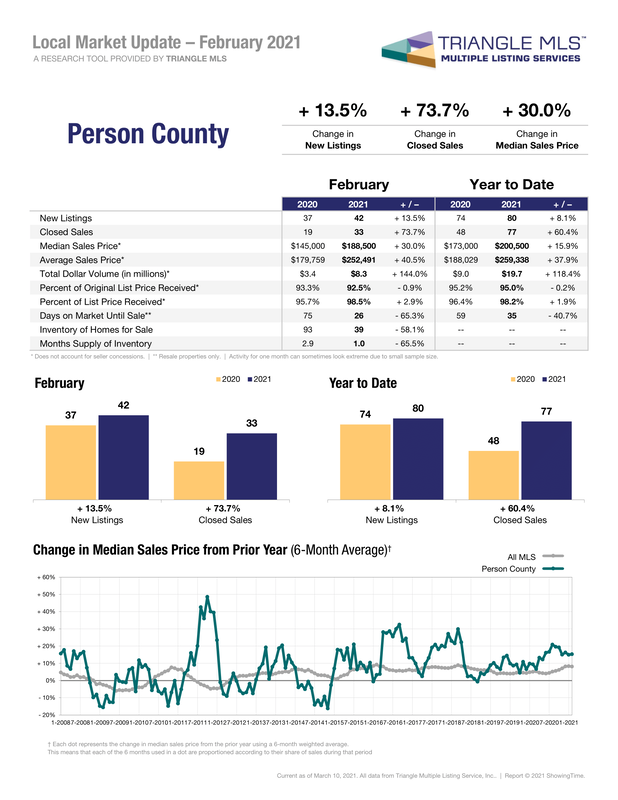

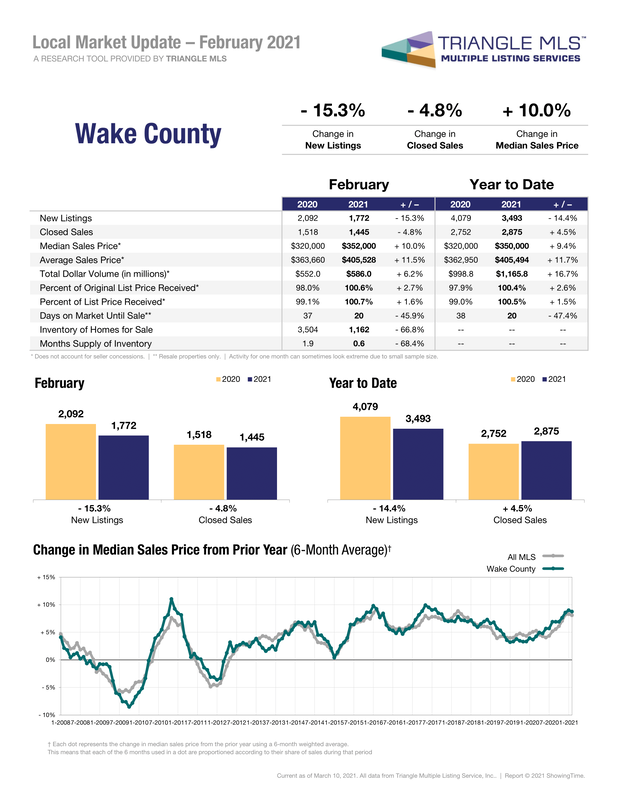

Below please find the February 2021 Market Update by County for the Triangle. To see market stats for communities in the Triangle, mouse over communities on this website and click on the community you would like market stats on and scroll to the bottom of the page. This resource is current to the date you pull data. Just another resource we offer to assist you with increasing your knowledge base about Real Estate. In Chatham County, there was a 9.2 percent decrease in the number of new listings in February, year to date, compared to last year, which decreased from 262 to 238. The number of closed sales increased from 173 to 185, a 6.9 percent increase. Median sales prices also increased by 11.5 percent. In February, Chatham County median sales price exceeded the median sales price for all MLS listings. In Durham County, new listings decreased by 13.1 percent and closed sales have decreased 12.5 percent year to date. Median sales price has increased 4.2 percent from this time last year, moving from $278,250 to $290,000. Average sales price increased by 7.1 percent year to date. In February, the Durham County median sales price was below the median sales price of all MLS listings. The number of listings in Orange County has decreased by 4.1 percent, from 319 new listings year to date last year to 306 new listings this year. There was a 28 percent increase in closed sales. Additionally, median sales price increased by 14.6 percent, from $297,995 to $330,000. In February, Orange County median sales price exceeded the median sales price for all MLS listings. The number of listings in Person County has decreased by 8.1 percent, from 74 new listings year to date last year to 80 new listings this year. There was a 60.4 percent increase in closed sales. Additionally, median sales price increased by 15.9 percent, from $173,000 to $200,500. In February, Person County median sales price exceeded the median sales price for all MLS listings. In Wake County, there was a decrease of 14.4 percent in the number of new listings year to date compared to last year, which decreased from 4,079 to 3,493. The number of closed sales increased 4.5 percent. Median sales prices also increased by 9.4 percent for February compared to February 2020. Compared to the median sales price for all MLS listings, Wake County median sales price were level in February. To learn more about Carl's services for Sellers, CLICK HERE.

Having a plan for saving is the first step towards being financially secure. Figuring out what steps to take will make your goals much more achievable. Read below to how to save with a purpose and the correct tools to get you there. Thinking about moving but already have a mortgage? CLICK HERE to learn about how home equity can help fuel your next move.

Having good credit is important, but did you know that it is also comes with benefits for you? There are many advantages to having strong credit that are reflected in all parts of your life. For tips on how your credit score can help you, and how to keep it high read below: To learn more about Carl's services for buyers CLICK HERE.

Selling your home is as much of a lifestyle decision as it is a financial decision. Like any other investment, you want to make sure that you're making financially responsible decisions every step of the way. One option that you have when selling your home is to use your current equity to finance your next move. Research shows that more and more homeowners are gaining equity in their homes regardless of state. By paying the equity in your current home towards purchasing a new home, you can achieve your real estate goals sooner than later. What is Home Equity? The equity in your home is its current value minus the remaining mortgage debt. As you pay your monthly mortgage, you grow the equity in your home. For instance, If you purchased your home for $200,000 using a mortgage loan and only have $50,000 remaining on the loan, your home equity is $150,000. How Can I Use My Existing Equity? As you consider selling your home, you likely already have another real estate goal in mind. Whether you're downsizing or purchasing a home for your growing lifestyle needs, you'll need to create a plan for how you're going to buy a new house. Instead of using your savings for another down payment, you can leverage the existing equity in your home to fund the purchase of your next home. There are a few ways that you can use your existing equity when selling your home:

Is using your equity to fund a new house purchase the right decision when selling your home? That depends on how much equity you have and how much you need to finance for a new home. Speak with your real estate agent to determine if leveraging your equity when selling your home is right for you.  Selling your home requires a lot of preparation. You'll need to take care of necessary repairs, update your curb appeal, and prepare for staging. When you start to pack and declutter, a storage unit can be your best friend. Storing some of your items off-site will make it easier to give your home the neat and organized look and feel that appeals to potential buyers. Here five things that you'll want to put into storage while you're selling your home.

If you're considering selling your home, you may believe it's an easier process than buying a house. While being on this end of the transaction does have its advantages, homeowners should be aware that it's easy to make costly errors. When you're ready to begin the process of selling your home, try to avoid these common mistakes.

'If you're thinking about selling your house, the time to start preparing is right now. Homes that are clean, well-presented, and priced right often receive multiple offers. However, selling a home still requires some preparation. Here are ten things to do as soon as you start thinking about selling a home.

To learn more about how Carl works with sellers CLICK HERE. |

Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed