|

If you’re planning on purchasing a new home or refinancing your mortgage, now could be the time to take advantage of low rates.

More than a year into the COVID-19 pandemic, mortgage rates continue to hover around historic lows which, along with a scarcity for properties and pressure from people looking to relocate, has caused a massive surge in mortgage applications, propelling home sales to a record 14-year high. The question still remains: is now a good time to buy? Mortgage rates are likely to stay low during 2021, but the current economy has made lenders tighten their applications and implement stricter rules for credit scores. The current rise of home prices is likely to go down at some point, making the waiting game a better strategy for someone who isn’t necessarily in need of a new home right now. Our advice is to lay low and prepare to buy when the time is right. Mortgages 101 The two most common types of mortgages are 30 and 15-year fixed rate mortgages. With these types of loans, your interest and monthly payments will remain the same throughout the entirety of the loan. For new homebuyers, the main difference between the two is lower rates for 15-year and lower monthly payments for 30-year loans. Aside from the two above-mentioned loans, aspiring homeowners can also choose an adjustable-rate mortgage, which fixes your interest and monthly payments during the first few years of the loan, after which the rates will reset at specific intervals, according to the market. The main advantage of ARMs is that they are considerably cheaper than fixed-rate mortgages, at least for the first few years of the loan, but they can also prove a double-edged sword should interest rates rise during the life of the loan. With Money’s Home Affordability Calculator, you can begin figuring out how much “house” you can afford using your proposed budget or debt-to-income ratio: https://money.com/how-much-house-can-i-afford/ Current Mortgage Rates—Where are we headed? Mortgage rates sunk deep during 2020, igniting a wave of refinance activity and purchases throughout the country. Many people were able to purchase homes they may have not been able to afford if rates had stayed the same. Starting in January 2021, rates have started to trend higher week-over-week, but experts estimate that the change will be a modest one throughout the year, and it won’t happen overnight. Increased vaccination efforts and government relief packages could even spur more positive activity and lower rates. Even with rising rates, now will still be an advantageous time to refinance or purchase a new home. Things to Consider as You Prepare Buying a home is a lot more than just rates and fees. Becoming familiar with the process and knowing the difference between common mortgage terms can help you prepare for closing on your dream home. Closing costs can range anywhere from 4% to 8% of the total purchase price and vary across states. Included among these is your homeowner’s insurance policy, which is typically included in your monthly mortgage payments but is paid to your insurance carrier instead of your lender. Although certain lenders allow buyers to finance them along with the mortgage, here are some closing costs you can expect to put down on the day of closing:

There is no universal mortgage rate for everyone. Many different factors in the current market and your personal financial situation will determine your outcome but taking ample time to choose the right lender will help you the most in achieving your desired payments. If you want to learn more about the current real estate market, click here to read our blog post on Brian Buffini and Dr. Lawrence Yun's Mid-Year Industry and Market Update.

1 Comment

Calling all Triangle residents: We’ve got the perfect staycation planned for you! Not only is Chapel Hill home to the University of North Carolina, but also it is bustling with culture and is full of good eats and fun excursions. To help you navigate your way through the college town, we’ve put together a list of our top spots for you to check out on your next staycation!

Explore the University Chapel Hill is home to the University of North Carolina, the first public university in the nation. With that said, take the time to walk around the university’s campus. You can drink from the Old Well, which is said to grant you good luck and academic success, visit the Carolina Basketball Museum, or catch a star show at the Morehead Planetarium and Science Center, the largest planetarium in the southeastern United States! Walk, Hike, or Bike Chapel Hill has trails, so make sure to bring you walking, hiking, and biking shoes. You can explore the North Carolina Botanical Gardens or hike/bike the Bolin Creek Trail through Chapel Hill! You can either explore on your own or take a free walking tour. Arts Galore If you want an up close experience with the Chapel Hill arts, check out the Ackland Art Museum, the Frank Gallery, and the Blue Dogwood Public Market. If you can’t make it to one of these galleries, you’ll find tons of show-stopping murals around the town! Farmer’s Market and Local Fruit and Flower Picking Local artisans and vendors set up booths at the Carrboro Farmers’ Market every Saturday. You can find everything from fresh produce, prepared foods, flowers, and crafts. If you want a more hands-on experience, check out these local farms that offer fruit and flower picking! Dining Chapel Hill and Carrboro have dozens of restaurants that offer a variety of different cuisines. Check out our favorites below and click on each for more information!

Click here for more information on Chapel Hill, or click here for more information about Carrboro. Wall decor can be the perfect accent to spruce up your space and freshen up your walls. The way in which you hang up your wall decor, however, depends on what kind of piece it is and where you are hanging it. Check out the guide below to determine how you should cover yours walls! Click here for Carl's real estate resources vlog on getting your home ready to sell.

In Brian Buffini’s “Bold Predictions Mid-Year Update,” he spoke with Dr. Lawrence Yun, Chief Economist and Senior Vice President of Research at the National Association of Realtors, about the current state of the real estate market. Dr. Yun explained that the economy is facing many new circumstances. The dollar value of goods produced is up to 100% and we have 48 states with below low job conditions, which means there are employees who have to complete more work than before due to a lack of workers and there are major job openings. In regards to the # of transactions we will finish the year with, Dr. Yun said it will be around 6.1 million - the highest since 2006. We are seeing some tapping out in home sales activity in recent months and home sales are approaching pre-pandemic sales. We are past the absolute acute shortage from pandemic decline and inventory will continue to improve over the next 6 months. We have more home building activity, but projects are taking longer to complete because of the expense of building materials.

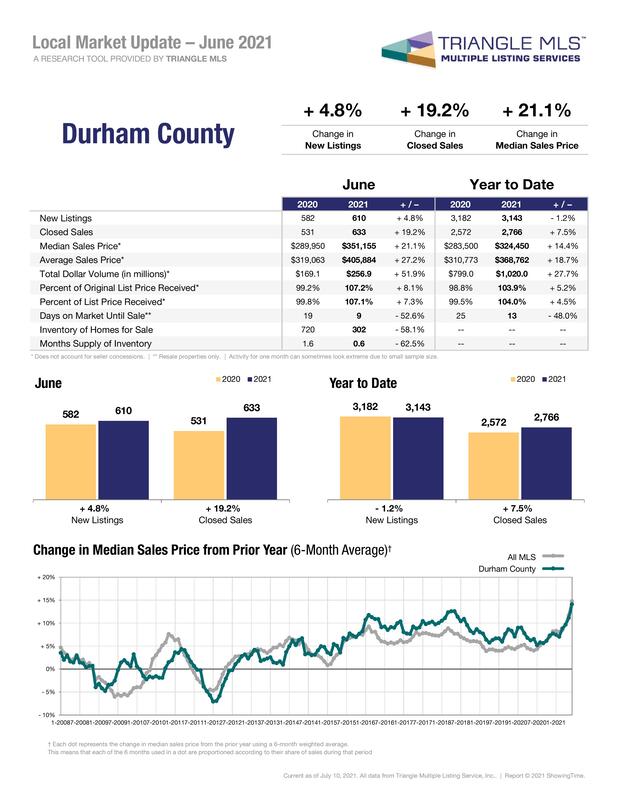

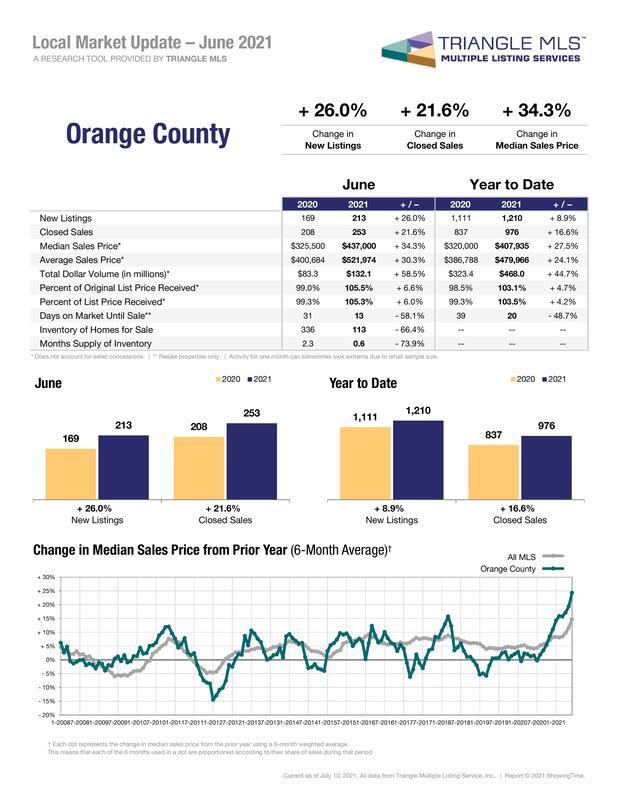

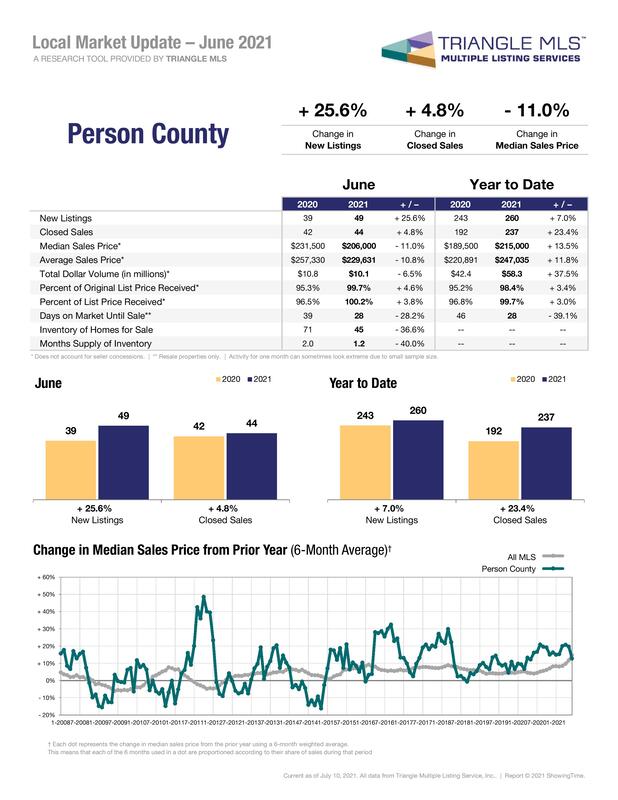

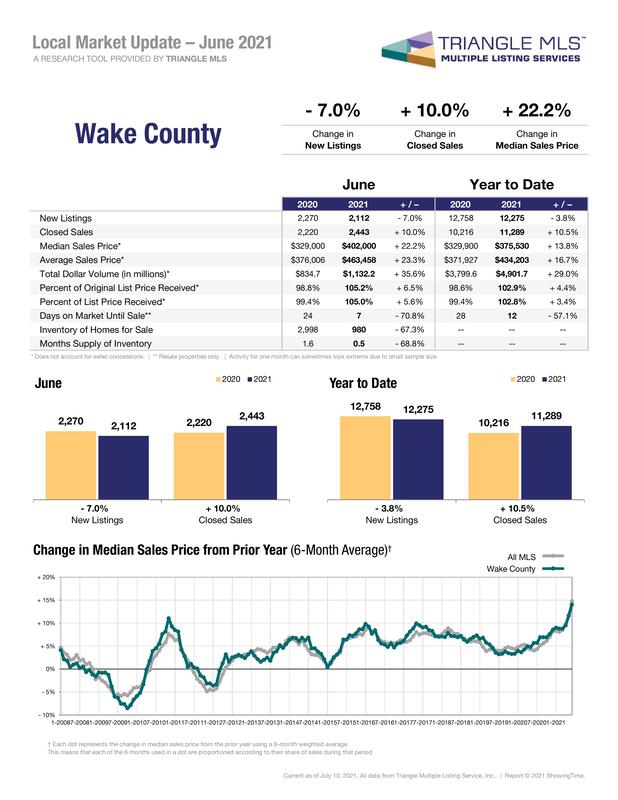

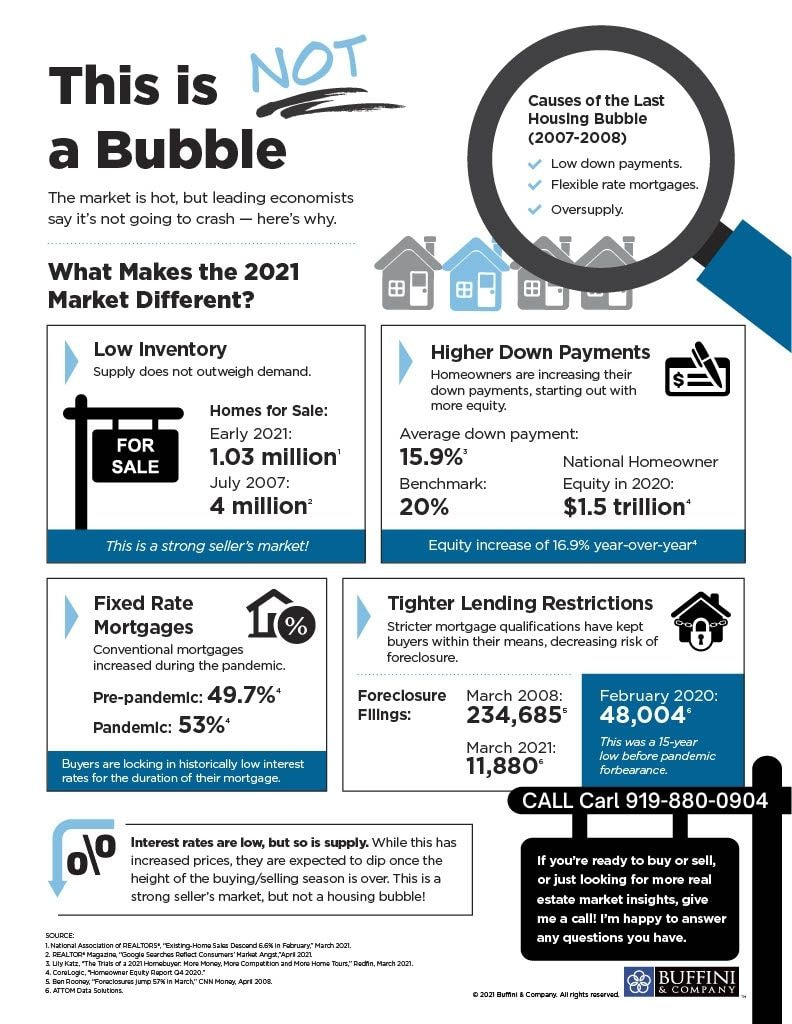

In the current market, home sales are increasing and houses are selling in record time. Reflecting on the 2006 housing bubble, the worry for many Americans and one of the most asked questions on Google is: “Are we in a real estate bubble?” The answer to that question, however, is no. Today, we have about 1.2 million homes for sale. When it declined in 2006, we had 4x as many homes listed for sale and mortgages were shady and risky. We have prices that are rising and more down payments than ever before. The rates are fixed, there’s more equity and a stable dynamic. There’s an army of home buyers who want a second chance opportunity so we are not expecting any persistent price decline. If you would like to learn more about the real estate market or need help navigating it, call or text Carl Johnson at (919) 880-0904! Per the June report from Triangle MLS "Summer’s here, and with vaccination rates on the rise, buyers continue to flood the market in search of their next home, with rock bottom inventory and record high sales prices reported throughout much of the country. Although closed sales were down nationally, overall demand for housing remains high, in part due to attractively low interest rates, offering buyers some relief and affordability in a fiercely competitive market. For the 12- month period spanning July 2020 through June 2021, Under Contract Sales in Triangle area were up 14.7 percent overall. Market-wide, inventory levels were down 60.0 percent. " In Chatham County, there was a 3.8 percent increase in new listings in June, similarly the year to date new listings, compared to last year, increased from 847 to 891. The number of closed sales increased from 653 to 779, a 19.3 percent increase. Median sales prices also increased by 16.0 percent. In June, Chatham County median sales price was slightly above the median sales price for all MLS listings. In Durham County, new listings decreased by 1.2 percent and closed sales have increased 7.5 percent year to date. Median sales price has increased 14.4 percent from this time last year, moving from $283,500 to $324,450. Average sales price increased by 18.7% percent year to date. In June, the Durham County median sales price was comparable to the median sales price of all MLS listings. The number of listings in Orange County has increased by 8.9 percent, from 1,111 new listings year to date last year to 1,210 new listings this year. There was a 16.6 percent increase in closed sales. Additionally, median sales price increased by 27.5 percent, from $320,000 to $407,935. In June, Orange County median sales price exceeded the median sales price for all MLS listings. The number of listings in Person County has increased by 7.0 percent, from 243 new listings year to date last year to 260 new listings this year. There was a 23.4 percent increase in closed sales. Additionally, median sales price increased by 13.5 percent, from $189,500 to $215,000. In June, Person County median sales price was comparable to the median sales price for all MLS listings. In Wake County, there was a decrease of 3.8 percent in the number of new listings year to date compared to last year. The number of closed sales increased 10.5 percent. Median sales prices also increased by 22.2 percent for June 2021 compared to June 2020. Compared to the median sales price for all MLS listings, Wake County median sales price were level in June. Click here to learn more about why we are NOT currently in a real estate bubble.

In the current market, home sales are increasing and houses are selling in record time. Reflecting on the 2006 housing bubble, the worry for many Americans and one of the most asked questions on Google is: “Are we in a real estate bubble?” The answer to that question, however, is no. In a webcast with Brian Buffini, Dr. Lawrence Yun reassured us that we currently have 1.2 million homes available for sale, and when home sales began to decline in the last housing bubble, there were 4x as many homes listed for sale. We don’t have the shady, risky mortgages we had before. House prices are rising and there are more down payments than ever before, creating greater equity, fixed rates, and a more stable dynamic. There’s an army of home buyers who want a second chance opportunity and don’t expect any persistent price decline. Check out the data below to understand why this is NOT a housing bubble. Click here to view Dr. Lawrence Yun's Market Report and Economic Forecast!

If you're looking to revamp or rearrange your home, there are many simple design trends and strategies you can consider that will transform your space. Check out the design tips below to help you embark on your redesign journey! Click here to read more about the Bold Predictions Mid-Year Update with Brian Buffinni, and Dr. Lawrence Yun.

|

Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed