|

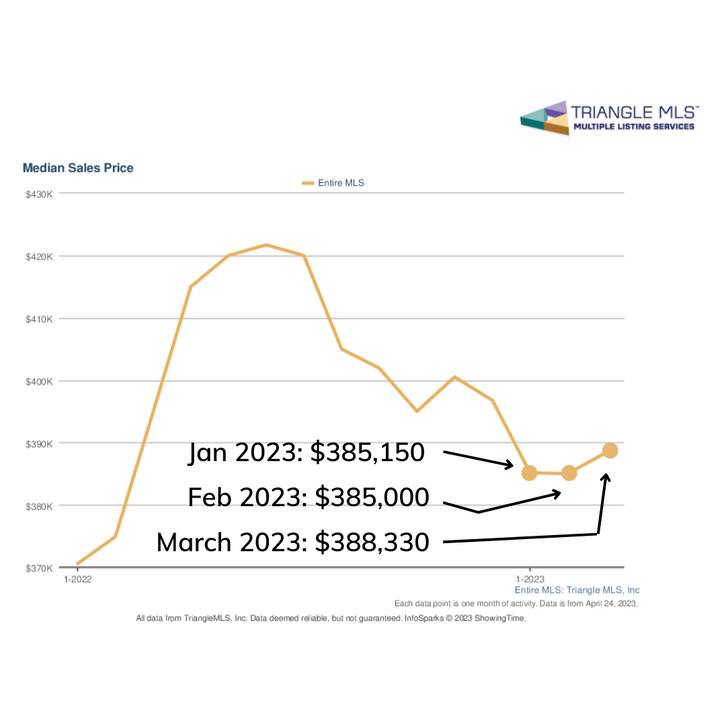

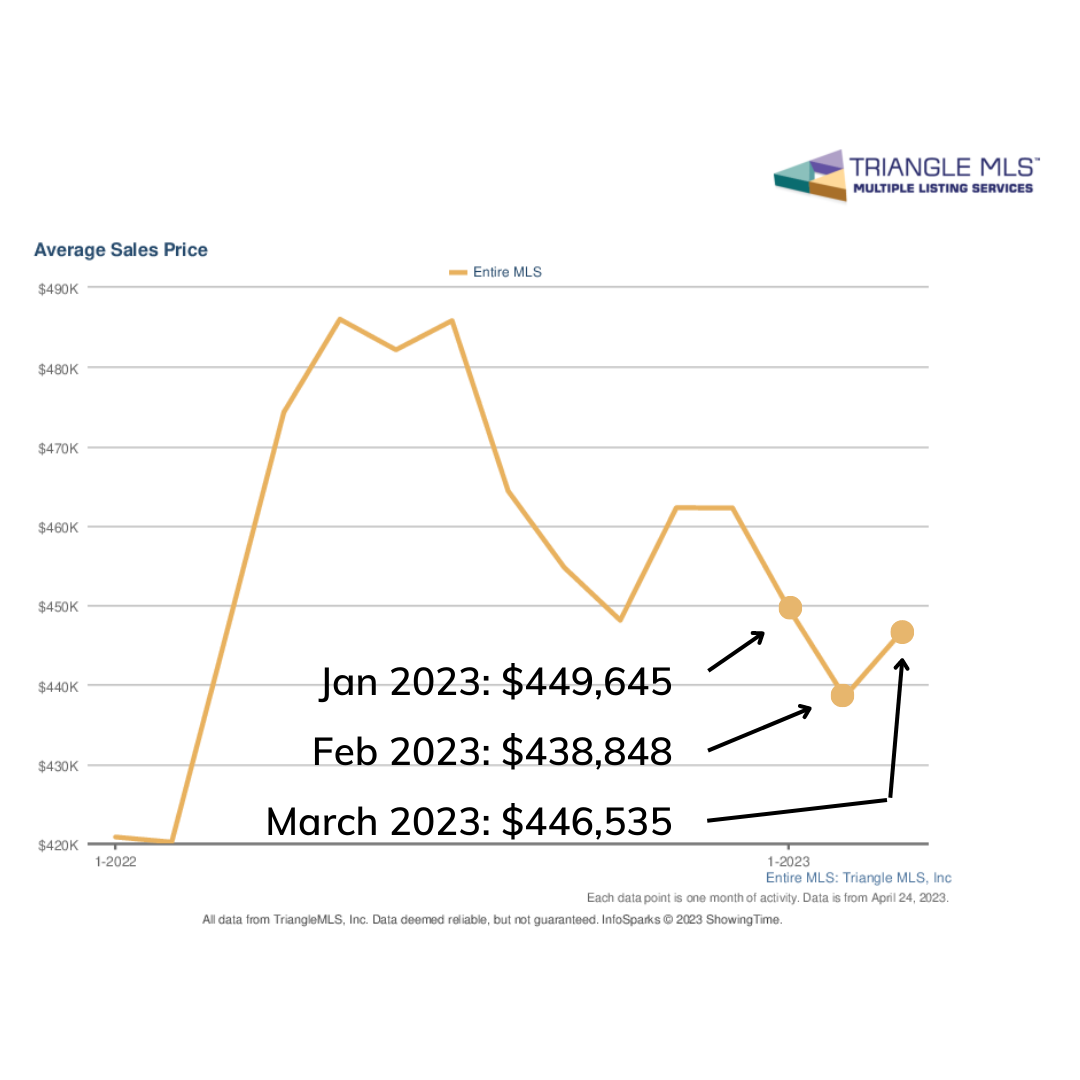

On April 20, 2023, The Wall Street Journal reported that the national housing market experienced its biggest annual decline in 11 years, leading to a challenging start for the spring selling season with a decrease in home sales. The real estate market in the Triangle MLS service area seems to be doing better compared to the national market. In March 2023, the median home sales price in this region increased to $388,330, which is higher than the median prices in January ($385,150) and February ($385,000) of the same year. Even though the average home sales price decreased to $438,848 in February from its high of $449,654 in January, it went back up to $446,535 in March. I predict that the pricing will continue to rise throughout the spring market. It seems that the Triangle's housing market is challenging the national trend, and homebuyers and sellers in the area may continue to see a strong market in the coming months. In this evolving housing market, it's important to stay up-to-date on the local trends. Carl Johnson, a proactive and knowledgeable REALTOR, will help with local knowledge of the market and ensure a successful outcome for all clients. If you're thinking about buying or selling a home, don't hesitate to reach out to Carl Johnson Real Estate today at 919-880-0904. CLICK HERE to schedule a free consultation!

0 Comments

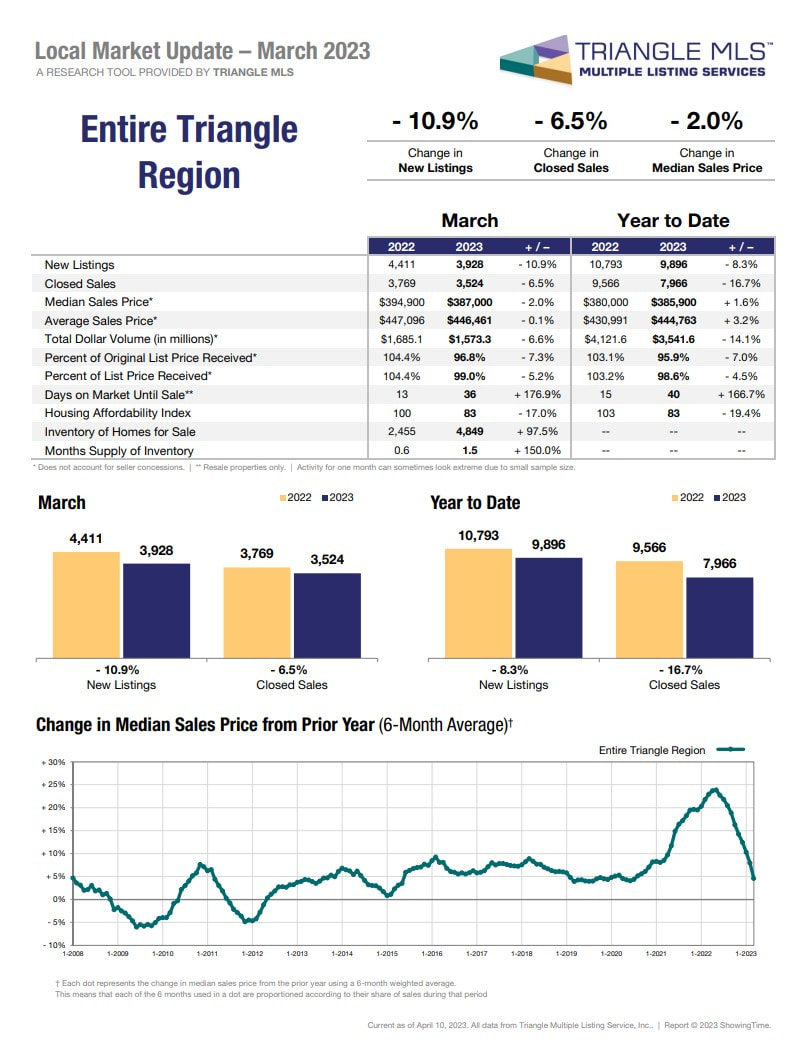

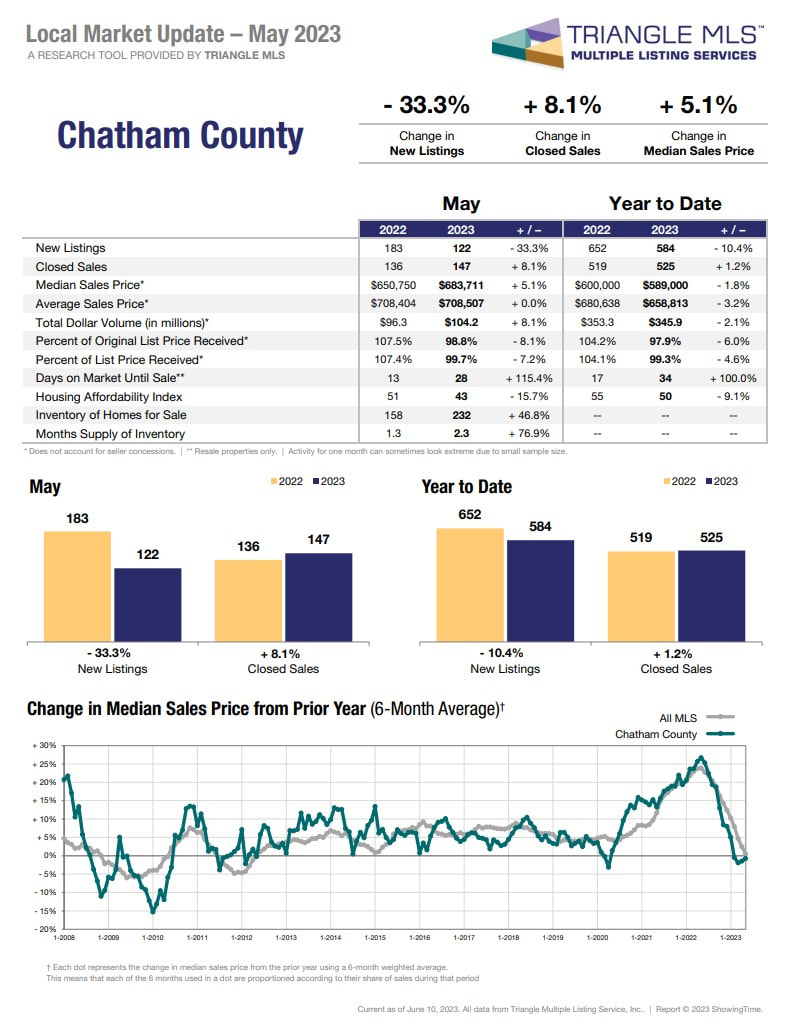

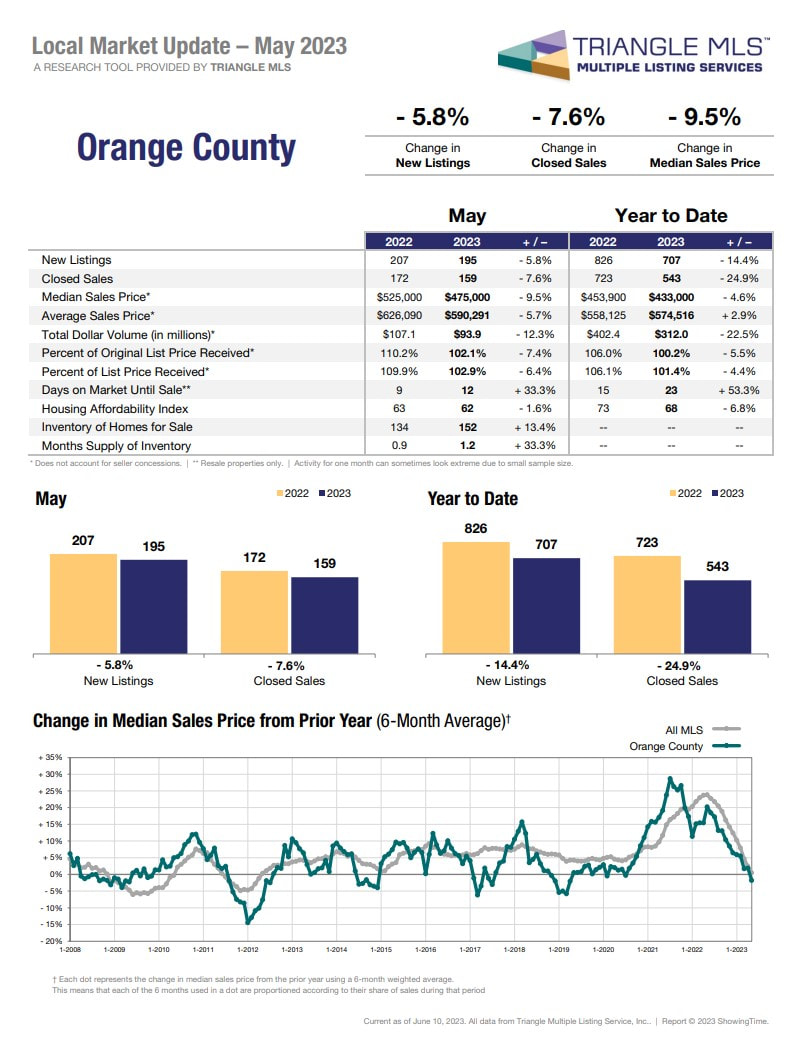

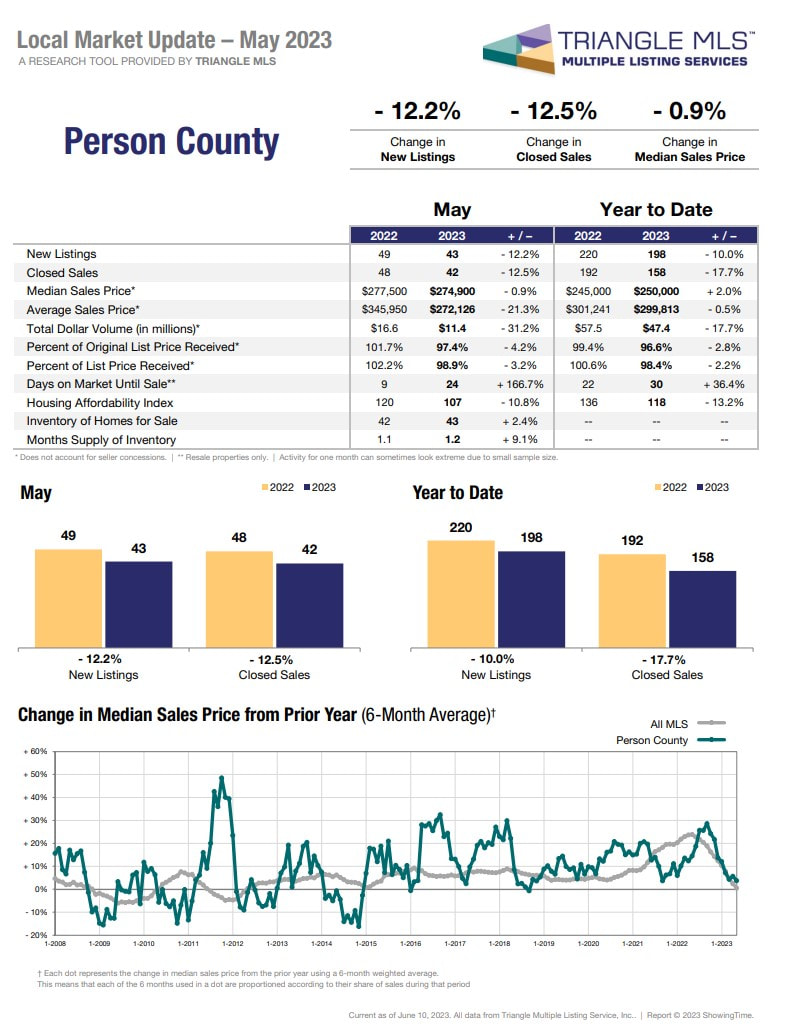

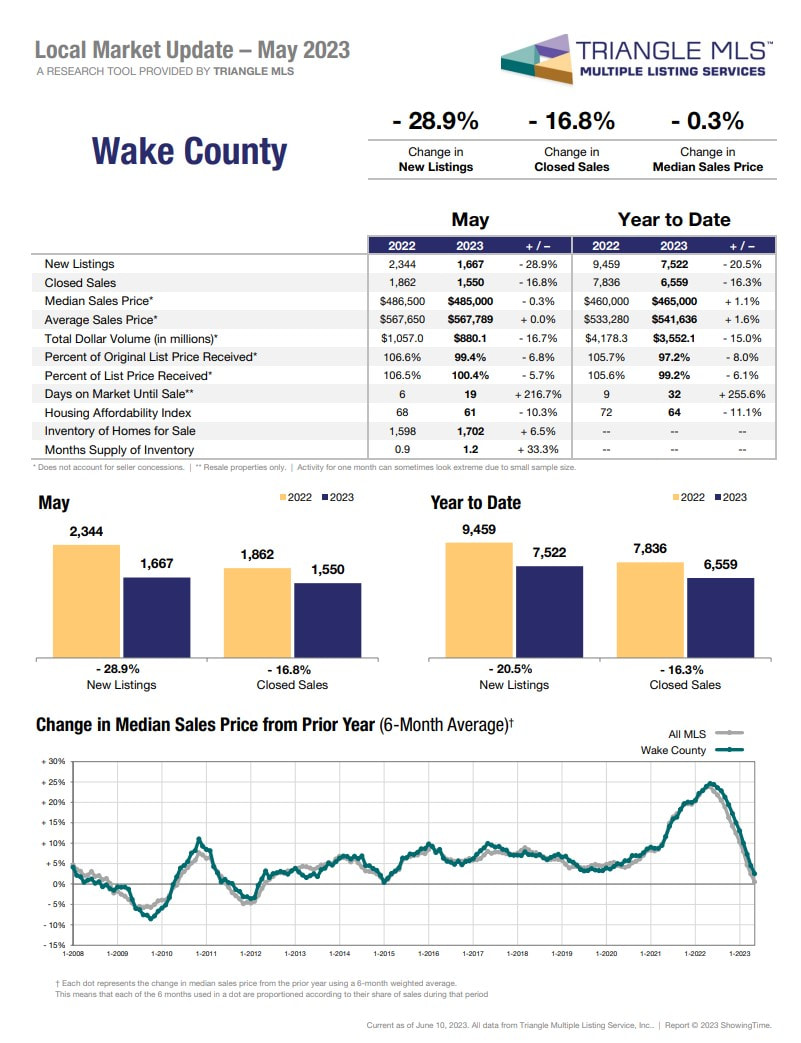

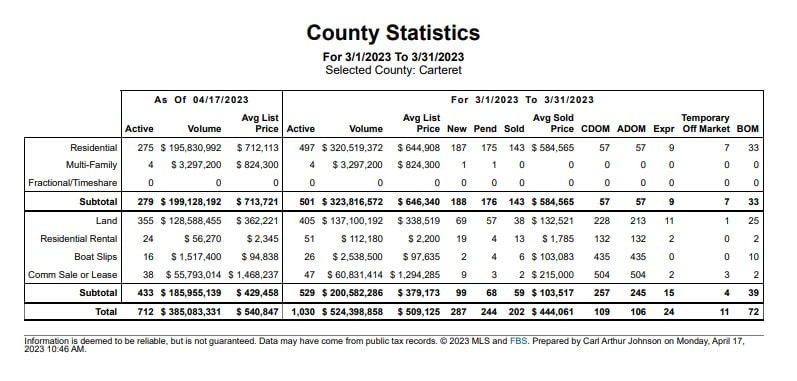

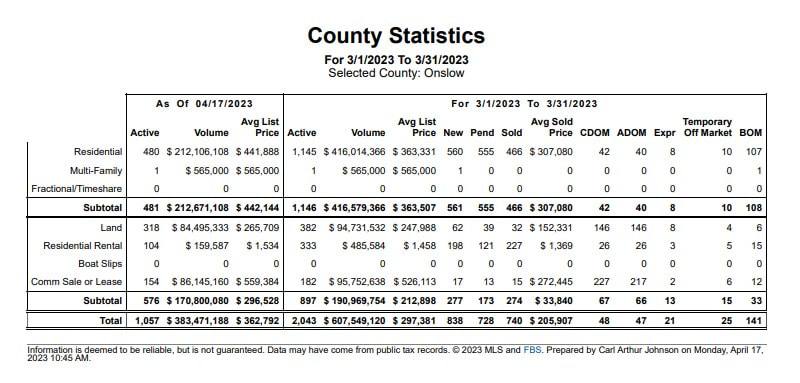

Great news for anyone interested in the North Carolina real estate market! The latest data from March 2023 shows that the market is continuing its upward trend. According to the North Carolina Association of Realtors, the median home price in the state has increased by 7.8%., an indication of the strong demand for properties in the area. There has also been an uptick in new construction, which is good news for those looking for newly built homes. The increase in new construction is a positive sign for the overall health of the market, as it indicates that developers and builders have confidence in the future of the industry. The state’s major metropolitan areas are experiencing particularly strong growth. Raleigh has seen a 7.1% increase. If you’ve been considering buying or selling property in North Carolina, now might be the time. Call Carl Johnson Real Estate to learn more about how you can make the most of this exciting market. 919-880-0904! CLICK HERE to read more about Carl's experience in the industry and to get in touch with him today! Per the March report from Triangle MLS: Across the entire Triangle region, the median sales price went from $394,900 to $387,000, which is a 2% decrease compared to March of last year. New listings were down by nearly 11%. Also decreased was the number of closed sales, which were 3,524. In Chatham County, there was a 4.3% increase in new listings over March of last year. The number of closed sales increased between 2022 and 2023, rising from 101 to 108. The median sales prices also increased by 2.1%. In Durham County, closed sales have decreased nearly 16% year to date. The Median sales price also fell, by nearly 3% compared to March last year, moving from $409,400 to $399,109. The average sales price, though, increased from $431,627 to $435,851. The number of listings in Orange County decreased by 3.4% from 179 listings last year to date to 173 new listings this year. There was a year-to-date 16.2% decrease in closed sales. Additionally, the median sales price decreased by 7.9%. The number of listings in Person County decreased by 13%. There was a 5.1% decrease in closed sales as well. Additionally, the median sales price increased by nearly 6%, from $229,900 to $242,990. In Wake County, there was a decrease of nearly 16% in the number of new listings year to date compared to last year. The number of closed sales also decreased, by 11.1%. The Median sales prices increased by 2.2% year to date, rising to $460,000. In Carteret County, there were 188 new listings, comprising residential and multi-family properties. There were 143 sold properties in March. While the average list price was $646,340, the average sales price was $584,565. In Onslow County, there were 561 new listings, comprising residential and multi-family properties. There were 466 sold properties in March. While the average list price was $363,507, which shows to be increasing in April. The average sales price was $307,080. If you’re ready to buy or sell in Carteret or Onslow County, Carl Johnson Real Estate can help you at the Crystal Coast. Give us a call at Carl Johnson Real Estate--919-880-0904—to learn more about how we can help get you to where you want and need to be.

To learn more about the Crystal Coast Communities CLICK HERE What is Pig Out For The Cure? A fundraising effort by Coldwell Banker Howard Perry and Walston agents in conjunction with the HPW Foundation (501c3). Proceeds benefit The UNC Lineberger Comprehensive Cancer Center and directly support the Mary Anne Long Patient & Family Resource Center. Funds are raised through the support of sponsors, the sale of BBQ plates for pickup at or delivery from several HPW offices and through donations. About UNC Lineberger Comprehensive Cancer Center and The Mary Anne Long Patient Family Resource Center The UNC Lineberger Comprehensive Cancer Center is a cancer research and treatment center at the University of North Carolina at Chapel Hill. Serving patients at the N.C. Basnight Cancer Hospital, UNC Lineberger is the only public comprehensive cancer center in the state of North Carolina. The Mary Anne Long Patient and Family Resource Center has extended hands and hearts to support cancer patients and families coming to N.C. Cancer Hospital from all 100 counties of North Carolina and beyond. How Can You Help?

If you’re looking for a top-performing agent, Carl of Carl Johnson Real Estate is the Triangle region’s leading professional. He knows your communities and the buying market. With his guidance, expertise, and tech savvy on your side, you’ll have what you need to navigate the 2023 market with confidence. CLICK HERE to learn more.

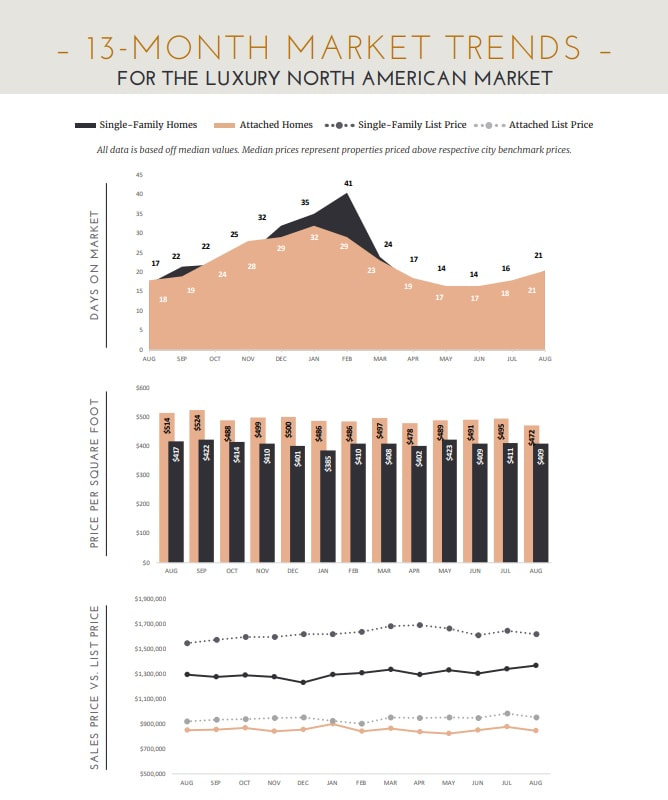

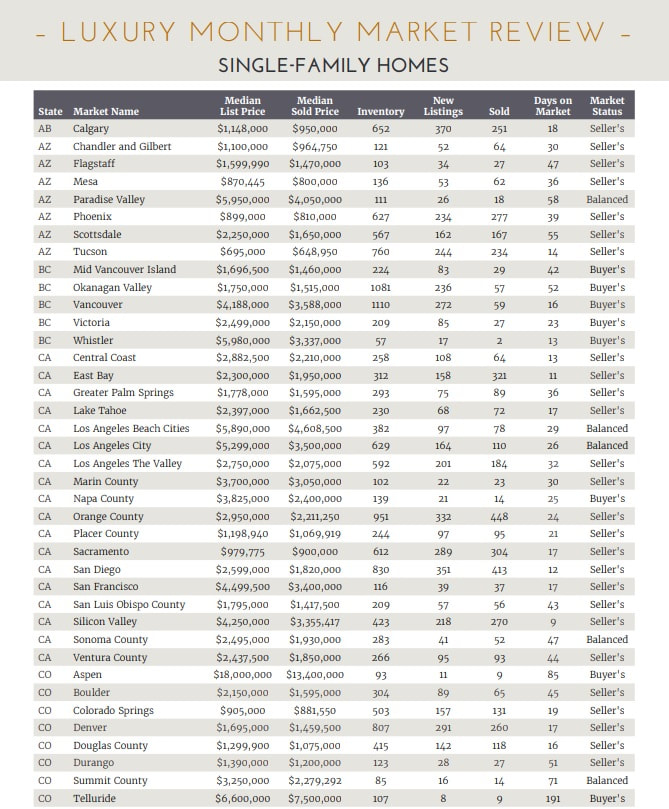

The April 2023 Institute for Luxury Home Marketing monthly trend report is out now! CLICK HERE to download the full report. We are happy to share this information to you. The following is per the Institute for Luxury Home Marketing April 2023 Market Report: Luxury Properties Return The quiet optimism forecasted last month seems to be paying dividends, as there was a distinct increase in the number of luxury property sales in March. In fact, our findings show sales for single-family homes and attached properties have risen nearly 50% compared to February 2023. The number of new listings entering the market has facilitated this increase in sales which rose over 32.9% for single-family homes and nearly 25.6% for attached properties in March, indicating that sellers are becoming more optimistic about selling again. The median sold price for both markets remained stable, too, while still slightly below March 2022; prices have climbed against February 2023. The sold price to list price ratio (SP/LP%) also trended back up in March. It moved from 97.67% in February to 98.56% for single family homes and 98.37% to 98.89% for attached properties – indicating that sellers are seeing prices closer to their expectations once again. By no means do these numbers imply that we are heading back to the overinflated demands of 2020 and 2021, but they do reflect growing confidence in the luxury market as we head further into spring. Not All Things Are Equal Overall, the market is still showing that it is favorable to sellers – but this is mostly due to increased sales and, despite increases in new listings, inventory levels remaining below the 10-year norm in many markets. However, significant differences between markets have arisen over the last few months, with some becoming increasingly more favorable for buyers, while others remain firmly in control of the sellers, and the remainder favorable to neither. Equally confusing is that in some markets, home prices continue to increase, while in others, they are on a downward trajectory. Different price points within the same market also report differing results, and it’s not always the lower priced properties that are selling the fastest! Additionally, results seem to be inconsistent from month to month! So how are buyers and sellers meant to understand whether it’s a good time to buy or sell? Key Parameters to Understanding Your Market One of the most important factors to consider is understanding inventory levels of similar properties on the market - not always an easy task in the luxury market where marketing homes is based on their differentions. Typically, the sales ratio, i.e., how fast the market is moving, measures the level of inventory remaining against the number of sold properties for that month. However, it is also important to review if there is a substantial amount of inventory in your price point, property type, or location, whether it has been on the market for a while or just unlikely to meet buyer expectations, as this can distort the true demand for your property. The second indicator is how long properties are taking to sell; this becomes your next barometer for understanding demand. If most sold homes are selling within days and at close to asking price, then this typically indicates that demand is high (irrelevant of how much inventory remains on the market). Often, you will find a common denominator in these sold properties, such as move-in ready, location, or price point is driving demand. Understanding these key parameters should help buyers and sellers manage their expectations, leverage opportunities, and appreciate their true negotiation power within their specific market. Luxury Markets in Demand As demand returns, we review several markets in the U.S. and Canada that experienced significant growth in March. Much has been written recently about the popularity of lower priced luxury markets, especially in the Midwest, so we wondered, with the uptick in sales during March, if this trend was still holding true…or if another shift is occurring. East Bay, California Taking the number one spot is not a Midwest market, but East Bay in California, where the median luxury sold price averaged close to $1.5 million during the first quarter of 2023. Not only did this market see a huge increase in demand during the pandemic, but once again it is drawing buyers to its highly diversified communities and seems set for a strong spring market. The sales ratio rose from 36% in January to 50% in February and then saw a huge uptick to 123% in March – with the number of sales in March far outstripping the level of new inventory entering the market. The average number of days these properties remained on the market fell from 22 days in January to 12 in February and down to just 9 in March. While the median sold price rose from $1 million in January to just under $2 million in March, this does not actually indicate that prices rose by 100%, but rather that there is a greater quantity of higher priced properties selling again. Hamilton County, Indiana Located just north of Indianapolis, Hamilton County routinely scores high marks when rated for its quality of lifestyle and has become one of the fastest-growing real estate markets in the U.S. Price certainly has been a factor for those looking to embrace a new luxury property at a more affordable rate, with the median price averaging around $750,000 for the last three months. Like East Bay, Hamilton County has seen its sales ratio steadily climb from 34% in January, to 55% in February, and 98% in March, while the days on market for sold properties have declined from 14 days in January to 6 in March. Oakville, Ontario A suburban town located on the shores of Lake Ontario, Oakville is part of the Greater Toronto Area (GTA), with nearly 75% of its population aged between 20-54 years old. Even before the pandemic, Oakville saw a consistent increase in its population from those looking to enjoy its picturesque location, active lifestyle, and easy access to downtown Toronto. Like much of the luxury real estate market, Oakville saw its transaction level stall during the last four months of 2022 into the start of 2023. However, demand has been on the uptick as expectations for Oakville’s economic growth and diversity attract people from around the world. Prices have risen month over month since January, from CAD$1,115,000 to CAD$2,332,000 in March – however, this is the result of an increase in the number of sales for higher priced properties. Still, Oakville’s sales ratio rose from 25% in January to 37% in February and jumped to 76% in March, and the average days on market consistently fell from 79 in January down to 9 days in March, all indicators of a strong seller’s market. St Louis, Missouri Taking the final spot is St Louis, a Midwest market whose popularity has risen dramatically over the last few years and certainly has luxury properties that rival many of the more recognized luxury cities in the U.S. Indeed, just last month, St Louis saw a record-breaking sale of $13 million for a property located in the coveted Huntleigh neighborhood. St Louis has become highly attractive for young professionals and families due to a significant urban revitalization, an influx of new businesses, and increased focus on expanding industries such as healthcare, biotechnology, and finance. The average days on market for luxury properties has fallen over the last three months from 28 to 15 days, while prices have increased from $650,000 to $773,150 – again, this is more reflective of the increase in sales of higher priced properties, although the average sold price is still seeing modest increases. Already significantly high in January with a sales ratio of 53%, this increased in February to 55% before jumping to 90% in March. In conclusion, it seems that price in the luxury market is becoming less of a factor as the number of sales for higher priced properties is on the uptick, and markets seeing the greatest demand have something more to offer potential buyers than just lower-priced homes. The art of selling and buying in this market needs a critical and analytical approach; understanding the realities and setting expectations accordingly will ensure that goals are achieved. For homeowners looking to buy or sell in today’s market, we recommend working with a Realtor who can capitalize on the preferences, trends, and demands in this dynamic and evolving environment. At Carl Johnson Real Estate we use our experience and knowledge to lead our clients in the right direction. CLICK HERE to read more about Carl Johnson, REALTOR®, Broker, Owner, and Founder of Carl Johnson Real Estate. Carl is certified as an Institute for Luxury Home Marketing Specialist, CLHMS, which means he offers superior knowledge and experience in the luxury market. His CLHMS membership also provides him with access to an elite network of contacts and resources that help drive the perfect buyer to your high-end listing or find you your dream home! Using the most up-to-date marketing information, Carl positions your listing ahead of the market curve. Call 919-880-0904 for a consultation or CLICK HERE

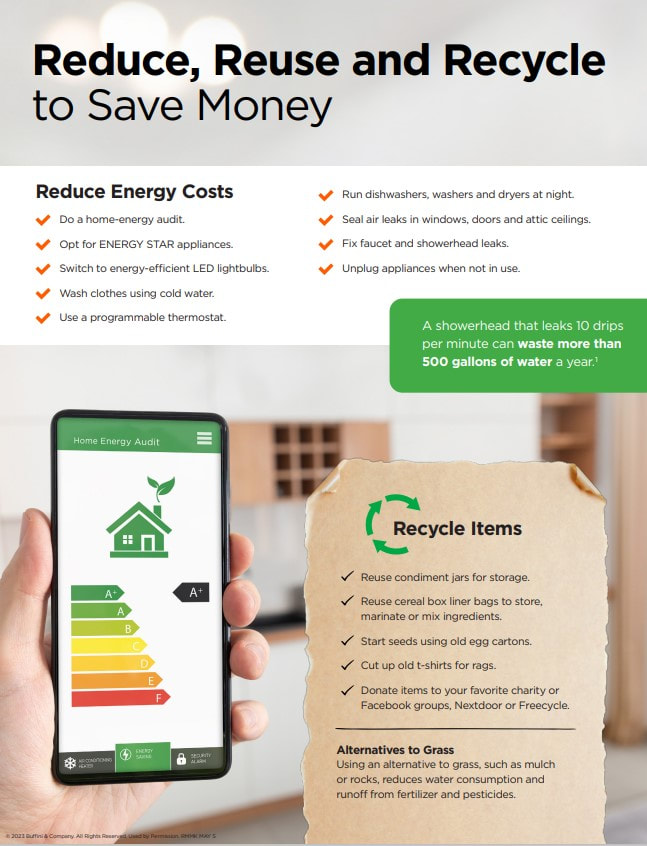

This month, I share some easy ideas you can use to reduce waste in your home that will also help you save money. Here are a few ways you can recycle common items in your home for other useful purposes. I will also offer suggestions on environmentally savvy ways you can repurpose items you no longer need or want in your home. Plus, some simple tips on ways to reduce wasted groceries as well as some composting hacks. CLICK HERE to read more about Carl's experience in the industry and to get in touch with him today!

This month, I am sharing with you highlights of some of the hottest home design trends experts are seeing this year. I also offer information on the ways some homeowners are incorporating color and natural materials to create a warm and relaxed luxe environment in their home. CLICK HERE and Carl will make your home buying/selling process less stressful.

|

Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed