|

When you get your tax refund, it’s easy to dream of what to spend it on. Of course, you can treat yourself to a gift or two. However, a decent tax refund can go a long way for hopeful home buyers. Even if it doesn’t cover the entire purchase price of a new home, you can use your tax return to cover a handful of home buying fees. Here’s a list of seven practical ways to use your tax refund to buy a home.

1. Use Your Tax Refund For A Down Payment The average down payment on a home is about 6% of the purchase price, but down payment options can be as low as 3%. Establish your house hunting price range and compare your planned down payment to what you’re getting back in taxes. Then decide if your tax refund is best applied to your down payment. A bigger down payment allows you to borrow less and strengthens your position when you put in an offer on a home. The more you put down, the more likely the sellers are to accept your offer over others. This is especially important in a seller’s market. 2. Use It On Closing Costs When you make it to the closing table, there are fees your tax return may be able to help with as well. Here are a few of the most common closing costs:

3. Buy Points A mortgage point – sometimes called a discount point – is a fee you pay to lower your interest rate on your home purchase. One discount point costs 1% of your loan amount and lowers your rate by a fraction of a percent decided by your lender. For example, if you take out a mortgage for $100,000, one point will cost you $1,000. For a $200,000 loan, a point costs $2,000. Points are paid for at closing. Your lender will calculate the cost of any points and add those costs to your other closing costs. Depending on your tax refund amount, you may be able to purchase discount points to save money on interest over the life of the loan. 4. Make Necessary Repairs If you’re planning on buying a fixer-upper, you can use your tax refund for renovations or repairs before moving in. You can also use it to fund smaller cosmetic changes like new paint and flooring. These types of projects are much easier to complete before moving in. Since you’re not living there yet, there’s likely no furniture to move out of the way. Using this money toward home updates can add value to the home and secure a higher sale price if you decide to sell later on. 5. Fund Moving Costs Moving costs money, even if you do have time to do it yourself. With a long-distance professional move averaging up to $8,000, a tax refund can come in handy. Your tax return will likely go further for a local move, which averages up to $1,600. No matter how far you move, your tax refund can relieve the financial burden of relocation, making moving easier. 6. Pay Off Debt The interest rate on your mortgage and your loan terms depends on your credit score. That’s why your credit should be in good shape before you apply for a mortgage. If your score needs some work, build your credit score back up by paying off debt. If you have credit card bills or late payments, your tax refund can help pay off debt and ultimately boost your credit score. This can give you a better chance of securing a lower mortgage rate and better loan terms. 7. Keep It In Your Emergency Fund Unexpected costs come up all the time for homeowners. If you already have your down payment and closing costs covered, consider keeping your tax refund in your savings. This way, you don’t have to stress if something needs to be replaced or repaired. When your furnace breaks or your basement floods, you’ll be thankful you set aside some money in an emergency fund. The Bottom Line Your tax refund can help you become a homeowner in more ways than one. You can put it toward major expenses like your down payment and closing costs. You can also cover some other fees associated with buying a home, like moving or home repairs. Or finally, you might find the best option is to set it aside to prepare for future costs of homeownership. And as always, if you are thinking about buying or selling a home, don't hesitate to reach out to Carl Johnson Real Estate today at 919-880-0904.

0 Comments

When buying a house, you want to do everything you can to get the best deal and ensure a seamless transition into your new home. Here are some best practices to help guide you when buying real estate in spring.

1. Understand Market Conditions To help determine whether you should buy a house in the spring, you should take a look at current market conditions. Market conditions include whether it’s a buyer’s market versus a seller’s market, current mortgage rates, real estate trends in your desired areas and more. These conditions can fluctuate throughout the year – even during the spring season – so it’s important to evaluate each condition before buying real estate in spring. 2. Determine Your Must-Haves With the potential for an overly competitive market in the springtime, it’s of the utmost importance that you’ve done your research and know exactly what you want. Being decisive and prepared can be the best way to make offers that stand out or score your dream home before the price goes up. Here are a few factors to research well before participating in the spring real estate season:

3. Get Approved For A Mortgage It can also be beneficial to have your loan options sorted out well before entering the spring real estate market. Consider applying for mortgage preapproval before you start touring homes and attending open houses. This way, you’ll know how much home you can realistically afford, as well as which lender will give you the best interest rate you can lock. 4. Work With The Experts Work with an expert Real Estate Agent throughout your buying experience. Real Estate Agent Before entering the spring real estate market, you should consider working with a real estate agent. Real estate professionals can offer in-depth knowledge of an area and even help you get your dream house based on concessions like an extra moving day or a more flexible schedule. Real estate agents are also valuable if you get caught in a bidding war or are worried about paying more than a home is worth. They can conduct a comparative market analysis (CMA) on a home and offer estimates and contractor referrals for any renovations the home may need. Home Inspector You may also want to consider enlisting the help of a home inspector for the spring housing market frenzy. Unlike the weather extremes you might experience during the summer or winter, spring’s mild climate may not highlight any potential issues in a home. A home inspection can bring to light any issues with a home’s structure, core systems like the plumbing and HVAC units, windows and window frames and any other features that might influence your decision to purchase the home. Potential Neighbors The homeowners who already live in the neighborhood you want to live in are the perfect candidates to ask about any concerns. Check with other neighbors about the quality of the school district or ask local business owners how busy downtown can really get. Locals can offer expert insight into a community – flaws and all. 5. Stand Out With A Verified Approval Letter (VAL) Due to the influx of buyers during the spring real estate season, you should do everything you can to secure a competitive edge and make your offer stand out. One surefire way to stand out is with a Verified Approval Letter (VAL). A VAL is an effective way to boost your credibility as a buyer. Having a VAL on hand shows a seller you’ve made plans for financing, and you’re serious about the purchase. Because financing issues are a common culprit for many failed home sales, presenting a VAL will give your seller peace of mind – and just might land you the sale. We hope these tips help you navigate the Spring housing market. And as always, if you are thinking about buying or selling a home, don't hesitate to reach out to Carl Johnson Real Estate today at 919-880-0904. Springtime brings a welcome change to the temperatures outside, clearing the winter clouds and making way for sunshine. It also brings more houses to the market, making it an ideal time to take that leap and buy your new home. There are several reasons buying a home in spring is better than other times of the year. Some of them are obvious, and some are more nuanced. Let’s explore how your home search can blossom with the change in seasons.

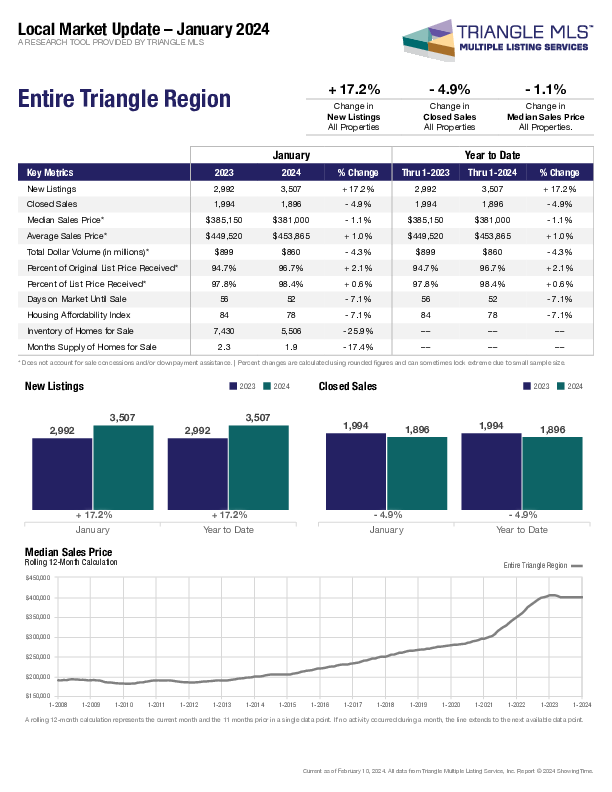

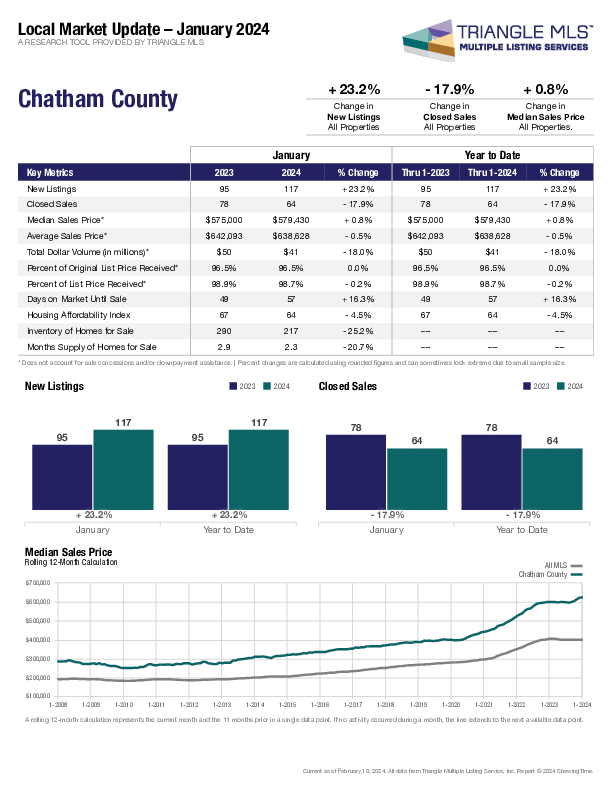

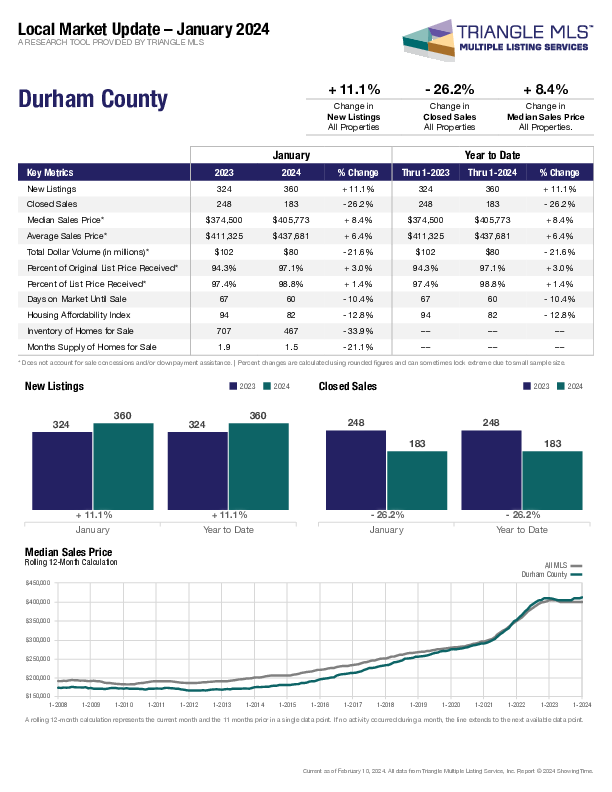

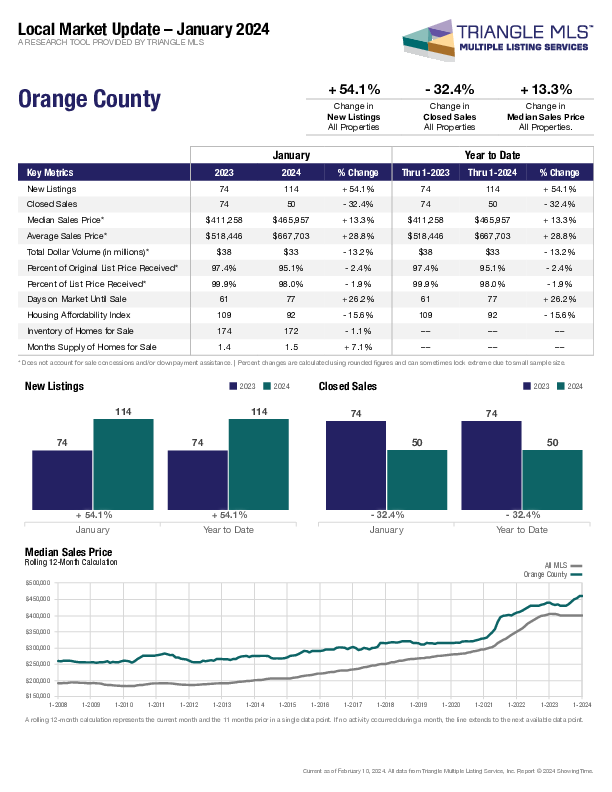

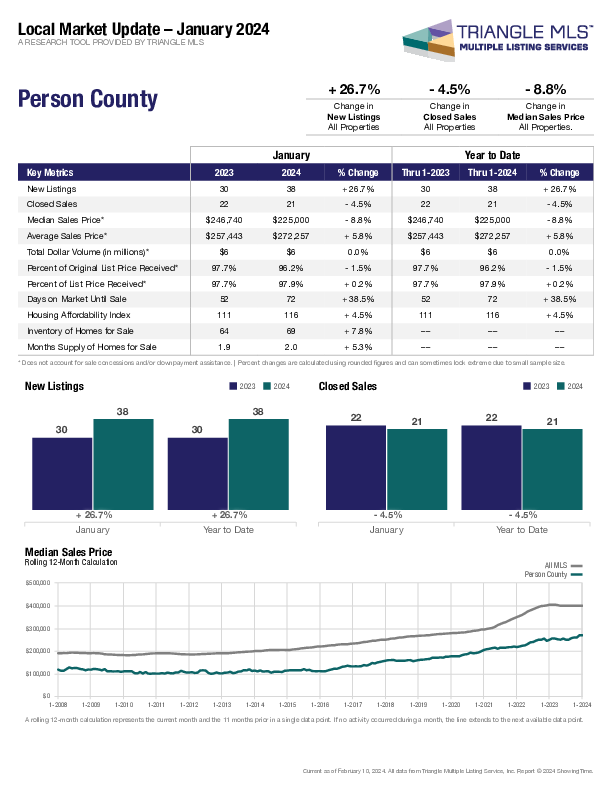

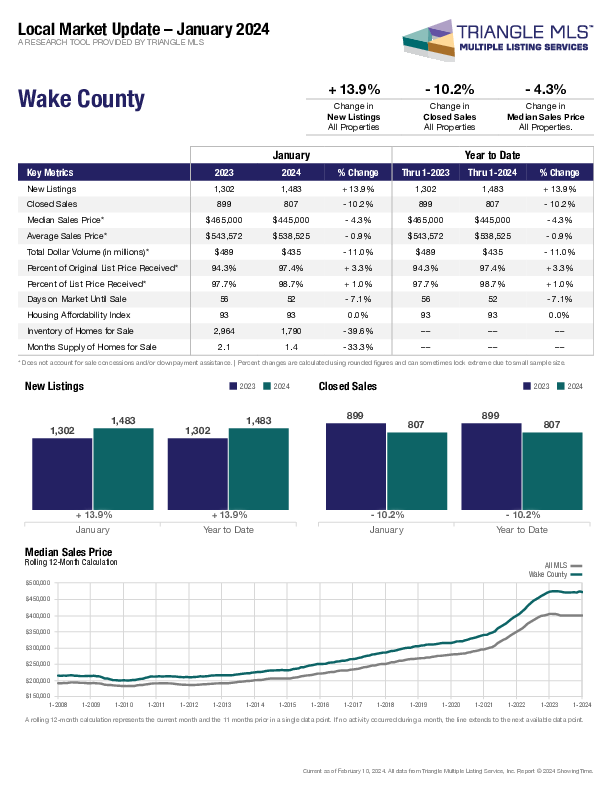

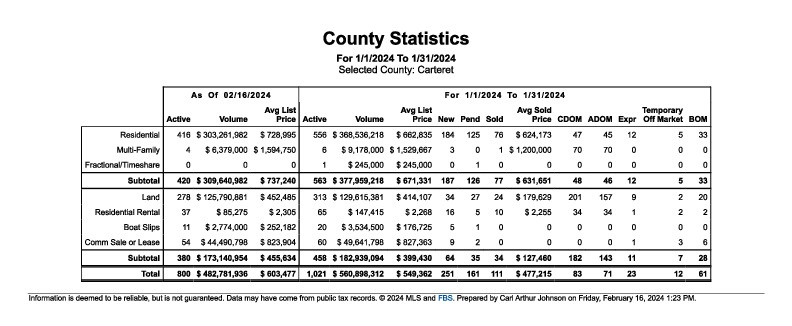

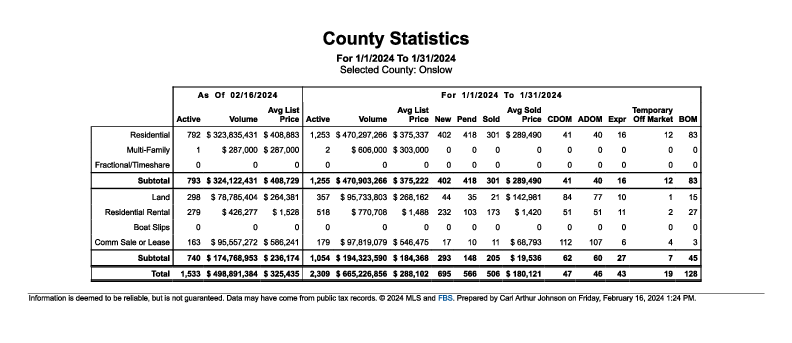

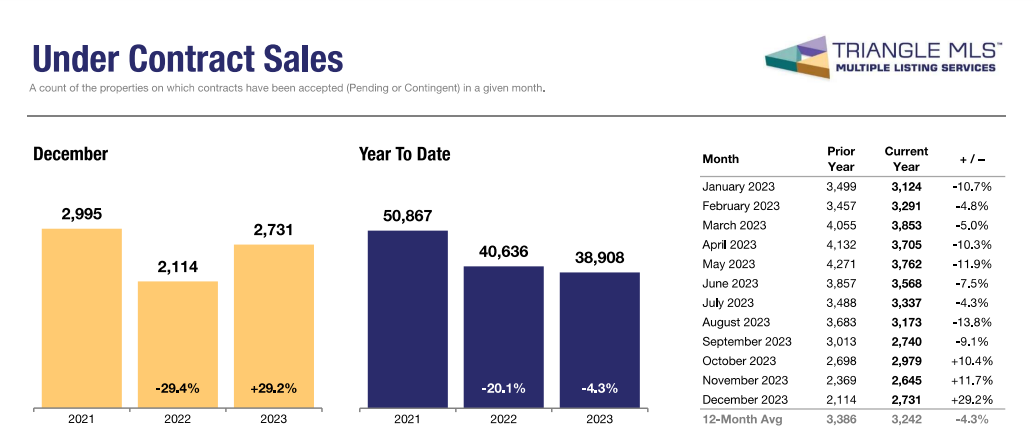

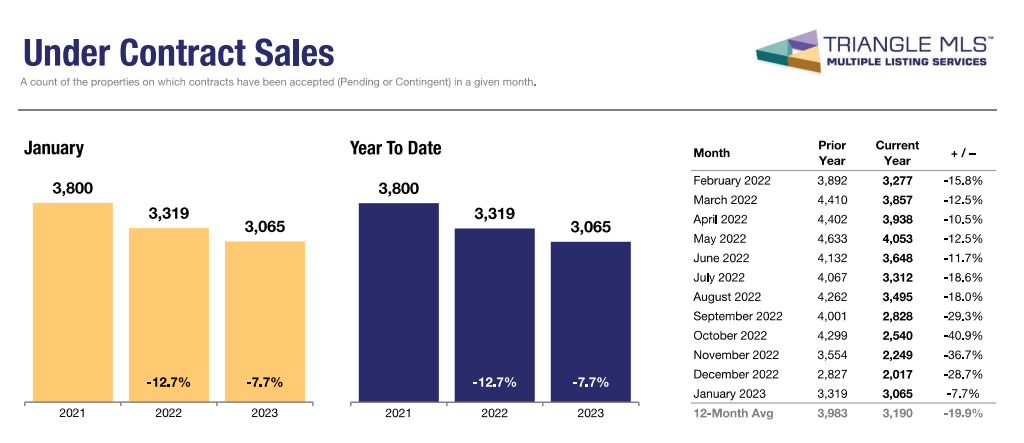

There’s More Inventory to Choose From. For starters, you’ll have more homes to choose from as you kick off your new home search in spring, and there are a couple of reasons for that. Houses show better in the spring than in the winter. With the brighter days and warmer weather, you get better views of the homes you’re considering. Instead of being covered with snow, you get to see the exterior of the house with its landscaping in full bloom and also get a better handle on its overall condition. Real estate agents know this and will often encourage their clients to list their home in the spring. Sellers are more motivated to get their house on the market. As the weather improves, sellers are often more motivated to kick things into high gear, complete any repairs or renovations, and get their homes listed. With more houses on the market to choose from, the likelihood you’ll find the one that’s just right for your needs increases and the length of time that’s likely to take you decreases. Families Are Looking to Buy During Spring This is also the time of year children graduate from schools and colleges, which can mean big moves for families. It’s both an ideal time to sell a home and to buy a new one, aligning with those other big life changes. It also allows you to be moved in and ready for the start of the next school year. With over half of US households having at least one child in the home, that’s a lot of potential for buying and selling, which helps drive the busy spring market. Better Weather Makes it Easier to Tour Houses We can probably all agree it’s better to head out to tour homes on a breezy spring day with the sun beating down than a cold, snowy one in winter. You won’t have to put on your boots and coat, and for most, it’s easier to muster that motivation to hit the road and check out what’s out there. Aside from the personal factor, you’ll also benefit from seeing the houses you’re touring in more ideal weather conditions. It’s easier to tell what’s in good shape and what might need repair without snow or ice in the mix. Prices Are Usually on the Rise but not at Their Peak While it’s true that buying a home in spring comes with the advantage of more inventory to choose from, that increase in inventory paired with better weather does make for more competition. And when there’s more competition, prices start to creep up. But prices aren’t always trending upwards as quickly as you might think. The National Association of Realtors tracks home sales and prices throughout the country. They’ve found that the peak month for the highest average sale price is June. So if you’re looking to buy in spring, it can be a great chance to have more options to pick from before prices are at their highest point. If You’re Ready to Buy Quickly, This is the Time Buying your new home during the spring season will likely not allow you the luxury of taking time to compare different houses or offers, but that doesn’t have to be a bad thing. If you go into your spring home shopping knowing that the market is moving fast, you can use it to your advantage. You can find your perfect home, get your offer accepted, close, and move in record time. And as always, if you are thinking about buying or selling a home, don't hesitate to reach out to Carl Johnson Real Estate today at 919-880-0904. Make sure to review the data located at the bottom of this blog post, which shares information about two counties along The Crystal Coast, from Swansboro to Beaufort. “U.S. existing-home sales slipped 1.0% month-over-month and were down 6.2% year-over-year as of last measure, while pending sales jumped 8.3% from the previous month, marking the largest gain since June 2020,” according to the National Association of REALTORS® (NAR). “After a brief decline, national sales of new residential homes are on the rise again, increasing 8% month-over-month an d 4.4% year-over-year to a seasonally adjusted rate of 664,000 units,” according to the U.S. Census Bureau. “Lower interest rates and a shortage of existing-home inventory continue to be a boon for the new-home market, with sales of new residential homes up 4.2% from 2022 to an estimated 668,000 units in 2023. For the 12-month period spanning February 2023 through January 2024, Under Contract Sales in Triangle area were down 6.0 percent overall. The price range with the largest gain in sales was the $245,000 to $344,999 range, where they increased 1.5 percent. The overall Median Sales Price was down 1.2 percent to $400,000. The property type with the smallest price decline was the Townhouse-Condo segment, where prices decreased 0.9 percent to $352,700. The price range that tended to sell the quickest was the $345,000 to $469,999 range at 39 days; the price range that tended to sell the slowest was the $244,999 or Less range at 65 days,” as reported by the Triangle MSL. New Listings in the Triangle Region increased 17.2% to 3,507. Under Contract Sales homes decreased 0.4%. Inventory decreased 25.9% to 5,506. Median Sales Price decreased 1.1% from $385,150 to $381,000. Days on Market decreased 7.1% to 52. Months Supply of Inventory decreased 17.4% to 1.9. New Listings in Chatham County increased 23.2% to 117. Inventory decreased 25.2% to 217. Median Sales Price increased 0.8% from $575,000 to $579,430. Days on Market increased 16.3% to 57. Months Supply of Inventory decreased 20.7% to 2.3. New Listings in Durham County increased 11.1% to 360. Inventory decreased 33.9% to 467. Months Supply of Inventory decreased 21.1% to 1.5. The Median Sales Price and Average Sales Price increased 8.4% and 6.4%, respectively. The number of Closed Sales decreased 26.2% to 183. New Listings in Orange County increased 54.1% to 114. Inventory decreased 1.1% to 172. Months Supply of Inventory decreased 7.1% to 1.5. The Median Sales Price and Average Sales Price increased 13.3% and 28.8%, respectively. The number of Closed Sales decreased 32.4% to 50. New Listings in Person County increased 26.7% to 38. Inventory increased 7.8% to 69. Months Supply of Inventory increased 5.3% to 2.0. While the Median Sales Price decreased 8.8%, the Average Sales Price increased 5.8% to $272,257. The number of Closed Sales decreased 4.5% to 21. New Listings in Wake County increased 13.9% to 1,483. Inventory increased 39.6% 1,790. Months Supply of Inventory decreased 33.3% to 1.4. The Median Sales Price and the Average Sales Price decreased 4.3% and 0.9%, respectively. The number of Closed Sales decreased 10.2% to 807. In Carteret County, there were 563 active and 187 new listings in January, comprising residential and multi-family properties. The number of sold properties was 77, while the average sold price was $631,651. The average list price, meanwhile, hovers at $737,240 thus far in February, good news for sellers in Carteret County. In Onslow County, there were 1,255 active and 402 new listings in January, comprising residential and multi-family properties. The number of sold properties was 301, while the average sold price was $289,490. The average list price, meanwhile, hovers at $488,729 thus far in February, good news for sellers in Onslow County. REALTORS are plugged into the pulse of the real estate market, and Carl Johnson Real Estate takes this to the next level, especially in the Greater Triangle. Carl’s comprehensive understanding of local trends, property values, and neighborhood dynamics gives you a distinct advantage. Whether you're a buyer seeking the perfect location or a seller aiming for the optimal listing price, Carl Johnson Real Estate's market insights are invaluable.

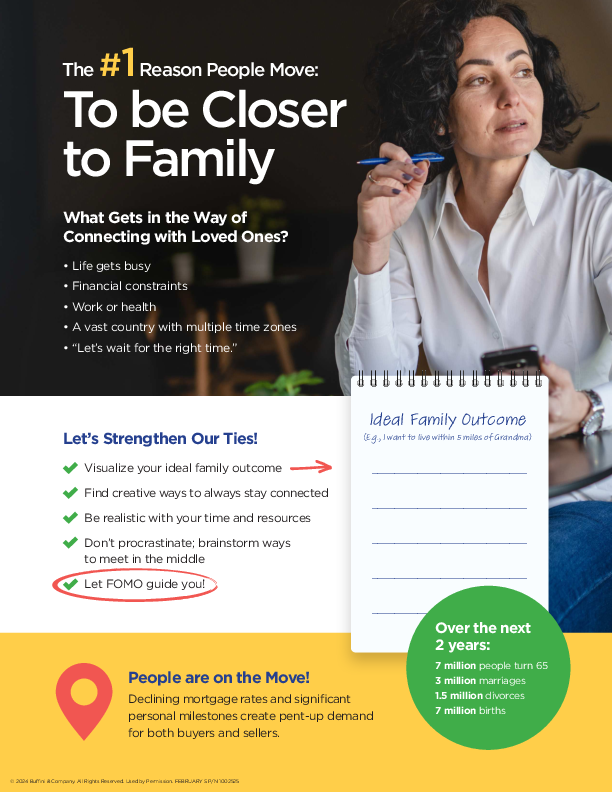

If you’re ready to buy or sell at the beach in Carteret or Onslow County, Carl Johnson Real Estate can help you at the Crystal Coast. Give us a call at Carl Johnson Real Estate at 919-880-0904 to learn more about how we will help. To learn more about the Crystal Coast CLICK HERE. Significant milestones in people’s lives, as well as declining mortgage rates, help to create a pent-up housing demand. Indeed, there are compelling advantages of residing in close proximity to cherished family and friends. Not only does proximity facilitate assistance with child or elder care, fostering a supportive environment for families, but it also plays a pivotal role in strengthening family bonds. The interconnectedness of lives contributes to a sense of unity, shared responsibility, and mutual support. The emotional and practical support systems established through proximity can also positively impact overall well-being, potentially leading to a longer and healthier life. Engaging a seasoned REALTOR like Carl Johnson, who is well-versed in the Greater Triangle area, brings a wealth of negotiation skills to the table.

Whether you're buying or selling in Durham, Chapel Hill, Carrboro, Hillsborough or the Crystal Coast, Carl's expertise ensures you get the best match to a property and the highest quality listing service with our Signature Listing Service, should you qualify, while providing professional & knowledgeable representation protecting our clients' best interests. From navigating offers to securing favorable terms, Carl Johnson Real Estate's finesse in negotiations can make a substantial difference in the outcome. Trusting Carl ensures you have a dedicated advocate, maximizing your chances of closing on the best terms. Call 919-880-0904 or CLICK HERE today to leverage Carl's expertise in the Greater Triangle. Cast Your Vote For Carl

Durham Magazine is hosting its annual the Best of Durham poll, and we would be honored if you voted Carl Johnson for BEST REAL ESTATE AGENT (not Real Estate Company please). As we are honored to be nominated for Best Real Estate Company. We are asking you to please VOTE CARL JOHNSON FOR BEST REAL ESTATE AGENT. Thank you so very much. If you already voted us for Best Real Estate Company, you can vote again in another category, BEST REAL ESTATE AGENT for Carl please. See below on how to vote for Carl, then vote for all your other Durham favorites from food to vets as well! Deadline to VOTE is Feb 29th. CLICK HERE to VOTE for Carl in the 2024 Best of Durham poll - detailed instructions below! Here is how to cast your vote! Go to... Vote for Your Favorites in Best of Durham 2024 (durhammag.com)

Every year, millions of Americans opt to relocate. The number one reason? The yearning to be closer to family. This longing is frequently fueled by significant life events such as the expansion of families, weddings, career changes, and/or retirements. Did you know that living near loved ones may help you to live 50% longer? In situations where living closer to family isn't currently feasible, there are strategies to strengthen those familial connections. At Carl Johnson Real Estate, we take the time to sit down with each buyer and discover the best way to work together. We discuss quality of life, lifestyle and your ideal wants & needs. This is in the forefront of our minds so that when searching for a home we find a match that checks most boxes. We are quality of life and lifestyle matchmakers. Whether you are looking to buy or sell a home, we are here for you. Call us TODAY 919-880-0904 and CLICK HERE if you'd like to know more about Durham's neighborhoods.

Carl Johnson Real Estate is pleased to report that the proposed rate hike for homeowner’s insurance of 42.2% has been rejected. NC Realtors joined together with homeowners to stand against this proposal from insurance companies. All of us at CJRE are happy to report that the results are in and the rate increase was REJECTED. As always, Carl Johnson and his team will stand with our customers to keep their best interests in mind.

About NC Realtors: From an initial membership of 135, NC REALTORS® today has a membership of 57,000 real estate professionals representing 44 local associations statewide. NC REALTORS® is one of the largest and most influential state associations in North Carolina. NC REALTORS® is dedicated to providing the opportunities and resources that aid our members. Our mission statement is succinct: “To promote the success of our members and enhance the Quality of Life in North Carolina.” We further pledge to: preserve and promote the right to own, transfer and use real property; maintain a leadership role in the legislative, political and regulatory process; promote and maintain the highest ethical standards; develop and provide the best education, products and services; and promote housing affordability. NC REALTORS® is headquartered in Greensboro near Grandover Resort and is easily accessible from Interstate 85 and Interstate 40. Office hours are Monday through Friday from 8:30 a.m. to 5 p.m. About Carl Johnson Real Estate: Carl’s passion is creating and growing companies with talent that have a can-do approach, encouraging a completely transparent company that supports all equally, while everyone learns from each other. Carl’s favorite saying is “you're only as good as those around you”. Carl has created his company with the mindset of, how do I want to be treated? Carl's experience include; starting Durham Magazine, Carl Johnson Advertising ( a boutique advertising agency), General Manager of The Chapel Hill Herald, Board Member; Chapel Hill Carrboro Chamber of Commerce, Board Member Carrboro Arts Center, Marketing Committee Member Greater Durham Chamber of Commerce and more. We have an unusual connection to the local community that provides our clients with a view from the inside out. We know the communities we serve and provide exceptional referrals outside our area in which we work. We serve the Greater Triangle Region of NC, The Raleigh-Durham area, as well as The Crystal Coast, from Swansboro to Beaufort NC. From coastal properties to town, city and country properties, we will work with you to provide the best solutions that meet and or exceed your expectations. In a promising turn of events for the real estate market, December brought a significant uptick in pending home sales both nationwide and specifically in the Triangle region. According to the latest National Association of REALTORS (NAR) data, nationwide pending home sales saw an 8.3% increase, marking the most substantial jump since June 2020's 14.9% surge.[1] However, the Triangle region outshone the national average with an impressive 29.2% rise in pending home sales for the same period.[2] Notably, this growth pales in comparison to the Triangle's exceptional performance in September, October, and November of 2022—nearly double the nationwide surge observed in July of 2020.[2] Whether you're a seller, first-time homebuyer or a seasoned investor, working with a REALTOR who stays informed and prioritizes your best interests is key to a successful real estate transaction. Reach out to Carl Johnson Real Estate at 919-880-0904 to get started today.

Want to stay informed about the latest real estate trends and developments in your area? Continue reading our blog HERE and stay ahead of the game. [1] Pending Home Sales Climbed 8.3% in December [2] All data provided by Triangle Multiple Services, Inc. |

Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed