|

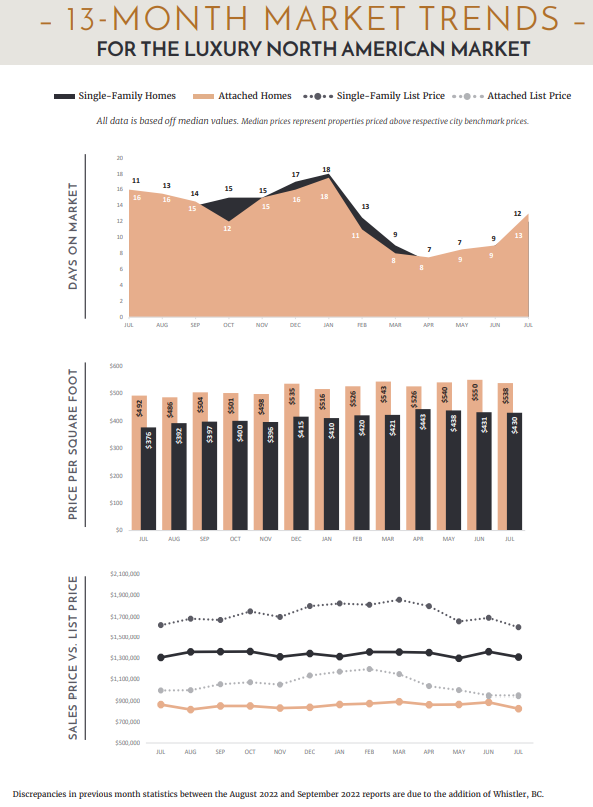

The September 2022 Institute for Luxury Home Marketing monthly trend report is out now! CLICK HERE to download the full report. We are happy to share this information to you from our personal resources! The following is per the Institute for Luxury Home Marketing September 2022 Market Report: "While it is contended that we are moving towards a buyer’s market, the current data for August 2022 shows that conditions in most luxury markets are still favorable to sellers – of the 140 single-family markets showcased in our report, 106 remain seller markets. Market Changes to Consider Over the last few months, the luxury real estate market has experienced the return of a more normal pace for those looking to buy and sell their homes. Recent trends also continue to show a considerable moderation in the number of sales and the rate of price increases, which has certainly taken the pressure off the market. While it is contended that we are moving towards a buyer’s market, the current data for August 2022 shows that conditions in most luxury markets are still favorable to sellers – of the 140 single-family markets showcased in our report, 106 remain seller markets. However, the sales ratio percentage, which measures the rate of sales against available inventory each month, is trending downwards in most markets month over month, in comparison to 2021 levels. Whether the overall luxury real estate market moves towards a balanced or buyer’s market will likely depend on changes in inventory levels and whether the available homes match buyers' demand. Even at the height of the buyer frenzy in spring 2021, homes that were considerably over-priced or needed extensive renovations or repairs often remained unsold. Demand for move-in-ready properties remains a top priority for affluent buyers who have little time or desire to embark on any more than simple updating projects. As we highlighted last month, properties that are fully furnished, down to kitchen utensils, dishware, and all the soft furnishings, are highly prized, often seeing some of the shortest days on the market. The level of inventory may have risen since May 2022, and now approximately 50% higher for single family homes and 18% for attached properties compared to August 2021, but of greater significance is that the number of new listings entering the market has continued to drop since June 2022. Expectations are that these numbers will rise as we enter the fall season, but it seems that some luxury sellers are hesitant to enter the current market. Return to Urban Living An increasing number of buyers are starting to return to the larger metropolitan cities for multiple reasons, including simply missing the lifestyle or looking for a potential investment opportunity. This door may close soon, as also in the mix are foreign investors (now that travel restrictions are easing) and first-time buyers heading to urban markets looking for the opportunity to purchase a property. Experts predict that city markets may see stronger returns on investment than their suburban counterparts. Emerging City Neighborhoods While cities are starting to experience an influx of new and returning buyers, some of the best deals may be found in emerging neighborhoods. Before the pandemic, many of these inner, mid-city communities and industrial areas had been on trend for gentrification. Cities from Vancouver and Toronto in Canada to Atlanta, Austin, Chicago, and San Francisco in the US saw their emerging neighborhoods stall in 2020 as people chose to purchase away from the more crowded metropolitan communities. Today, emerging neighborhoods not only afford buyers better values but have the potential to create greater equity returns. These are ideal for buyers ready to invest in a property for the longer term, understanding that they are buying early and will need to wait for the neighborhood to evolve and mature. New Priorities As we enter the latter part of 2022, mainly due to the historic rise in property values over the last 24 months, many affluent are now starting to reprioritize with a keen eye on market stability and potential returns. Which trends will see better investment return; larger estate-sized homes, properties with views, those located on expansive land, or smaller homes closer to amenities, are questions being asked of our luxury real estate professionals. The answer may lie in reviewing the sales data for the last six months, which reveals that luxury mid-sized homes ranging from 3,000 to 3,500 sq ft are proving to be in the greatest demand for single family homes and 1,500 to 2,000 sq ft for attached properties. While people want extra space, they do not want to be overwhelmed with larger debt, especially as interest rates continue to rise. Equally, land and privacy are still important, but as things return to normal, the shift back to living closer to amenities and locations closer to work are becoming the main priority once more. Time to Diversify Now that remote working is mainstream, there is still an increased focus on investing in real estate that aligns with people’s lifestyle choices. Vacation and second home properties are expected to continue to increase in popularity, especially for those who need escape options from their primary property. The affluent are continuing to seek diversity in their lifestyle, and owning multiple properties, whether in the city, mountains, or beach locations, is an important facet in meeting that requirement. The art of selling and buying in this market needs a critical and analytical approach; understanding the realities and setting expectations accordingly will ensure that goals are achieved. For homeowners looking to buy or sell in today’s market, we recommend working with a Realtor who can capitalize on the preferences, trends, and demands in this dynamic and evolving environment. The following is the Luxury Monthly Market Review of Single-Family Homes for the Raleigh-Durham Market: Getting ready to move? CLICK HERE to see our resource on 10 Moving Tips to help you have your best move yet!

1 Comment

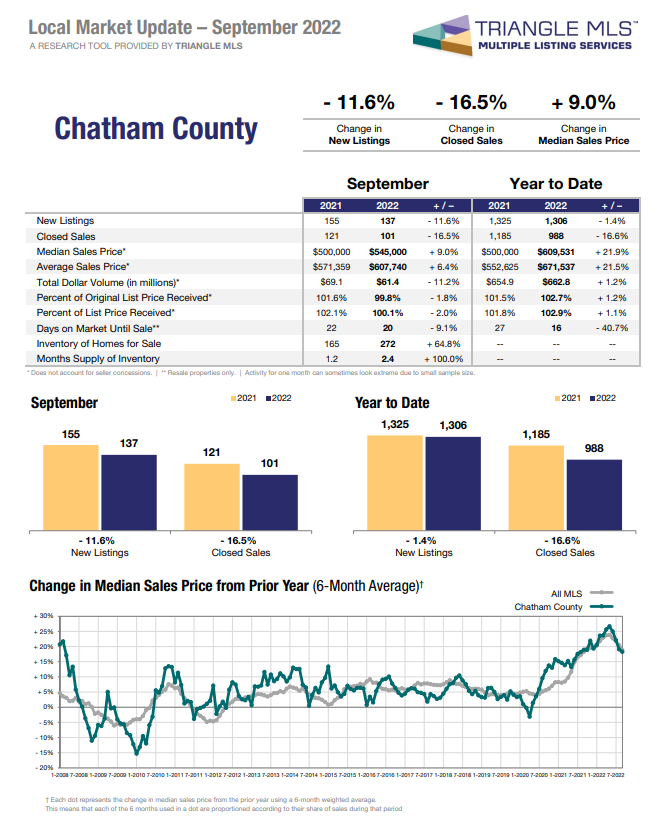

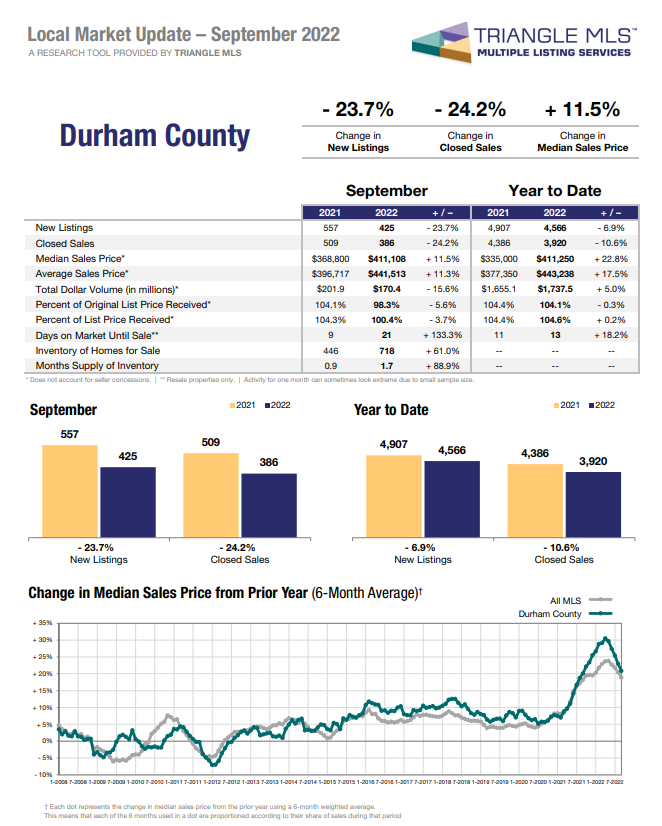

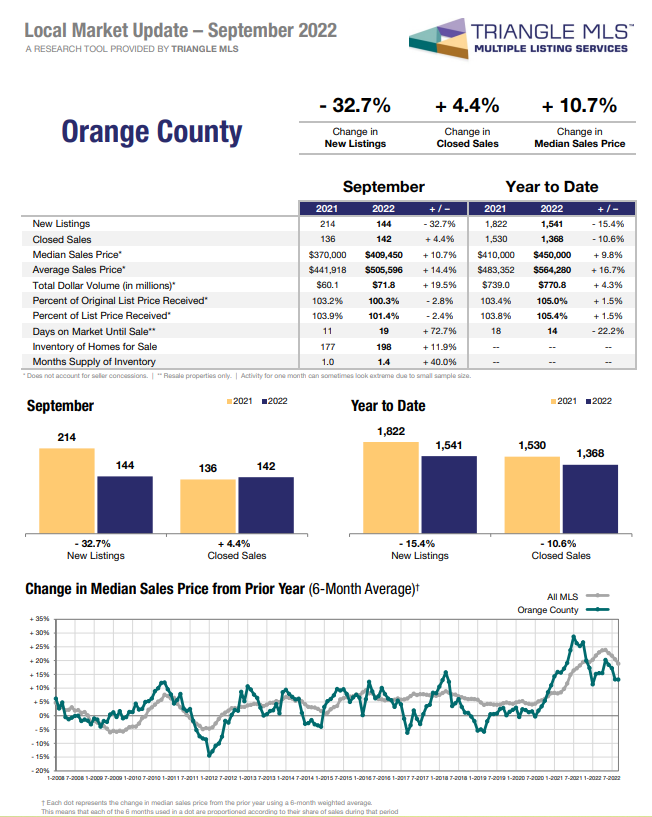

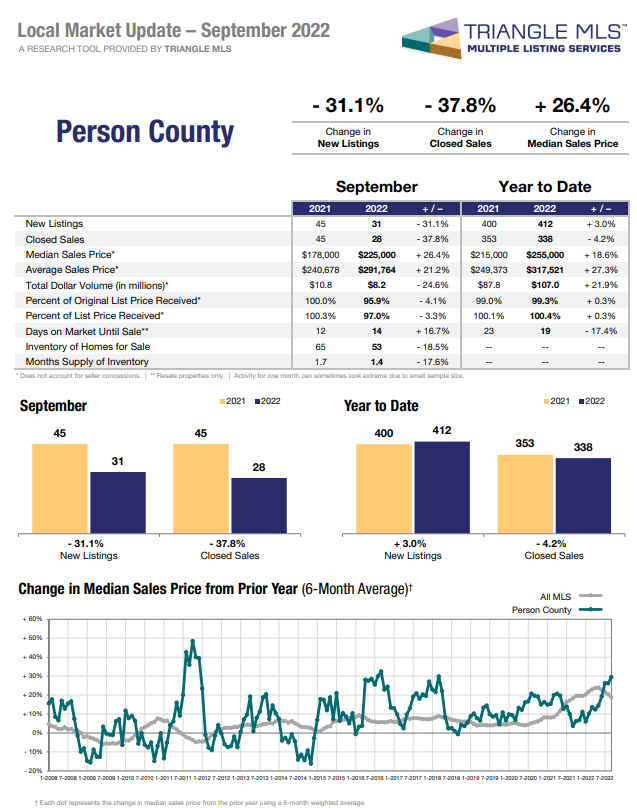

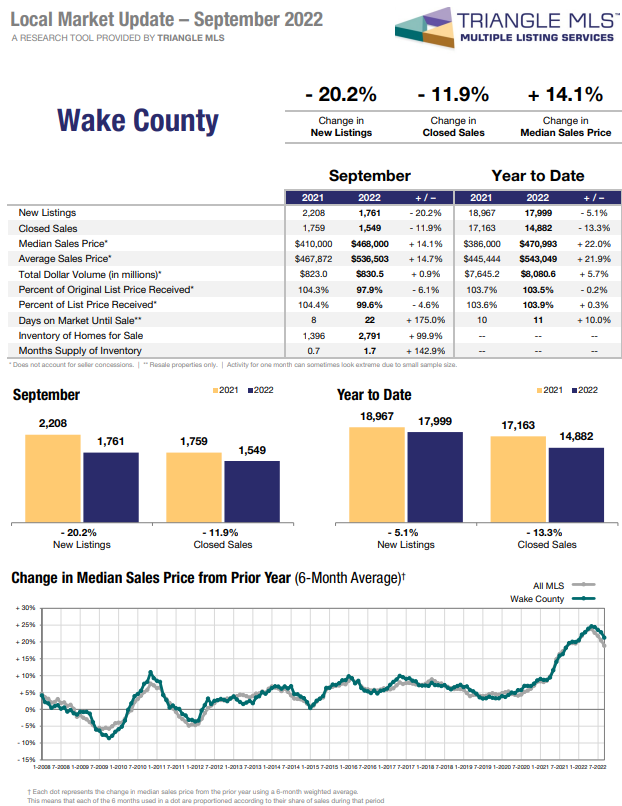

Per the September report from Triangle MLS: "In Chatham County, there was a 11.6% decrease in new listings in September from last year. The number of closed sales decreased between 2021 and 2022, dropping from 1,185 to 988. Median sales prices also increased by 21.9 percent. In Durham County, closed sales have decreased 10.6 percent year to date. Median sales price has increased 11.5 percent when compared to September last year, moving from $368,800 to $411,108. Average sales price increased by 17.5% year to date. The number of listings in Orange County has decreased by 15.4 percent, from 1,822 listings last year to date to 1,368 new listings this year. There was a year to date 10.6 percent decrease in closed sales. Additionally, median sales price increased by 9.8 percent, from $410,000 to $450,000. The number of listings in Person County has increased by 3.0 percent, from 400 new listings last year to date to 412 new listings this year. There was a 4.2 percent decrease in closed sales. Additionally, median sales price increased by 18.6 percent, from $215,000 to $255,000. In Wake County, there was a decrease of 5.1 percent in the number of new listings year to date compared to last year. The number of closed sales decreased 13.3 percent. Median sales prices increased by 22.0 percent year to date, rising to $470,993. What to learn more about the Downtown Carrboro area? CLICK HERE to read about our Neighborhood Series which featured Downtown Carrboro and the great communities that call it home!

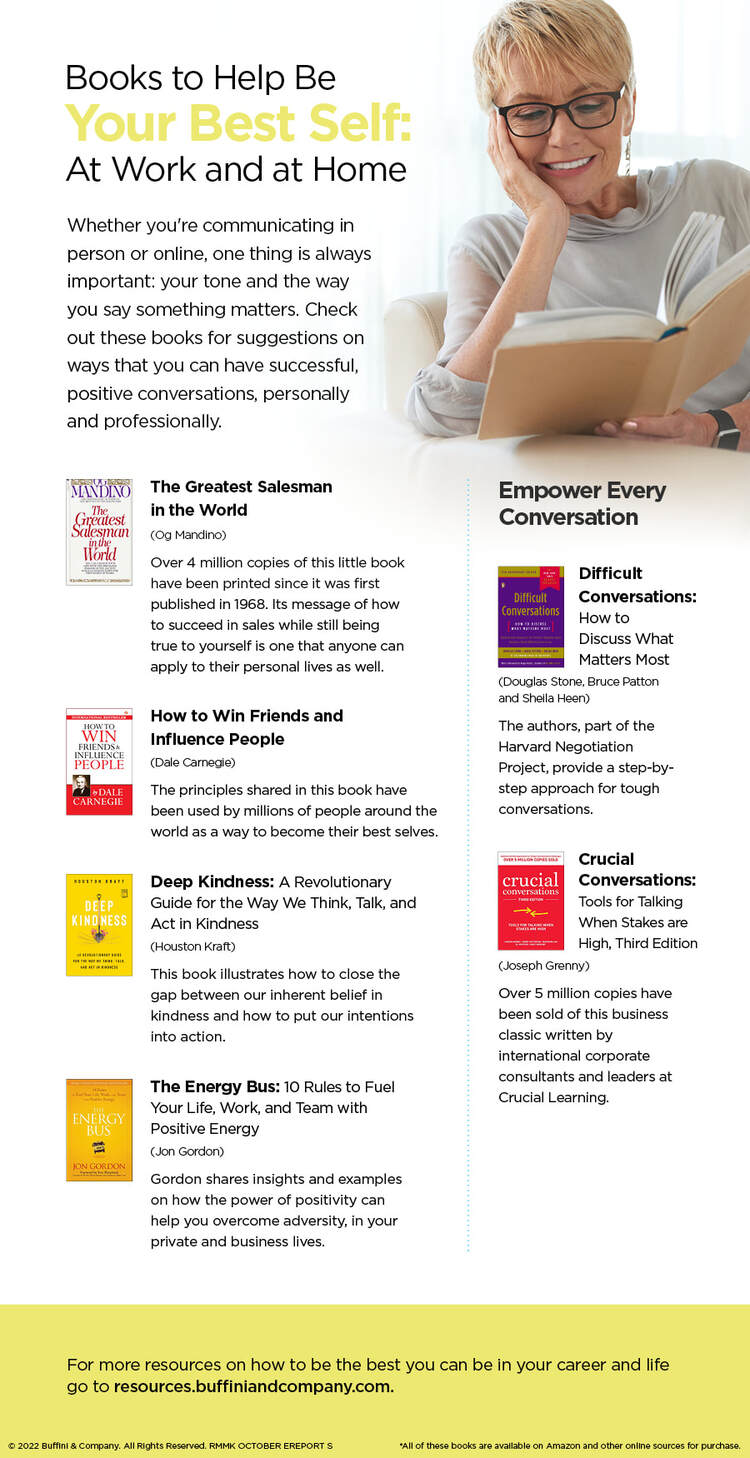

Selfcare is an act that is easy to overlook or to put off. But the value of taking the time to slow down and care for yourself, both physically and mentally, can help you achieve more in all aspects of life! See our flyer below for information on a variety of books that are designed to help you be the best version of you! Do you know what features make a home a luxury home? Do you know it is more than just the price tag? CLICK HERE to read our resource on Luxury Properties and see how Carl Johnson Real Estate is able to help you buy or sell your next luxury home!

Though having a tough conversation with someone, whether it's a coworker, child, or friend, can be difficult! However uncomfortable, the benefits of having the tough conversations out way the negatives and will have positive impacts for you. See our flyers below for some tips on how to Tackle Tough Conversations and learn about the benefits that come with it for all parties involved. Thinking about buying a home? CLICK HERE to read our resources about Getting Ready for a Mortgage.

The WRAL TechWire released a recent article positioning the Triangle as a strong healthy economy and as proof that the U.S. economy's potential to remain positive. Read the article below or CLICK HERE to go to the WRAL's site for more!

"Triangle a ‘shining star’ in U.S. economy, says top Fed official by Jason Parker — September 30, 2022 RALEIGH – The president and CEO of the Federal Reserve Bank of Richmond believes that the economy is showing strength. That’s despite feeling that the U.S. economy was on the brink of an economic recession as recently as two months ago, said Tom Barkin, at a Thursday event sponsored by Wake County Economic Development. Now, though, Barkin believes that the economy is showing signs of strength. That’s because of recent job and employment data show that the U.S. economy is adding jobs and the labor force participation rate is again growing, which could be a key factor in a “soft landing” for the economy. There are still some mixed signals in the national economy, with falling stock indices and rising mortgage rates. Still, Barkin’s remarks pointed toward a belief that a recession may not be imminent, as others, including Jamie Dimon, the chairman and CEO of JPMorgan Chase, may believe. Dimon also spoke at an event in the Triangle on Thursday, as JPMorgan Chase plans for continued expansion to and investment in North Carolina. CONSUMER CONFIDENCE AND THE FUTURE OF THE ECONOMY One measure referenced by the Fed official was that consumer confidence is higher and more positive than some might otherwise assume with concerns about inflation, stock market volatility, and layoffs leading headlines in recent weeks and months. Still, even with the economy showing more signs of strength, Barkin noted in his remarks that inflation will remain a key target and that the Federal Reserve will continue to take aggressive action to get price appreciation for consumer goods like food, shelter, and energy under control. “No matter what theory you have on inflation, you are seeing promising signs,” Barkin said in a speech delivered at the Potomac Science Center on the campus of George Mason University in Woodbridge, Virginia on Friday morning, the day after the event in Raleigh. “Inflation should come down. But I don’t expect its drop to be immediate nor predictable,” Barkin said in the Friday speech. “We’ve been through multiple shocks, as I’ve discussed, and significant shocks simply take time to dampen.” Barkin said that the Federal Reserve will persist until inflation comes down. But that could have an impact on the economy. One such impact: a recession. And on Thursday, Dimon said that a recession is “probably” imminent after a wave of economic news that signal volatility in the U.S. economy. TRIANGLE A ‘SHINING STAR’ But one thing that Dimon and Barkin may agree on is that the Triangle is well-positioned within the overall U.S. economy. “Obviously, North Carolina is a great state. The Triangle is one of the fastest growing parts of America,” Dimon told WRAL TV’s Sarah Krueger on Thursday. “It has innovation and growth and universities and companies. It’s got everything you need.” And statewide, the latest unemployment figures show that North Carolina is ahead of the national average, with Triangle-area counties showing very low unemployment rates. Meanwhile, the region continues to attract investment, with a diverse group of industries. For example, a recently renovated campus in RTP that was bought for $37 million three years ago sold for more than $288 million. In fact, the Triangle is considered a “shining star,” Barkin said. That’s because the region continues to attract in-migration from talented workers who are moving to the region and will become a part of the local economy, Barkin explained. — WRAL reporters Joel Davis and Sarah Kruger contributed to this story" What to learn more about Carl Johnson Real Estate and how we can help you reach your real estate goals! CLICK HERE to read about our Founder, Carl Johnson, and how his experience and unique skills are the best in the business! |

Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed