|

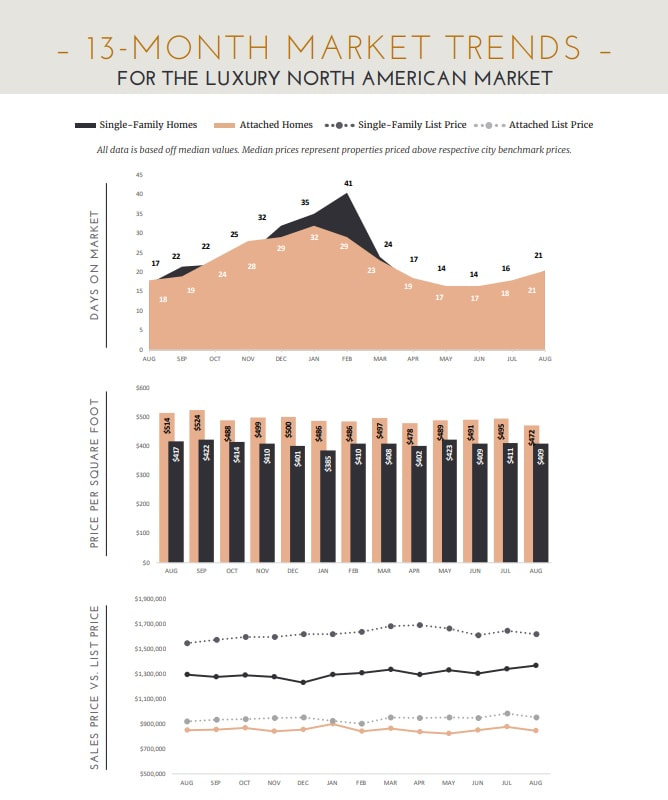

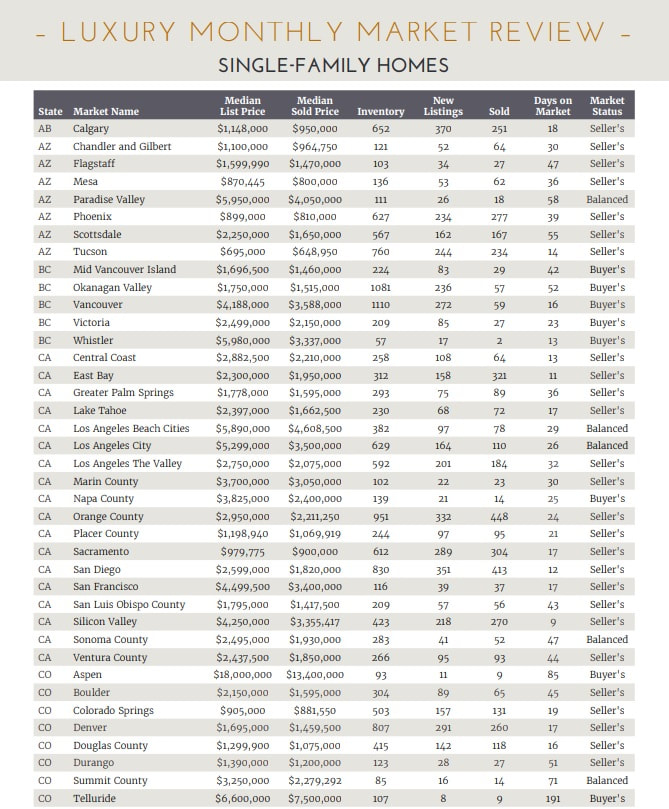

The April 2023 Institute for Luxury Home Marketing monthly trend report is out now! CLICK HERE to download the full report. We are happy to share this information to you. The following is per the Institute for Luxury Home Marketing April 2023 Market Report: Luxury Properties Return The quiet optimism forecasted last month seems to be paying dividends, as there was a distinct increase in the number of luxury property sales in March. In fact, our findings show sales for single-family homes and attached properties have risen nearly 50% compared to February 2023. The number of new listings entering the market has facilitated this increase in sales which rose over 32.9% for single-family homes and nearly 25.6% for attached properties in March, indicating that sellers are becoming more optimistic about selling again. The median sold price for both markets remained stable, too, while still slightly below March 2022; prices have climbed against February 2023. The sold price to list price ratio (SP/LP%) also trended back up in March. It moved from 97.67% in February to 98.56% for single family homes and 98.37% to 98.89% for attached properties – indicating that sellers are seeing prices closer to their expectations once again. By no means do these numbers imply that we are heading back to the overinflated demands of 2020 and 2021, but they do reflect growing confidence in the luxury market as we head further into spring. Not All Things Are Equal Overall, the market is still showing that it is favorable to sellers – but this is mostly due to increased sales and, despite increases in new listings, inventory levels remaining below the 10-year norm in many markets. However, significant differences between markets have arisen over the last few months, with some becoming increasingly more favorable for buyers, while others remain firmly in control of the sellers, and the remainder favorable to neither. Equally confusing is that in some markets, home prices continue to increase, while in others, they are on a downward trajectory. Different price points within the same market also report differing results, and it’s not always the lower priced properties that are selling the fastest! Additionally, results seem to be inconsistent from month to month! So how are buyers and sellers meant to understand whether it’s a good time to buy or sell? Key Parameters to Understanding Your Market One of the most important factors to consider is understanding inventory levels of similar properties on the market - not always an easy task in the luxury market where marketing homes is based on their differentions. Typically, the sales ratio, i.e., how fast the market is moving, measures the level of inventory remaining against the number of sold properties for that month. However, it is also important to review if there is a substantial amount of inventory in your price point, property type, or location, whether it has been on the market for a while or just unlikely to meet buyer expectations, as this can distort the true demand for your property. The second indicator is how long properties are taking to sell; this becomes your next barometer for understanding demand. If most sold homes are selling within days and at close to asking price, then this typically indicates that demand is high (irrelevant of how much inventory remains on the market). Often, you will find a common denominator in these sold properties, such as move-in ready, location, or price point is driving demand. Understanding these key parameters should help buyers and sellers manage their expectations, leverage opportunities, and appreciate their true negotiation power within their specific market. Luxury Markets in Demand As demand returns, we review several markets in the U.S. and Canada that experienced significant growth in March. Much has been written recently about the popularity of lower priced luxury markets, especially in the Midwest, so we wondered, with the uptick in sales during March, if this trend was still holding true…or if another shift is occurring. East Bay, California Taking the number one spot is not a Midwest market, but East Bay in California, where the median luxury sold price averaged close to $1.5 million during the first quarter of 2023. Not only did this market see a huge increase in demand during the pandemic, but once again it is drawing buyers to its highly diversified communities and seems set for a strong spring market. The sales ratio rose from 36% in January to 50% in February and then saw a huge uptick to 123% in March – with the number of sales in March far outstripping the level of new inventory entering the market. The average number of days these properties remained on the market fell from 22 days in January to 12 in February and down to just 9 in March. While the median sold price rose from $1 million in January to just under $2 million in March, this does not actually indicate that prices rose by 100%, but rather that there is a greater quantity of higher priced properties selling again. Hamilton County, Indiana Located just north of Indianapolis, Hamilton County routinely scores high marks when rated for its quality of lifestyle and has become one of the fastest-growing real estate markets in the U.S. Price certainly has been a factor for those looking to embrace a new luxury property at a more affordable rate, with the median price averaging around $750,000 for the last three months. Like East Bay, Hamilton County has seen its sales ratio steadily climb from 34% in January, to 55% in February, and 98% in March, while the days on market for sold properties have declined from 14 days in January to 6 in March. Oakville, Ontario A suburban town located on the shores of Lake Ontario, Oakville is part of the Greater Toronto Area (GTA), with nearly 75% of its population aged between 20-54 years old. Even before the pandemic, Oakville saw a consistent increase in its population from those looking to enjoy its picturesque location, active lifestyle, and easy access to downtown Toronto. Like much of the luxury real estate market, Oakville saw its transaction level stall during the last four months of 2022 into the start of 2023. However, demand has been on the uptick as expectations for Oakville’s economic growth and diversity attract people from around the world. Prices have risen month over month since January, from CAD$1,115,000 to CAD$2,332,000 in March – however, this is the result of an increase in the number of sales for higher priced properties. Still, Oakville’s sales ratio rose from 25% in January to 37% in February and jumped to 76% in March, and the average days on market consistently fell from 79 in January down to 9 days in March, all indicators of a strong seller’s market. St Louis, Missouri Taking the final spot is St Louis, a Midwest market whose popularity has risen dramatically over the last few years and certainly has luxury properties that rival many of the more recognized luxury cities in the U.S. Indeed, just last month, St Louis saw a record-breaking sale of $13 million for a property located in the coveted Huntleigh neighborhood. St Louis has become highly attractive for young professionals and families due to a significant urban revitalization, an influx of new businesses, and increased focus on expanding industries such as healthcare, biotechnology, and finance. The average days on market for luxury properties has fallen over the last three months from 28 to 15 days, while prices have increased from $650,000 to $773,150 – again, this is more reflective of the increase in sales of higher priced properties, although the average sold price is still seeing modest increases. Already significantly high in January with a sales ratio of 53%, this increased in February to 55% before jumping to 90% in March. In conclusion, it seems that price in the luxury market is becoming less of a factor as the number of sales for higher priced properties is on the uptick, and markets seeing the greatest demand have something more to offer potential buyers than just lower-priced homes. The art of selling and buying in this market needs a critical and analytical approach; understanding the realities and setting expectations accordingly will ensure that goals are achieved. For homeowners looking to buy or sell in today’s market, we recommend working with a Realtor who can capitalize on the preferences, trends, and demands in this dynamic and evolving environment. At Carl Johnson Real Estate we use our experience and knowledge to lead our clients in the right direction. CLICK HERE to read more about Carl Johnson, REALTOR®, Broker, Owner, and Founder of Carl Johnson Real Estate. Carl is certified as an Institute for Luxury Home Marketing Specialist, CLHMS, which means he offers superior knowledge and experience in the luxury market. His CLHMS membership also provides him with access to an elite network of contacts and resources that help drive the perfect buyer to your high-end listing or find you your dream home! Using the most up-to-date marketing information, Carl positions your listing ahead of the market curve. Call 919-880-0904 for a consultation or CLICK HERE

0 Comments

Leave a Reply. |

Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed