|

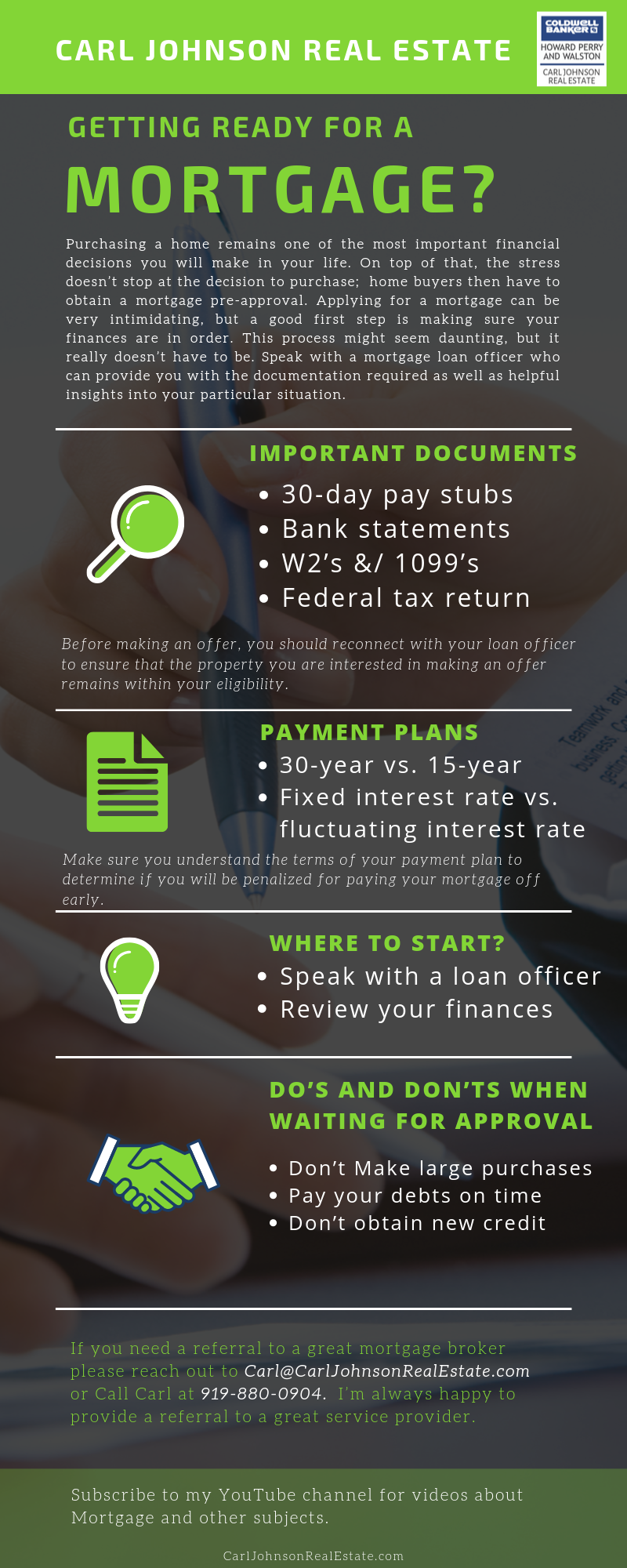

The initial important documents you will need for a mortgage approval will be your current 30-day pay stubs, previous 2-month bank statements, and W2’s &/ 1099’s and Federal tax returns from the past 2 years. The loan officer will decipher your eligibility based on your credit score and your debt-to-income ratio. Your loan officer will help develop strategies and provide you with your financial overview. Before making an offer, you should reconnect with your loan officer to ensure that the property you are interested in making an offer remains within your eligibility.

Deciding on the right mortgage essentially comes down to the right payment plan for you. How much you plan to pay for your mortgage can affect whether or not you should apply for a 30-year or 15-year mortgage or a fixed or fluctuating interest rate. Don’t make the mistake of charging large purchases, such as cars or furniture, or obtain new credit, which could impact your mortgage approval due to the impact of increasing your debts. It’s probably best to hold off on larger purchases until after you have closed on your mortgage purchase. However, if you do have any big changes in your financial situation, it is highly advisable to notify your loan officer as soon as possible. The majority of Americans have to obtain a mortgage in order to purchase a home. The process may be long, but it doesn’t have to be scary. The best thing you can do when searching for the right mortgage is to speak to a loan officer to determine the best options and financial decisions you should make. Subscribe to my YouTube channel for videos about Mortgage and other subjects by clicking here. If you need a referral to a great mortgage broker please reach out to Carl@CarlJohnsonRealEstate or Call Carl at 919-880-0904. I’m always happy to provide a referral to a great service provider.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed