|

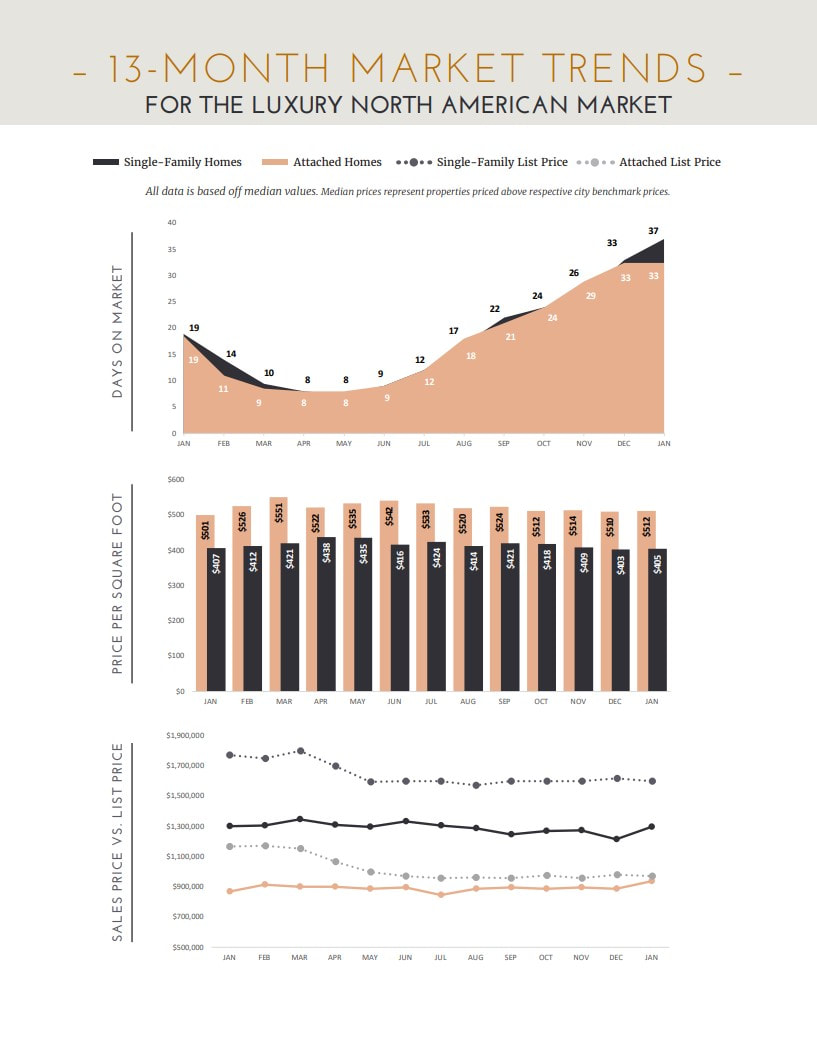

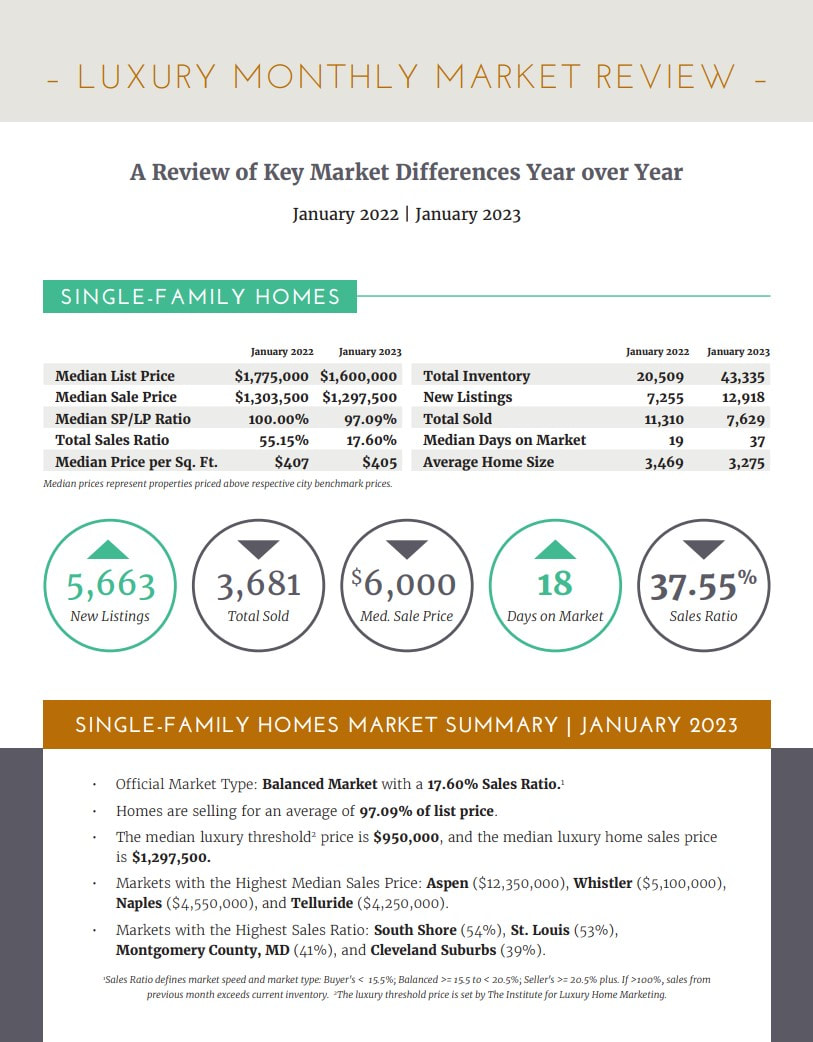

The February 2023 Institute for Luxury Home Marketing monthly trend report is out now! CLICK HERE to download the full report. We are happy to share this information to you from our personal resources! The following is per the Institute for Luxury Home Marketing February 2023 Market Report: Real Estate Cycles – Norms, Exceptions, and Expectations Shaping 2023 As we move out of two and half years of one of the most dynamic luxury real estate markets and transition into a new cycle, there is still an underlying apprehension as to what 2023 will bring, especially in the upcoming spring market. For the most part, expert and media expectations of a recession causing major impacts on the market have quieted, and the talk is now of ‘correction’ rather than ‘crash.’ It has long been a common belief that the real estate market is cyclical, with predictable patterns emerging both in the short term as well as over multiple years. It is contended changes are not random, and most patterns involve cyclical trends that recur both seasonally and in the long term. However, there is also an expression “there are always exceptions to the rule,” and certainly, the last three years have seen outside influences impact the speed of change and some of the expected norms in traditional cyclical periods. Cyclical Trends Understanding real estate cycles are important as they can provide reliable information about how and when to buy and sell, particularly when a market is moving through a transition. Typically, the short-term real estate cycle in North America happens over the four quarters of the year, when generally the overall market sees definite and distinctive ebbs and flows. In normal years, expectations are that the winter months will see the build-up of interest by sellers to list. This is in anticipation of buyers wanting to purchase in the spring market, which is usually the most prevalent time for buying and selling. Summer typically sees a decline in sales, and as inventory remains on the market longer, the negotiation power starts to shift to the buyer’s favor. Fall sees inventory levels that have increased significantly during September create the second busiest time of year, only for inventory and sales to decline as we head toward the end of the year. Driven by economic forces, the long-term cycle usually overlays the short-term’s cyclical patterns and is responsible for providing a bigger picture of the status of the market (i.e., whether it’s buyer, seller, or balanced) and the overall direction of consumer demand. It is comprised of four main phases: Peak, Recession, Trough, and Expansion, and unlike short-term cycles, there is no exact science on when and how long each of these phases last. Historically, these cycles will be experienced consecutively as you cannot have a sustained expansion or peak without an eventual recession and trough. How strongly each of these phases impacts the market also varies considerably. Norms Return Current expectations are that the market will return to more normal patterns in 2023’s short-term cycle, so it’s highly likely a marked uptick in properties entering the market will occur this spring. Equally, it is anticipated that sellers will no longer expect over-asking or multiple bids; instead, their pricing will reflect an understanding that price growth has slowed with the need to counter increased costs associated with buying. In the long-term cycle, the market has entered into the Recession Phase, an expected transition as no market can indefinitely continue in the Peak Phase of high demand and increasing prices, so it naturally finds its tipping point. Typically, during a Recession Phase, we would see expect to see downward pressure on prices as supply exceeds demand. Our analysis of 125 markets in this report indicates that inventory levels are increasing, and so long as there isn’t a corresponding uptick in sales, the spring could well see a slight correction in prices. Exceptions and Contradictions However, one of the reasons that we will probably not see a significant decrease in prices typically experienced in a Recession Phase, is that inventory levels are still below historic norms, and demand for desirable properties remains relatively stable. National figures will likely contradict local results as we expect to see a contrast in demand between markets that offer more affordability over those where prices have grown disproportionate to the demand of buyers. While some markets may be more affected by the downward pressure on their prices, others are still reporting increases in prices. This disparity is likely to manifest in greater demand for markets that provide an opportunity for either more affordability or potential price growth. As stated by Dr. Lisa Sturtevant, chief economist for Bright MLS, “Prices could rise 5% or more in these more-affordable markets in 2023. On the other hand, high-cost markets where housing affordability is a challenge could be poised for price drops of 10% or more." Equally, expect to see contradictions within the same market for different price points and the types of homes being purchased, with shifting demographic demand creating unexpected anomalies. Indeed in 2023, it is predicted that the millennial generation will become a strong investor in the entry-level luxury real estate market, while the mass affluent will continue to increase demand for second and third home investment purchases. Contrary to this, the very high-net-worth are looking for homes that offer more than just a luxury abode. Lifestyle has become their driver, and homes that offer unique experiences, access to adventure, and are filled with high-end amenities are more their concern than worries about higher interest rates. At Carl Johnson Real Estate we use our experience and knowledge to lead our clients in the right direction. CLICK HERE to read more about Carl Johnson, REALTOR®, Broker, Owner, and Founder of Carl Johnson Real Estate. Carl is certified as an Institute for Luxury Home Marketing Specialist, CLHMS, which means he offers superior knowledge and experience in the luxury market. His CLHMS membership also provides him with access to an elite network of contacts and resources that help drive the perfect buyer to your high-end listing or find you your dream home! Using the most up-to-date marketing information, Carl positions your listing ahead of the market curve. Call 919-880-0904 for a consultation or CLICK HERE

0 Comments

Leave a Reply. |

Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed