|

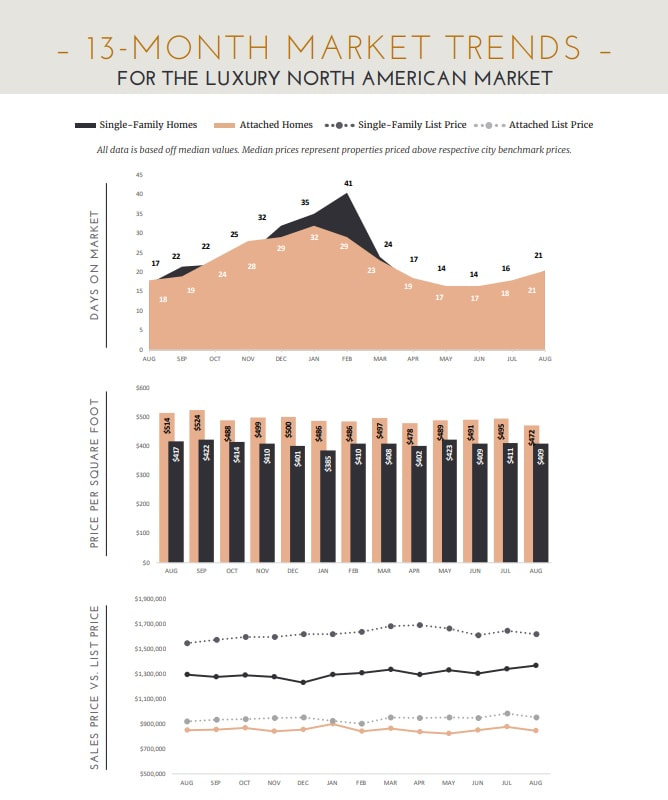

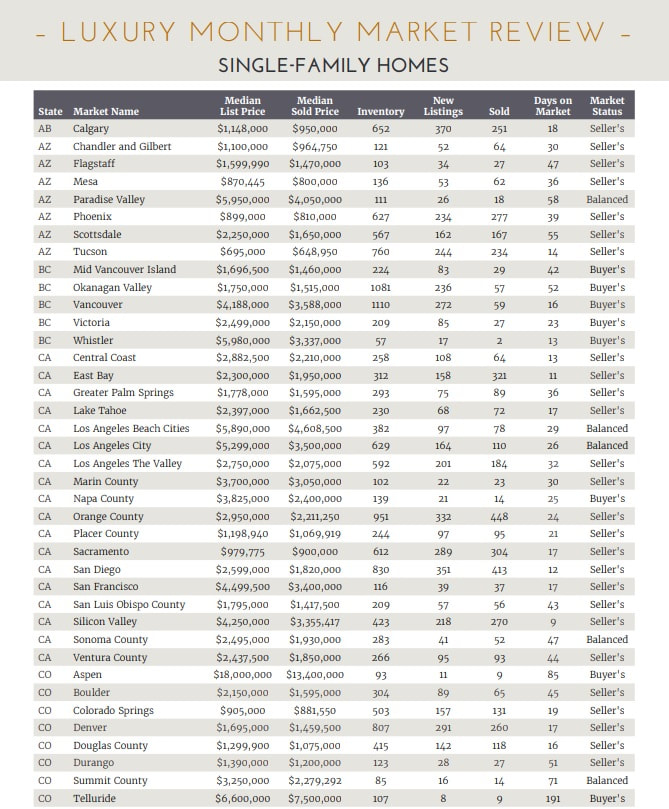

The July 2023 Institute for Luxury Home Marketing monthly trend report is out now! The following is per the Institute for Luxury Home Marketing July 2023 Market Report: This month we take stock of the luxury real estate market at the six-month mark and end of the second quarter for 2023. The most significant trend, and one that seems contrary despite the continuous reports of lower sale volumes compared to 2022, is that, for the most part, the North American luxury real estate remains a seller’s market. June’s statistics show that out of the 150 single-family home markets researched by The Institute, 110 are seller markets, 20 are balanced (neither favorable to sellers nor buyers), and only 20 are favorable to buyers. It is important to note that 13 of the buyer markets are either winter resorts or destinations, i.e., their real estate sales are typically not as strong during the summer months. The attached market shows an even stronger bias towards sellers; out of the 103 reviewed, 84 are seller markets, 8 are balanced, and 11 are buyer markets. While the number of sales in June 2023 compared to June 2022 fell approximately 11.5% for single-family homes and 14.0% for attached properties, sales have increased by 170% and 119% since January 2023 and by 8% and 1% compared to May 2023 respectively. Interestingly, in 2022 we saw the number of sales in June decline compared to May. Inventory levels continued to climb, albeit slowly; single-family homes increased by 2.22% compared to June 2022, and attached properties rose by 8.56%, which has helped increase the opportunity for sales. However, the continued lack of new inventory each month, falling 19.18% compared to last June for single-family homes and 13.09% for attached properties, is probably the major contributor to luxury markets remaining favorable to sellers. Until the volume of properties available for sale increases substantially, back to traditional norms recorded pre-Covid, it is unlikely that the luxury market will transition into a true buyer’s market anytime soon. Looking at demand, sales, and prices during the first half of 2023, the North American market has continued to show a resilience that many would not have predicted at the start of the year. Looking to the immediate future, we can now say, with some confidence, that we are entering a period of more stability and sustainability. A Global Perspective A great deal of wealth was created globally over the last three years. Despite the downturn of the global equity markets in early 2022, according to Wealth-X, an Altrata Company, there has been a return to the steady increase of wealth creation since last June. Although the cost of borrowing has increased globally, one long-term effect of the pandemic is that it has refocused the affluent’s desire to own property, the significant increase of cash sales by the affluent reaffirms their desire to buy luxury real estate. The consistency of demand also shows a resilience that despite interest rate increases for the affluent who chose to borrow money, they recognize it is a temporary situation that can be actively managed. A combination of the lockdown, a growing appetite to travel or relocate on a semi-permanent basis is seeing an uptick in the affluent obtaining a second passport or citizenship in 20231, a figure that rises to 16% amongst Asian ultra-high-net-worth individuals. This is a complex landscape to navigate, as changes can be rapid and very dependent on whether a country has fulfilled its goals. For instance, while Canada has a large incentive to drive new immigrants to its shores, on the other hand, they have introduced a foreign buyer ban for two years (starting January 2023) in the major metropolitan areas. Golden Visa programs were highly attractive for potential buyers in Portugal and Ireland, but recently they were terminated. However, against all the economic and stock market uncertainty, the affluent are often the first to recognize the opportunity this presents and look to diversify, whether to hedge against inflation or simply spread the risk, so expectations are that the affluent will expand their portfolios across multiple countries in the future. The Long View The affluent see real estate as a safe long-term asset, as the equity and crypto markets have become unsteady investments over the last year. Interestingly, the emphasis on purchases has changed in the North America considerably. Before the pandemic, one of the most significant reasons for purchasing was the return on investment; today, the emphasis has moved towards an improved lifestyle and security as being equally important. CLICK HERE to download the full report in its entirety. We are happy to share this information with you. At Carl Johnson Real Estate we use our experience and knowledge to lead our clients in the right direction. CLICK HERE to read more about Carl Johnson, REALTOR®, Broker, Owner, and Founder of Carl Johnson Real Estate. Carl is certified as an Institute for Luxury Home Marketing Specialist, CLHMS, which means he offers superior knowledge and experience in the luxury market. His CLHMS membership also provides him with access to an elite network of contacts and resources that help drive the perfect buyer to your high-end listing or find you your dream home! Using the most up-to-date marketing information, Carl positions your listing ahead of the market curve. Call 919-880-0904 for a consultation or CLICK HERE.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed