|

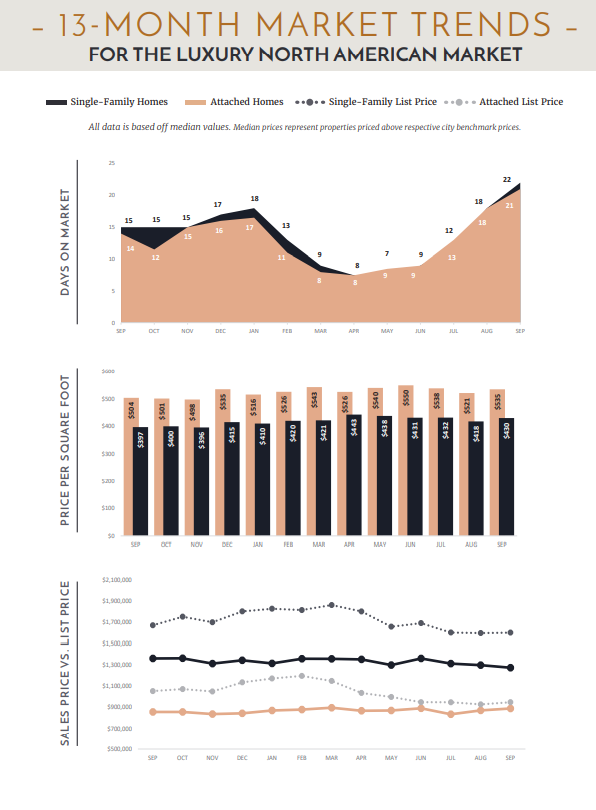

The October 2022 Institute for Luxury Home Marketing monthly trend report is out now! CLICK HERE to download the full report. We are happy to share this information to you from our personal resources! The following is per the Institute for Luxury Home Marketing October 2022 Market Report: "Given the time of year, the current economic influences, and the uncertainty surrounding real estate demand, it is still hard to predict when or even if the luxury market will fully become a buyer’s market. Where is the Market Headed: The simple truth is that both the economy and the real estate market are in a state of unpredictable flux, when even traditional methods, such as raising interest rates, are not achieving the desired results as inflation increases. In September, U.S. inflation rose to 6.6%; in Canada, it is currently 7%. In some locations, we see the severe impact of this increase in interest rates on the number of sales, whereas, in others, the lack of inventory is still playing heavily in the seller’s favor. Some buyers are feeling the affordability squeeze because of the additional increase in the cost of borrowing. Yet, with very few sellers needing to put their homes on the market, inventory levels remain historically low, leaving even cash buyers without the negotiating power typically expected in a transitioning market. The reality is the factors of how buyers and sellers are reacting combined with influences from outside the industry are creating conflicting messages that are resulting in strange times throughout the real estate market. Still a Seller's Market It may be a surprise to discover that our analysis for September shows that many markets remain favorable to sellers for both luxury single-family and attached properties. Last month we reported that 106 of our 140 single-family markets were still favorable to sellers. While 16 have transitioned to balanced – where the market is equally favorable to sellers as it is to buyers – 90 remain seller’s markets. n the attached market, of the 96 markets reported on by the Institute, 77 remain seller’s markets. It seems that there are still plenty of buyers – indeed, a survey by Bank of America found that the young and wealthy prefer assets like cryptocurrency, real estate, and private equity over investing in the stock market. “Individuals ages 21 to 42 with at least $3 million in assets have only a quarter of their portfolio in equities, compared with more than half for those who are older”, according to the study. This is significant, especially for the future, as Baby Boomers are estimated to transfer over $84 trillion of their wealth to Generation X and millennials between now and 2045, according to market research by Cerulli Associate. A Trend Towards Balanced Coming back to the current status, it is important to realize that most luxury markets are starting or transitioning toward more favorable conditions for buyers as inventory levels steadily climb month over month. As of September, the sales ratio, which measures the monthly sales against the remaining active listings at the end of the month for both single-family home and attached property markets, saw a further shift downwards towards the 21% threshold mark, which signifies a change from seller to a balanced market. However, there is an anomaly in the claim that inventory levels are rising – the reality is that they are also increasing because homes are staying on the market longer. More choice has slowed the velocity of sales compared to 2021, but the lack of new inventory has equally slowed. September’s increase in new inventory is typically one of the largest of the calendar year, escalated by individuals returning from the vacation season with new plans; it kicks off the second busiest season in real estate. While the actual number of properties for sale in September 2022 rose significantly compared to September 2021, an increase of just 6% from August 2022 is well under the traditional expected norms of a 12-18% increase between these two months. But it would be unrealistic to expect the extraordinary results of 2021, where the number of sales was greater than the remaining inventory each month. Nor should we expect to see many sales closing over the asking price and even fewer multiple offers – all typifying a directional transition toward a more balanced market." The following is the Luxury Monthly Market Review of Single-Family Homes for the Raleigh-Durham Market: Did you know we offer sales and marketing for Builders? CLICK HERE to see what we offer for Builders who are looking to have the busy real estate sales & marketing burden taken off their hands so they may focus on doing more of what they love....build & design.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed