|

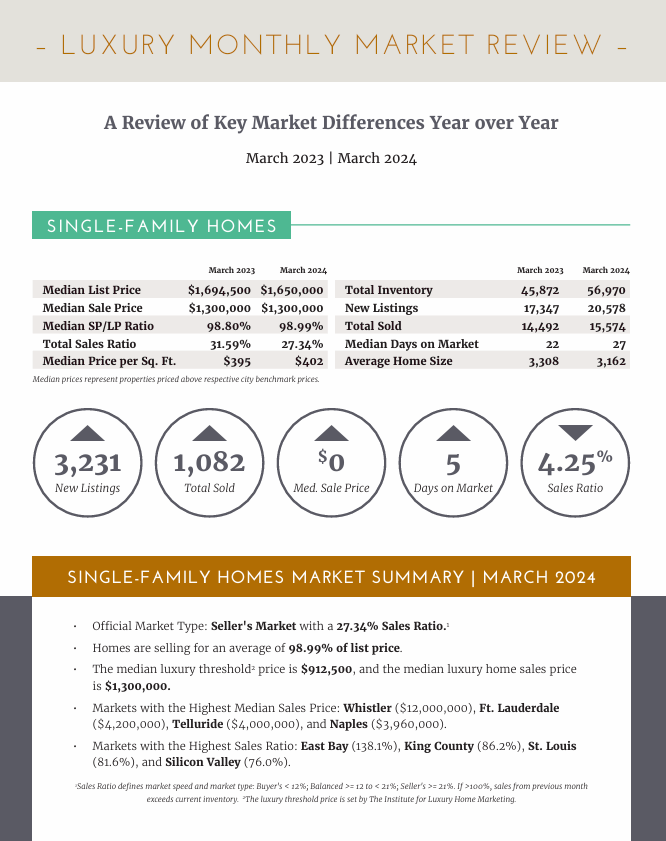

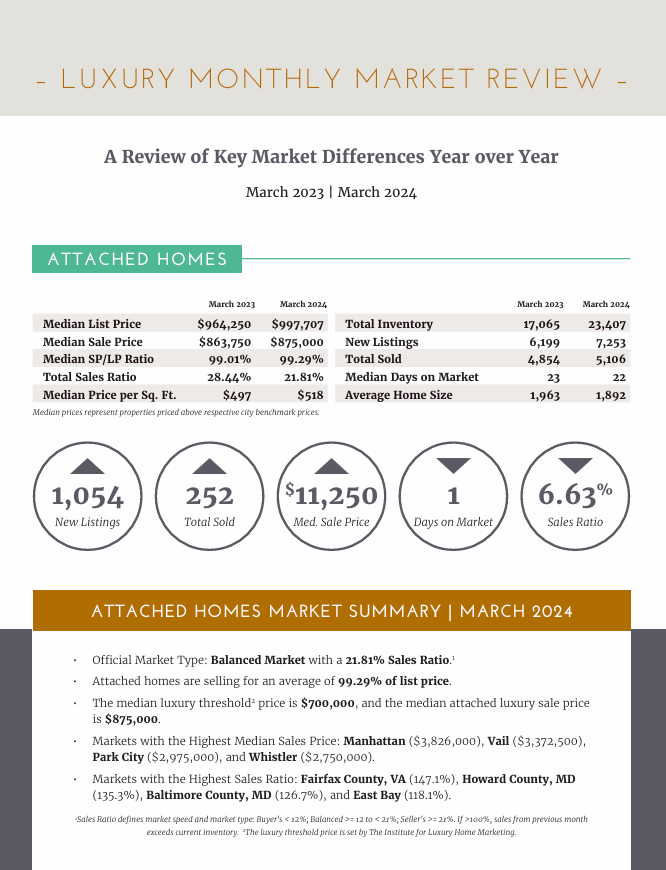

Welcome to the Luxury Market Report, your guide to luxury real estate market data and trends for North America. Produced monthly by The Institute for Luxury Home Marketing and brought to you by Carl Johnson Real Estate, this report provides an in-depth look at the top residential markets across the United States and Canada. A Stronger but Variable Spring Market March, often heralded as the commencement of the spring market, not only marks the awakening of nature but also provides insights into the trajectory of the real estate landscape for the ensuing months. After six months of steadily increasing levels of inventory and sales, March’s statistics also tell a story of continued strength. Positive seller sentiment is reflected in the uptick of new properties entering the market, which in turn, is fueling the opportunity for buyers to fulfill their new home expectations. In the luxury single-family market, inventory levels grew by 24.1% compared to March 2023, and by 5.8% compared to February 2024. New inventory entering the market also comparatively increased by 18.7% and 9.4%, respectively. In the luxury attached property, market inventory levels grew by 37.7% compared to March 2023, although fell by 5.1% compared to February 2024. Comparatively, new inventory entering the market increased by 20.8% but fell by 3.8%, respectively. Although inventory has increased annually for both single-family and attached properties, it still needs to be recognized that active listings remain approximately 40% lower than pre-pandemic levels. Sales, on the other hand, have increased both year-over-year and month-over-month. Sales of luxury single-family homes grew by 7.5% compared to March 2023, but more significantly by 31.1% compared to February 2024. Sales of luxury attached properties grew by 6.3% compared to March 2023, but again more significantly by 25.7% compared to February 2024. This higher demand for luxury properties also saw homes close quicker during March, selling nine days faster than in February 2024 for single-family homes and ten days faster for attached properties. Overall, the market is showing that it has become more favorable to sellers. Market Dynamics: Not All Markets are Equal. March’s trend back to a seller’s market is mostly due to the significant increase in sales that, despite considerable increases in new listings, still saw the overall inventory level remain below the 10-year norm. However, this is not true at the local level, where significant differences between markets have continued to increase over the last few months. Some markets have become more favorable for buyers, while others remain firmly in control of the sellers, and the remainder are favorable to neither. For instance, East Bay saw a sales ratio of 138.1%, indicating that there were more sales than new listings entering the market during March. Greater Seattle saw 86.2 out of every 100 homes sell, i.e., an 86.2% sales ratio, and St. Louis saw 82 out of every 100 homes sell during March. At the other end of the spectrum, Whistler in Canada saw very few sales, with a 1.4% sales ratio for its luxury homes. Fountain Hills in Arizona reported only 4.8 luxury homes sold out of 100 i.e., a 4.8% sales ratio, while South Walton in Florida fared slightly better with a 6.7% sales ratio. On the balanced side, three Florida markets: Coastal Pinellas, Marco Island, and Broward County all reported sales ratios trending downward into the 12 percentiles, thereby leaning towards a buyer’s market. Whereas Toronto, Kauai, and Sonoma County in California trended upwards into the 20 percentiles, towards a seller’s market. Equally confusing is that in some markets, home prices continue to increase, while in others, they are on a downward trajectory. Different price bands within the same market also report differing results, and it’s not always the lower-priced properties that are selling the fastest! While statistical data gives deeper insights into market dynamics and helps identify underlying trends, it needs to be appreciated that real estate decisions are also influenced by subjective factors such as personal preferences, lifestyle choices, and emotional attachments.

Equally, current and future community influences must be considered by both sellers and buyers. Markets are influenced by complex interconnected drivers such as economic conditions, regulatory policies, and demographic trends, as well as local factors such as culture, community dynamics, neighborhood characteristics, and urban development trends. Understanding these key parameters during this spring market will help buyers and sellers manage their expectations, leverage opportunities, and appreciate their true negotiation power within their specific market. The art of selling and buying in this market needs a critical and analytical approach; understanding the realities and setting expectations accordingly will ensure that goals are achieved. For homeowners looking to buy or sell in today’s market, we recommend working with a Realtor who can capitalize on the preferences, trends, and demands in this dynamic and evolving environment. Did you know that Carl Johnson is certified as an Institute for Luxury Home Marketing Specialist, CLHMS, which means he offers superior knowledge and experience in the luxury market? His CLHMS membership also provides him with access to an elite network of contacts and resources that help to find you your dream home from Swansboro to Beaufort and beyond. Trust your luxury listing to Carl Johnson Real Estate! Call 919-880-0904 for a consultation or CLICK HERE.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed