|

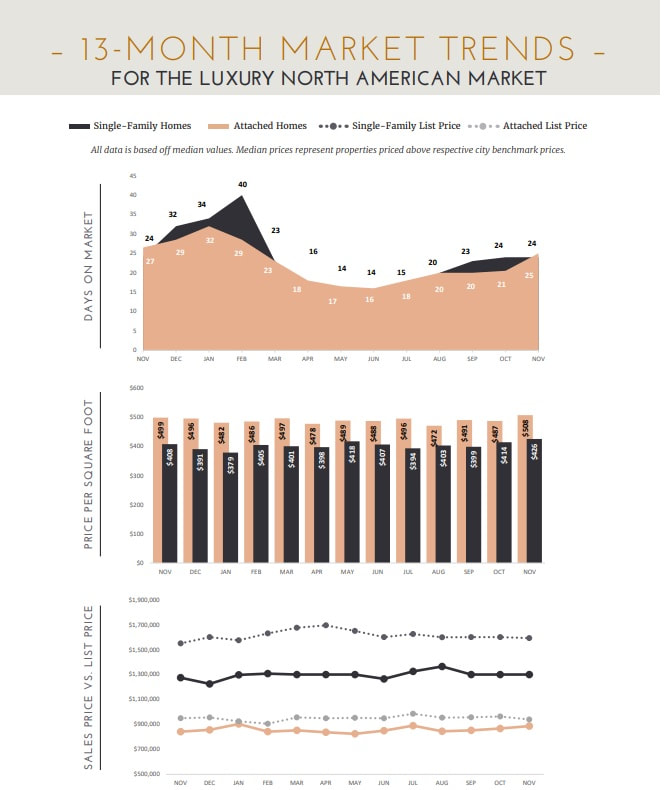

The Glimmer of Change Grows Brighter Last month, we reported a glimmer of hope as the luxury market, for the first time in 2023, witnessed an increase in the number of sold properties and new inventory entering the market compared to the same month in 2022. This encouraging trend continues this month. The Numbers are Up Compared to November 2022, the number of sales last month rose 5.1% for single-family homes and 13.7% for attached homes. This is not the only growth statistic that could show the start, albeit a slow one, of a market comeback. The number of new listings entering the market last month also increased compared to November 2022, by 21.1% for single-family homes and 29.3% for attached properties. The rise in new inventory entering the market is equally significant as it shows a growing confidence by sellers compared to last year. Lack of new inventory has been one of the most significant challenges to the growth of sales during most of 2023, as it created a roadblock for opportunity. This was especially significant in a market where buyers had become highly specific in their property specification preferences. As we noted last month, an increase in new listings has opened the door for this uptick in sold properties. This would not be the outcome, especially at this time of year, if the market was moving in a downward trajectory. Other statistical parameters are also showing growth indications. The median sold price rose year over-year just under 2% for single-family homes and over 5.3% for attached properties. The sold price-to-list-price ratio also increased slightly by 0.2% to 98.2% for single-family homes and 0.6% to 99.0% for attached properties. It is important to reiterate that these are not month-over-month increases, nor should there be an expectation of growth at this time of year. However, importantly, what has happened is a much NORTH AMERICAN LUXURY REVIEW slower rate in the slowdown of sales and new inventory than typically expected in November. This, again, is a positive indicator of seller and buyer optimism. Interest Rates Trend Down This turn of events has also been bolstered by the much-publicized decreases in interest rates over the last month. Not because the rate has decreased significantly, but for the first time since March 2022, there is a definite indication of a halt in the rise of mortgage costs. So, the big question is will interest rates fall in 2024? Fannie Mae forecasts that rates will drop from 7.6% to 7.1% during 2024. The National Association of Realtors is slightly more optimistic, with predictions of 7.5% in Quarter 1 and 6.3% in Quarter 4. The Mortgage Bankers Association predicts an even lower rate of 6.1% by the end of 2024.1 In Canada, rates are predicted to fall even further. Currently around 7.2%, the Prime Rate is expected to drop as low as 5.95% by the end of 2024. However, much of this depends on whether the Canadian government can reach its target of a 2% inflation rate.2 As economists continue to feel optimistic that interest rate hikes are done, especially after recent rate falls and signs of slowing inflation, it will still be the right combination of factors that will ultimately control the speed of the market’s recovery. Controlling Factors Rising inventory, lower mortgage rates, and economic stability are the factors that will see buyers and sellers return to the market. More inventory would ease the upward pressure on home prices. However, if mortgage rates drop too fast, demand is likely to surge, which would likely result in prices rebounding again. Keith Gumbinger, Vice President at mortgage website HSH.com, shared a sentiment that many would agree would be the best solution for controlling the market’s comeback. “Better that rate reductions happen at a metered pace, incrementally improving buyer opportunities over a stretch of time, rather than all at once.” He adds that mortgage rates returning to a more “normal” upper 4% to lower 5% range would also help the housing market, but over time, so it could return to 2014-2019 levels. However, most experts predict that a surge of inventory is unlikely because many homeowners are still “locked-in” to even lower mortgage rates and new construction has continued to decrease despite the demand for new stock. Consumer Sentiment Although the year-over-year increases in sales and new inventory levels indicates greater optimism by buyers and sellers comparatively, which is also certainly responsible for driving some of the market upticks, this is not to be confused with the current consumer sentiment, which remains cautious. Overall, in even the affluent demographic, there continues to be a considered approach to buying and selling in the luxury market, with little change anticipated, especially in the first quarter of 2024. Where purchasing or selling a home is more often a “want” than a “need,” the affluent are expected to continue prioritizing searching for properties that offer value for money, are move-inready, and match their lifestyle choices. A little more inventory would certainly assist in their endeavors, but equally this slower market affords them the time to assess what is available against their requirements. And often they are willing to wait for the property that fulfils these goals. A recent survey by Fannie Mae3 on consumer sentiment indicates it has not changed significantly as of the end of October 2023. The report reveals that many buyers and sellers are still on the fence. But then again, perhaps it’s a little too early to expect a significant change in sentiment, given that trends typically occur before perceptions of the reality catch up.

Did you know that Carl Johnson is certified as an Institute for Luxury Home Marketing Specialist, CLHMS, which means he offers superior knowledge and experience in the luxury market? His CLHMS membership also provides him with access to an elite network of contacts and resources that help to find you your dream home from Swansboro to Beaufort and beyond. If you have a high-end listing, using the most up-to-date marketing information, Carl positions your listing ahead of the market curve. Call 919-880-0904 for a consultation or CLICK HERE.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed