|

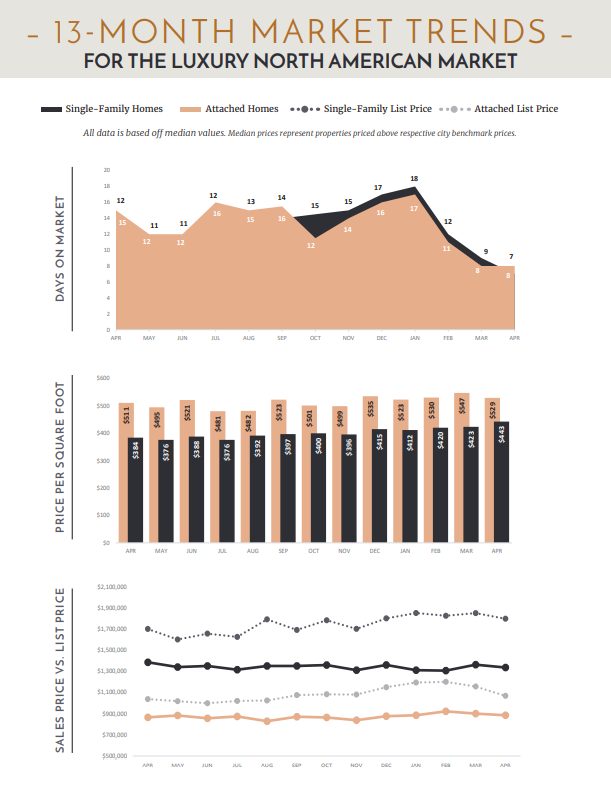

The Institute for Luxury Home Marketing has released their May 2022 monthly trend report, CLICK HERE to download the full report. We are happy to share this information to you from our personal resources! The following is per the Institute for Luxury Home Marketing May 2022 Market Report: While the ownership of luxury properties throughout the world has always been part of the affluent's portfolio, prior to the pandemic, the pace of decision-making and purchasing was so much slower, with the level of inventory far exceeding the demand. From London to Miami, Los Angeles to Sydney, the increasing demand for luxury properties continues to be at unexpected levels while inventory availability decreases and prices increase – further compounded as more countries open up and return to some semblance of normalcy, with the return of the international buyer. While it cannot be declared that the U.S. and Canada were the trendsetters in the meteoric increase in purchasing luxury properties over the last two years, the comparative statistics indicate that North America recorded the fastest growth of demand during the first year of the pandemic. Also, NORTH AMERICAN LUXURY REVIEW demand has not only not abated, but it consistently increased, and even in April 2022, we saw a higher volume of sales compared to 2021. Rising global wealth, increasing numbers of affluent individuals, investment return opportunities, and the growing importance of intrinsic value that a luxury property offers have all been instrumental. We can see this global change more emphatically by looking at the numbers provided by Wealth- X for individuals with a net worth of over $5 million through a comparison of growth from 2020 to the end of 2021. In 2020, their global wealth grew by 2.1%, from $61 trillion to $62 trillion, but in 2021 it exploded with a 20.4% increase of $12.8 trillion, equaling a growth of wealth to over $75 trillion. However, it is more likely that the population growth of these individuals with a net worth of over $5 million could be the most important factor in the dramatic decrease in inventory levels. In 2020, we saw a 2.2% growth in the number of individuals with wealth of over $5 million in net value, but in 2021 that number grew by an outstanding 19.8%. While this growth of wealth and the individuals with this wealth undoubtedly created one of the most significant impacts on the demand for luxury real estate, what is truly fascinating is some of the unexpected diversification of where the wealthy are buying and why. Since reopening its borders, Australia has seen a marked interest in Sydney and Melbourne's luxury real estate markets, and despite their tight foreign ownership rules, demand has been extremely high. In the past, distance and remoteness were a hindrance, but in today's world, these factors are now considered a benefit. Throw in additional tax incentives for relocating a business, and the elite start to look at the viability of moving here. Looking to India, we see predictions for a continuation of a strong luxury real estate market. Already Delhi, Mumbai, and Goa have seen the ultra-rich invest heavily in high-end property. The widely traveled affluent are leading the charge as they have experienced living in more luxurious accommodations and are ready to spend their wealth on luxury real estate to upgrade their lifestyle in a city of their choice. While the affluent are attracted to Mumbai due to it being the commercial capital, especially for investment with well-established luxury property developers, areas such as Lutyens' Zone, Vasant Vihar, and South Delhi remain hot real estate destinations in Delhi. Dubai has seen a resurgence in its market in the last six months. Despite all the negative press about Russian Oligarchs using it as a hiding place, Dubai recorded its best quarter since 2010, with top investors coming from the UK, France, and Italy. Europeans have dominated investment, but increasing numbers of individuals from Canada, India, and Pakistan are taking significant interest as visa reforms and economic stability have proven to be successful draws. As global demand for luxury homes continues to increase, the opportunity for developers and builders holds a world of opportunity, innovation, and, of course, financial gain. In North America, cities were high on the list for the wealthy, especially Washington D.C., New York, Los Angeles, Miami, and Honolulu, with individuals desiring a return to downtown lifestyles. And more than 10% of luxury searches were conducted by foreign buyers, according to data collected for Mansion Global by Realtor.com. One trend this analysis of the global market for real estate demonstrates is that the affluent are on the move again, and North America will probably be one of the largest beneficiaries. The strength and stability of the luxury markets in Canada and the U.S. over the last two years, not to mention investment opportunities in the growth of new real estate markets and luxury developments, will drive the incentive from international buyers. Below are the stats for the 13 month market trends review. Below are the monthly stats for your local luxury market reports of single-family homes. Do you know Durham is still a hot market to live in?! More and more companies are setting up headquarters in Durham and bringing new job opportunities and resources to the area. CLICK HERE to see our recent blog post about a New Home and Mixed-Use Development that is being built in Durham to keep up with the house demand!

1 Comment

9/21/2022 09:03:31 am

Great article!, I love all this, because I was able to gain information and also some tips. Thank you for posting this very informative article.

Reply

Leave a Reply. |

Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed