|

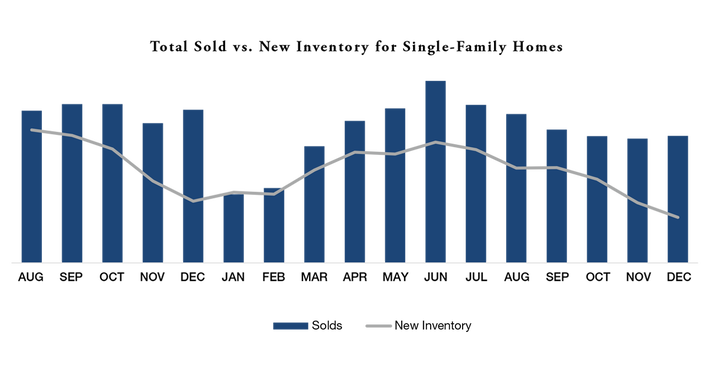

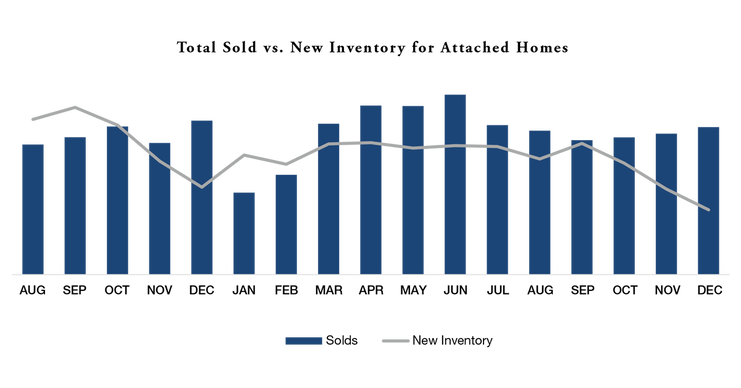

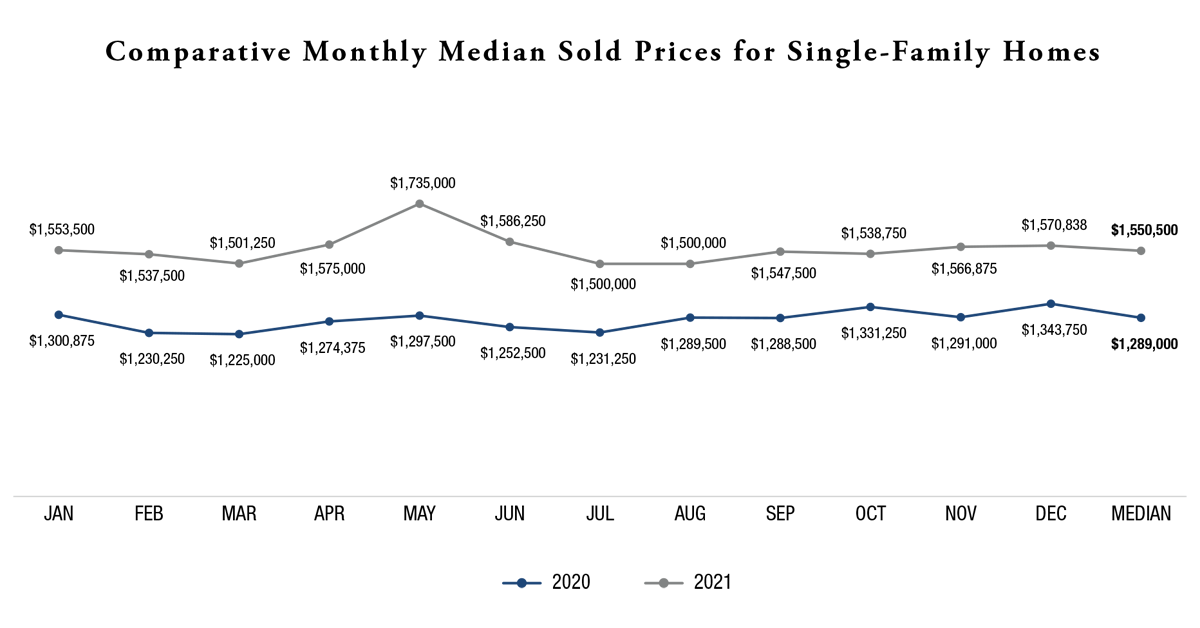

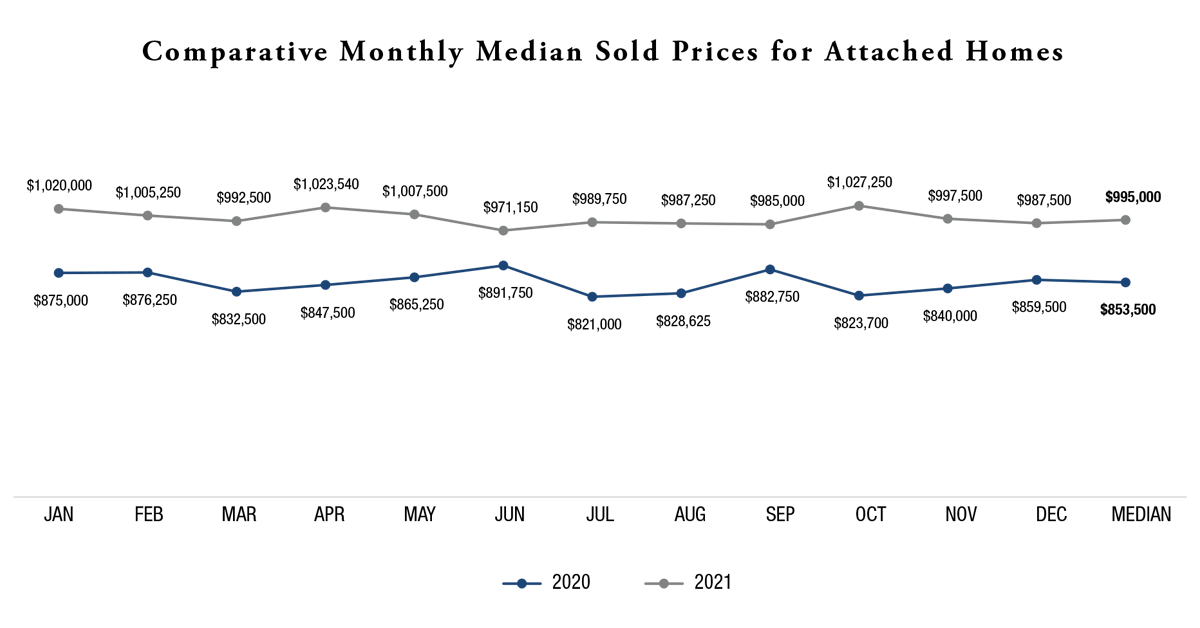

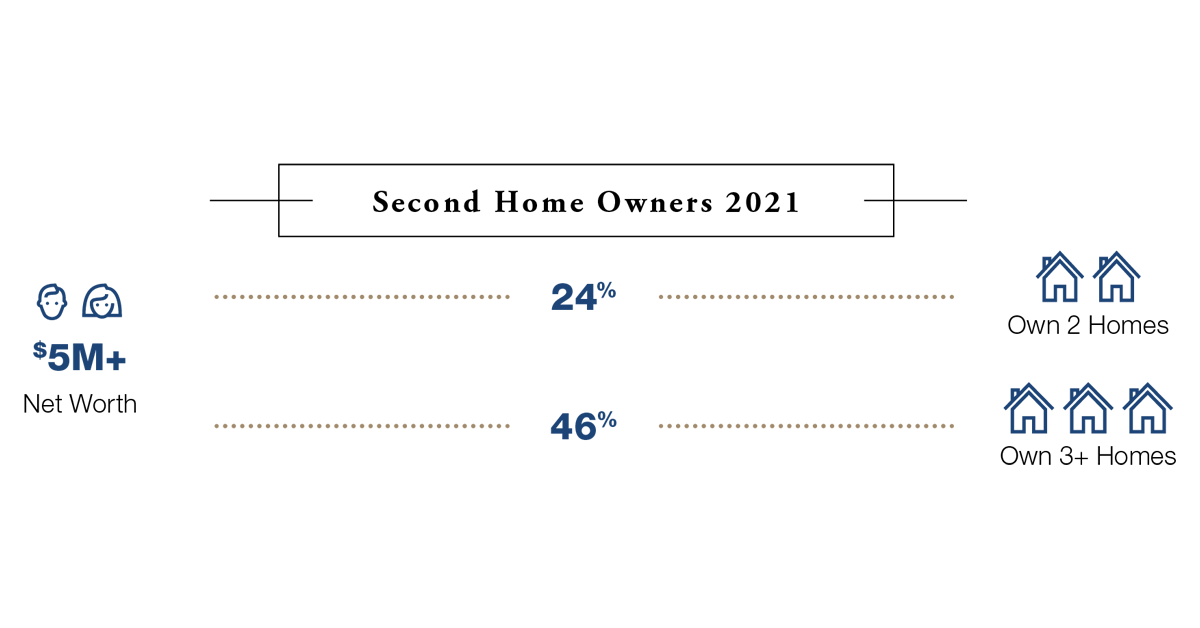

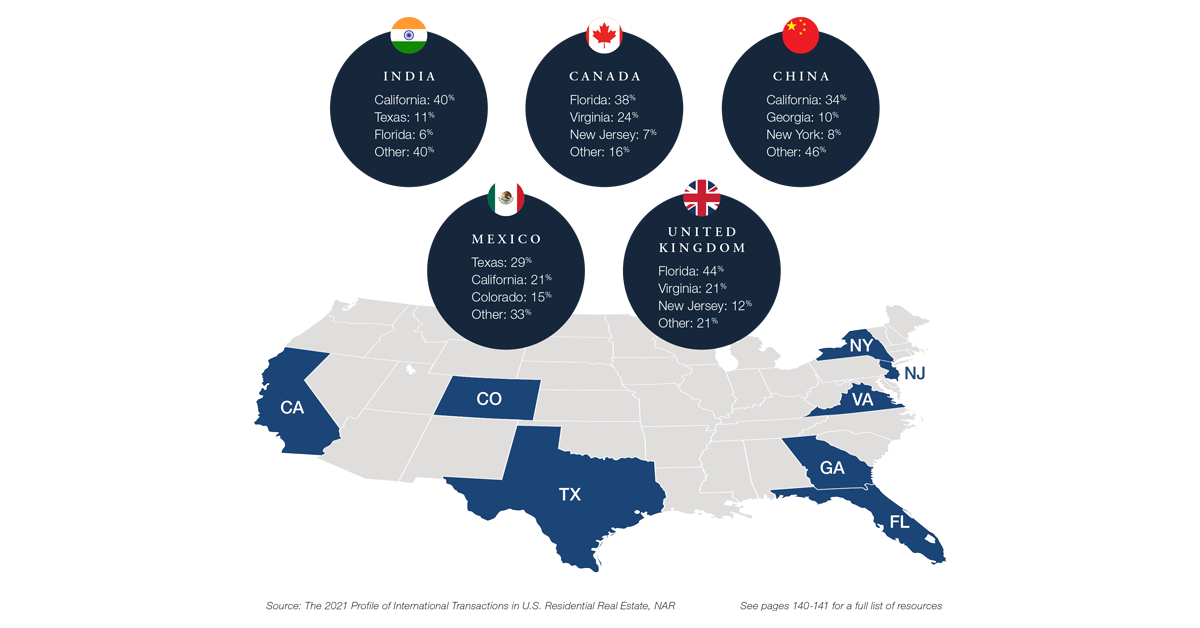

Which 2021 trends will influence luxury real estate in 2022? Curating surveys from Coldwell Banker Global Luxury Property Specialists worldwide and data compiled by Wealth-X, the Institute for Luxury Home Marketing and other sources, Coldwell Banker Global Luxury’s The Report 2022 homes in on six market trends and opportunities to watch this year. 1. Supply and Demand Equilibrium With about 73% of Coldwell Banker Global Luxury Property Specialists reporting that a lack of inventory remains a major challenge for 2022, the big question on everyone’s mind this year is: “Will supply and demand find an equilibrium after last year’s unprecedented imbalance of new-inventory-to-sales ratios?” A few market factors could shift later in the year, putting supply and demand on more equal footing, including an increased number of listings hitting the market in the spring and an expected construction boom (Total housing starts for 2021 were up 15.6% by the end of 2021, according to NAHB). With luxury real estate prices so high, some insiders expect to see “real estate realism” set in certain markets, potentially pushing the number of buyers and sellers closer together. Time will be the ultimate test, of course. 2. Rising Price Thresholds Luxury home prices rose faster in 2021 than in any one-year period in documented history. From January 2020 to December 2021, median luxury sold prices rose 20.3% for single-family homes and 16.6% for attached properties in the top 10% of 120 markets reviewed by the Institute for Luxury Home Marketing. The median 2021 sales price for single-family homes is now $1.55 million compared to $1.28 million in 2020 and for attached homes, it is $982,000 compared to $853,500. The big question for 2022 is: Will these new luxury price thresholds become the new normal, even if supply and demand equalize? The answer lies in the “if.” While most Coldwell Banker Global Luxury Property Specialists contend that the current rate of price growth isn’t sustainable long term, the majority do not expect demand and supply to level out enough to bring prices down significantly in 2022. Even if construction does pick up later in the year, the effects on inventory won’t be felt for months, if not longer. And even if new construction brings new homes to market, it won’t necessarily lower prices. 3. A New Map for Luxury Affluent buyers began making major life-changing geographical moves – often out of state – as they were freed up by work-from-home opportunities and searched communities that better fit with their lifestyle and values. In fact, 38% of Coldwell Banker Global Luxury Property Specialists surveyed for The Report said that most buyers were from out-of-state. Among the beneficiaries of this paradigm shift were Sun Belt states like Arizona, Florida, Georgia, Nevada, North and South Carolina, Oklahoma, Tennessee and Texas. Four of these Sun Belt states – Florida, Texas, Tennessee and Nevada – have no income tax, which appealed to companies and top earners with financial considerations. Beyond financial and lifestyle motivations, affluent buyers have begun to factor other considerations into their relocation decisions, such as climate change. Concerns about natural disasters and extreme temperatures have filtered into the buyer consciousness, which goes back to the values of health and safety that became so essential after 2020. Given the historic price increases and low inventory in many of these “hot” new markets, some folks may be wondering where are the places that may still have room to rise and houses to buy? This led the Coldwell Banker Global Luxury team to develop our first Opportunity Index for The Report, which measures year-over-year price increases against inventory levels. Among the markets with the highest buying potential for single-family properties in 2022: Staten Island, Delaware’s Sussex County Coastal, Cincinnati, Charlottesville and Napa County. Meanwhile, Cincinnati, Lake Norman, N.C., California’s Marin County, Greater Seattle and Coastal Pinellas County, Florida, may still have room to grow for attached homes. 4. Multiple Home Ownership and Rising Real Estate Footprints Whether it is because of wealth creation, changing lifestyle preferences, climate change considerations, politics or economics, there has been a rapid rise in global consumers who own multiple homes. Nearly 70% of individuals with a net worth of $5 million+ now own two or more properties, per Coldwell Banker Global Luxury’s most recent “A Look at Wealth” report based on Wealth-X data. Traditional lines between primary residences and secondary residences have also become blurred with many affluent choosing to spend more time in their secondary homes, or in some cases, deciding to add new homes to their real estate portfolios. All of this has led to an expanding global residential footprint among today’s high-net-worth (HNW) individuals. According to a new review by Wealth-X from 21 major cities outside the U.S., the top locations with the highest real estate footprint, which considers all properties owned by affluent individuals with a net worth of $5 million+ include: London, Paris, Singapore, Geneva and Beijing. 5. Sustainability Shift The expectation for 2022 and beyond is that more homes will go “green” because of the shifting buyer preferences and the construction industry’s growing commitment toward a zero-carbon future. Sustainability and environmental considerations were already becoming increasingly important purchase criteria among wealthy homebuyers, but the movement could gain even more traction moving forward. Areas of interest for green design include net zero energy-efficient homes, LEED certification, locally sourced or recycled materials, solar-paneled roofs, smart home systems, geothermal heating and cooling, and energy-efficient appliances and lighting. According to research from NAHB, homebuyers say that they are concerned about the environmental impact of new builds, and more than half are willing to pay for upgrades like solar panels and insulated windows. This number is only expected to grow as more millennial and younger buyers enter the real estate market, who are especially attracted to homes that incorporate personal and environmental wellness into the design, and are most likely to view eco-friendliness as a buying factor. Younger generations of affluent consumers are set to account for 70% of the luxury market by 2025 and contribute 130% of luxury market growth, according to Bain & Company. 6. Return of International Buyers International investment may return to the U.S. real estate scene as travel restrictions loosen and overseas investors who have benefited from massive wealth creation look to the U.S. for their real estate investments. Approximately 83% of Coldwell Banker Global Luxury Property Specialists anticipate the return of international buyers to the U.S. market. Major metropolises like Los Angeles, New York and Miami remain favorites among international investors, but suburban cities may begin to see foreign investment as buyers seek single-family homes, larger spaces and increased privacy. Below, are the U.S. hotspots for international buyers by country. Connecting the Dots

As buyers continue to move to new locations, agents must understand their client’s needs, be knowledgeable about their local community and be aware of the lifestyle offered within that community – from school waitlists to local philanthropies and membership clubs. They also need to be well-versed in what’s happening in other markets as well as macroeconomics, the flow of wealth and shifting affluent buyer preferences and concerns. “It used to be agents only had to know their market, but with so much movement happening in luxury, they need to be able to speak about other markets from a place of knowledge,” notes Liz Gehringer, President of Affiliate Business and COO of Coldwell Banker Real Estate. Click here for information on 2022 design trends.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed