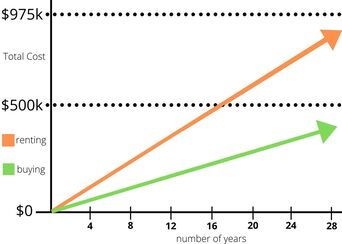

Original Content & Design by Carl Johnson Marketing The decision to buy or rent a home not only affects monthly expenses but also your choice of lifestyle and the depth of your savings. Although renting provides flexibility and minimal responsibilities, the best choice right now is to buy a home. Purchasing real estate is one of the best investments you can make; Since January of 1991, the annual growth rate of the House Price Index has increased 3.6% a year, according to the Federal Housing Finance Agency. Owning a home also comes with intangible benefits such as having a feeling of stability, pride in ownership, and belonging to your community. If you are paying $2100 a month in rent, it is cheaper to buy if you are staying in that home 2 years or more. You will be able to comfortably afford a home anywhere from $260,000 to $280,000 dollars. The total cost of renting for 2 years would be $51,217 compared to only spending $43,231 if you own; Meaning, it would cost $2,134 a month to rent and $1,801 to buy. That is a difference of almost $8,000. The longer you stay in your home the more you will save by owning rather than renting. Use this website (https://www.nerdwallet.com/mortgages/rent-vs-buy-calculator) to calculate how much you can save on your home The largest expense of homeownership is mortgage interest. In an example from Investopedia, if you borrow $100,000 for 30 years at 4%, the first monthly payment will be $477.42. Of that, $144.08 is principal and $333.33 is interest. It will take approximately 13 years for your monthly mortgage payment to go mostly towards principal instead of interest. Paying off the home will cost $71,869.51 in interest, but the benefit of home ownership is the ability to deduct both mortgage interest and property taxes you pay. Early in a loan term, mortgage interest expenses are decreased by mortgage interest deductions. For every dollar spent on interest, you may save around 20 to 30 cents on your tax bill. When renting, at each lease renewal, landlords have the option to increase rent, for there are no rent control laws in North Carolina. However, if you have a fixed-rate mortgage, your monthly payments will never increase From 2012 to 2018, home values in Durham, Chapel Hill, and Raleigh have increased by approximately 30 percent and rental rates have increased about 20 percent. Prices are being driven higher by low inventory, a trend that will continue for the next couple of years. Homes in North Carolina have gone up 5.2 percent in value in the past year, according to Zillow. The combination of low inventory and growth in the area means houses will have positive appreciation value. CLICK HERE to contact Carl if you are interested in buying a home

1 Comment

6/18/2023 11:01:53 am

Residential real estate refers to properties that are primarily used as homes or dwellings. This includes single-family houses, townhouses, condominiums, and apartments. Residential properties are often valued based on factors like location, size, amenities, and market conditions. Buyers and sellers in the residential market engage in negotiations and transactions facilitated by real estate agents and brokers.

Reply

Leave a Reply. |

Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed