|

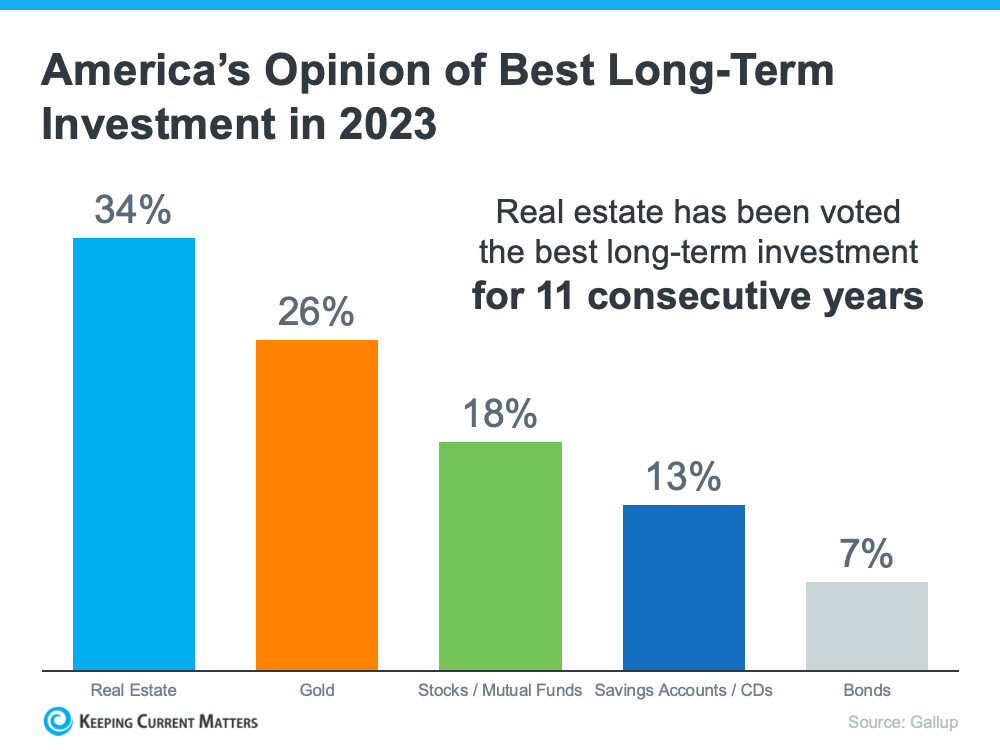

Original Content by Carl Johnson The future can be worrisome as the unknown is often scary. This especially holds true when it comes to retirement, savings, and the investing of your own money. As stock markets are only projections and affected, both good and bad, by many outside factors, there is one true investment that has lasted the test of time. . . Real Estate. Investment in land is a one of a kind opportunity to own a piece of something that there literally cannot be more made of. With the right research, knowledge, and opportunity, real estate property can be the best long-term investment for you. Image Credit: Keeping Current Matters Real Estate as an Investment For most it is hard to part with your weekly or monthly paycheck to put into savings, especially when it is not a direct draw from your pay. To simply pull money out of your checking to put into savings is hard to do for many in this economy, as well as too easy to put off or to have a ‘do it next monthly’ mentality. A main factor to the benefits of real estate as an investment is that each payment you make towards your mortgage is actually a payment into your savings. As stated by Dr. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR) “. . . homeownership is a catalyst for building wealth for people from all walks of life. A monthly mortgage payment is often considered a forced savings account that helps homeowners build a net worth about 40 times higher than that of a renter” (Keeping Current Matters). Whether interest rates are 8% or 2%, the principle you are paying will always go back into your ‘savings’ in the form of ownership on your property, something that you will never get back as a renter. Your investment grows as the home appreciates over time in addition to you paying off your mortgage. You also gain leverage with a real estate investment overtime which allows you to pull money from the property which you can in turn reinvestment in more real estate to make your gains even more. MoneyCheck (Why Real Estate Is the Best Long-Term Investment: Complete Guide (moneycheck.com)) gives a great example of how leverage works: “Paying down your mortgage gives you equity in your home. Banks and other lenders will allow you to borrow money against the equity in your home. So, for example; if you paid $200,000 for your home, and pay off $50,000 over 5-years on your mortgage, you now have $50,000 of equity in your property. If the property market increases over this same 5-year period and your home is now worth $250,000, then you have $100,000 of equity in your home. Banks will let you borrow money against this equity.” You can pull this $100,000 to put towards a down payment on another real estate property, reinvest your money, and start a whole other unit of savings. Photo Credit: Keeping Current Matters Long Term Investment The 2021 Q1 findings of the National Council of Real Estate Investment Fiduciaries (NCREIF) show the average return percentages over 25 years of the following (webinar-slides-1q-2021-v2.pdf (ncreif.org): Residential Real Estate: 10.3% S&P 500: 9.6% You can see that the percentage of average return for real estate outperforms that of the S&P 500 (a popular stock market index). And if you are someone who wants to be involved with your investment, there are ways to make your growth even larger. From renting out your real estate property, updating and renovating a property, or even refinancing to a lower rate over time are all ways to get more value out of your investment than that 10% rate. Options for all Levels When it comes to real estate as a long term investment there are options for you to get involved at a variety of levels. Residential real estate can be in the form of simply buying your own home. It can also include buying a property and using it as a residential rental property that you rent out to others. The good news is that residential real estate as a long-term investment can be a simple 1-bedroom apartment to a large home with property, whichever is realistic to you. As long as you are taking on the ownership of the property, you are putting that money back into your savings. Do Your Research Whether you are buying a residential rental property to invest in or looking at your first home, it is important to know what you value in a home as well as what makes the home valuable. Location is a key factor to consider when looking to purchase a home as an investment. From established neighborhoods to acres of property or even to an up and coming part of the city, these are all things to consider that will help your property appreciate its value over time. Some areas are better than others in terms of residential rental properties to own. Areas around the Triangle that are near the universities can be good spots as well as anywhere on the Crystal Coast. We work with clients at the Crystal Coast, from Swansboro to Beaufort with selling their rental properties and buying new ones, to clients looking to buy a beach home that doubles as an investment. You also want to know whether the property you are buying needs work, and is this a renovation where you will be able to get your value back or more. Be cautious not to out price yourself with what you have to put into the property. To heighten investment return, factors such as school districts, location to public transportation and business parks, past rental history and repairs, may be points you want to check that impact value. Downtown Beaufort Waterfront - Photo Credit: Crystal Coast Tourism Authority Let us Help You

Since investing in real estate is a major step whether it is your first home or your first investment property it is important to have a real estate agent on your team that is knowledgeable, trustworthy, and understands the area and industry. At Carl Johnson Real Estate we value what you value and want to help you succeed. CLICK HERE to contact us today and we can help you invest in your future.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed